OIL OUTPUT WILL UP

PLATTS - The global oil market "is going to be stressed" when US sanctions against buyers of Iranian crude return in November, but the US government is confident increased production from Saudi Arabia and Russia can meet the supply gap, US Energy Secretary Rick Perry said Thursday.

Perry said he would not recommend that the US tap its Strategic Petroleum Reserve to respond to a price spike after the sanctions take effect.

"The Strategic Petroleum Reserve is in place for emergency natural disasters," Perry told reporters at the World Gas Conference in Washington, DC. "So I would not recommend [tapping it], and I don't think the president would either."

"We look at this as an opportunity for OPEC members to fill this gap, if you will," he added.

Oil prices rose sharply this week after the US State Department announced it would offer no waivers to Iran's oil buyers when sanctions snap back in November, a hardline approach many allies did not expect after the Obama administration allowed them to continue some imports in 2012-2015 as long as they made significant cuts every six months.

Analysts increased their projections for potential supply shortages in the fourth quarter, as plans by Saudi Arabia and Russia to boost output may not cover the shortfall.

S&P Global Platts Analytics expects a loss of more than 1 million b/d by November if the US manages to pressure Iranian oil buyers to eliminate their imports, "with Europe expected to have high compliance due to secondary sanction risks," said Chris Midgley, global head of analytics for Platts.

Perry said he feels "quite comfortable" that Saudi Arabia will be able to produce 11 million b/d and that Russia will increase output "so that the worldwide crude market does have some stability."

Saudi Arabia produced 10.01 million b/d in May and set a record monthly high of 10.66 million b/d in August 2016, according to S&P Global Platts OPEC survey records.

"I think you're going to see a settling-down of the market -- people feeling comfortable that Saudi Arabia, Russia and the United States, we've got substantial production," Perry said, while acknowledging pipeline constraints in Texas that are holding back Permian Basin oil exports.

"There will be some spikes in prices from time to time," he said. "But as we go forward, markets are going to become calmer and calmer as we go forward, realizing supply is going to be there to meet the demand."

Perry and US Secretary of State Mike Pompeo met with Fatih Birol, executive director of the International Energy Agency, on Tuesday to discuss global energy security.

US Senator Lisa Murkowski, chairwoman of the Senate Energy and Natural Resources Committee, said separately at the gas conference Thursday that the SPR must remain a "safety net" for the country.

"There's a lot of people who view the SPR as a piggy bank. I don't," Murkowski, a Republican from Alaska, said. "I view it as an insurance policy for when we need it, when we have an emergency that we could have never anticipated.

Congress has mandated nearly 30 sales from the SPR through fiscal 2027 to pay for modernization of the facilities, government budgets and unrelated legislative efforts. More than 300 million barrels of government-owned crude is expected to be sold over the next decade.

The SPR held 660 million barrels as of June 22, including 405.4 million barrels of sour crude and 254.6 million barrels of sweet crude, according to the Department of Energy, which manages the stockpile.

-----

Earlier:

2018, June, 27, 11:20:00

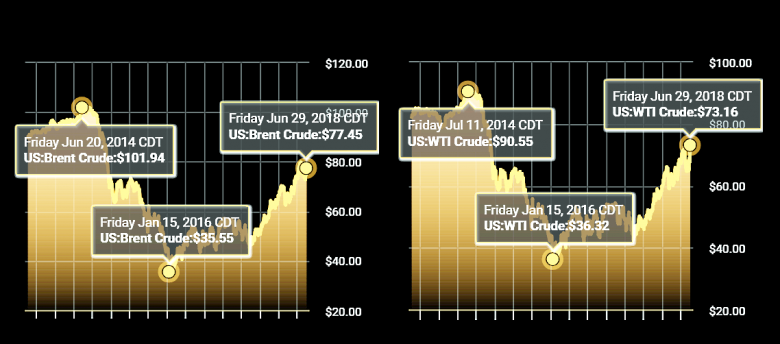

OIL PRICE: NOT ABOVE $77REUTERS - Brent crude futures LCOc1 had climbed 61 cents, or 0.8 percent, from their last close to $76.92 per barrel by 0650 GMT. U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $70.88, up 35 cents, or 0.5 percent. |

2018, June, 27, 11:15:00

U.S. - RUSSIA COOPERATIONREUTERS - “We met. We discussed energy issues, among other things. We touched upon questions related to sanctions,” Novak said in a press briefing in Washington. “We can’t sidestep these difficult questions, so of course we touched upon them during our contact.” |

2018, June, 27, 10:50:00

U.S. - IRAN SANCTIONSARAB NEWS - The United States warned countries that they must stop buying Iranian oil before Nov. 4 or face a renewed round of American sanctions. |

2018, June, 25, 12:30:00

БОЛЬШЕ НЕФТИ: +1 МБДМИНЭНЕРГО РОССИИ - На пресс-конференции по итогам заседания Министр энергетики Российской Федерации Александр Новак отметил, что доля России в общем увеличении добычи нефти стран ОПЕК и не-ОПЕК в 1 млн баррелей в сутки может составить около 200 тыс. |

2018, June, 25, 12:20:00

U.S. OIL UP TO 10.9 MBDWSJ - U.S. production has grown at a record-setting pace this year, hitting 10.9 million barrels a day this month after oil prices exceeded $70 a barrel for the first time since 2014. That makes the U.S. the world’s No. 2 oil producer behind Russia, but ahead of Saudi Arabia. |

2018, June, 22, 13:25:00

RUSSIA - SAUDIS SUPER OPECBLOOMBERG - Russian Oil Minister Alexander Novak said in a speech yesterday that “we need to build upon our successful cooperation model and institutionalize its success through a broader and more permanent strategically focused framework.” His Saudi counterpart Khalid Al-Falih echoed those comments. |

2018, June, 18, 14:25:00

РОССИЯ И САУДОВСКАЯ АРАВИЯ: ДОЛГОСРОЧНАЯ СТРУКТУРАМИНЭНЕРГО РОССИИ - Стороны также договорились работать совместно со всеми подписантами «декларации о кооперации» от декабря 2016 для создания долгосрочной структуры для взаимодействия на основе декларации, а также пригласить к взаимодействию прочих крупных производителей нефти. |