U.S. OIL FOR CHINA

PLATTS - Chinese tariffs on US energy exports would affect roughly one of every four barrels of oil the US currently ships to foreign refiners and, if ultimately imposed, would spark a significant shift in global crude flows, analysts said Monday.

China, which threatened the retaliatory tariffs on US energy exports over the weekend, would need to replace as many as 450,000 b/d of US crude, likely with barrels from West Africa and the North Sea, while additional, discounted US barrels would scramble for market share in Europe and elsewhere in Asia.

Without the Chinese market, WTI and other US crude grades would see steeper discounts to Brent.

"That lower price, in turn, may spur new buyers for US crude oil or increased purchases from traditional buyers, like Canada and Western Europe," said Mason Hamilton, a petroleum markets analyst with the US Energy Information Administration. "A lower price may also incentivize US refiners to increase runs of the light, sweet domestic crude oil grades typically exported. A mix of both outcomes is possible."

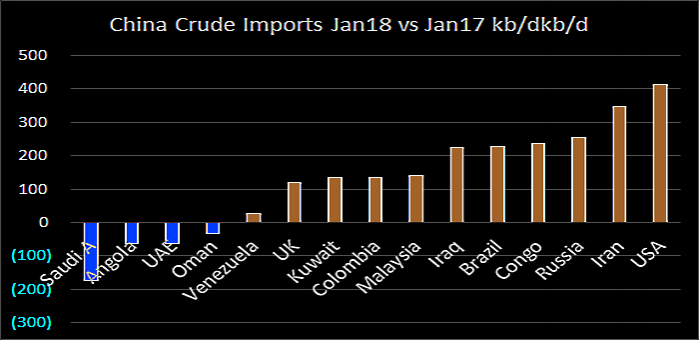

Since the US dropped all limits on crude exports in 2015, China has competed with Canada as the top buyer of US crude. US crude exports to China averaged over 358,000 b/d in the first quarter, up from nearly 175,000 b/d in Q1 2017. US crude's market share in China rose to 3.5% from 0.4% over the same period.

China sourced its remaining crude imports in Q1 from Russia (1.3 million b/d), Saudi Arabia (1.1 million b/d), Angola (1 million b/d), Iraq (860,000 b/d) and Iran (660,000 b/d), according to S&P Global Platts Analytics.

US crude exports to China reached 448,000 in October, the highest monthly export average since 449,000 b/d were sent to Canada in October 2015.

Analysts said Monday that if the tariffs go into effect, they expect that China will likely replace medium sour offshore grades from the US with barrels from the Middle East and Angola. Light sweet grades from the US would likely be replaced by barrels from West Africa, specifically Nigeria.

"As long as the trade dispute remains bilateral, the global crude market will shuffle supplies to accommodate, meaning US crude oil will still find a home overseas," said Kenneth Medlock, senior director at Rice University's Baker Institute Center for Energy Studies.

"So, China will substitute to other crude sources and US crude will land elsewhere in order to mitigate the price effects. In the end, the cost to Chinese consumers is higher, while US producers will see slightly lower netbacks," he added.

Amy Myers Jaffe, director of the Council on Foreign Relations' energy security and climate change program, said even if China imposes 25% retaliatory tariffs on US crude, it may not matter much.

"Another buyer will take US crude. In a really oversupplied market US crude could suffer a slight penalty, but, in a tight market, it would be relatively negligible," she said.

Still, the threat of retaliatory tariffs and an ongoing trade war with China and other trading partners is already creating risk around US oil and other energy exports, analysts claim.

"The industry is very concerned about it," said Joe McMonigle, an analyst with Hedgeye Capital. "I think the energy industry is concerned about trade policies in general, and not just China tariffs."

In addition, the ongoing trade feud could hinder future crude oil and other energy flows to China, according to David Goldwyn, president of Goldwyn Global Strategies and a former special envoy and coordinator for international energy affairs at the Department of State.

"The Chinese have long been worried about the reliability of US energy exports, even mistakenly believing LNG exports to China were not permitted," said Goldwyn. "I think there are now greater risks to long-term oil supply arrangements with China, as well as risks to US investment in the Chinese energy sector."

Medlock with Rice University said while US producers may have near-term alternatives to China, an escalation in the trade war would risk a loss of possibly the most important global growth market for natural gas and oil.

"In the end, the current mercantilist rhetoric is damaging to economic growth and can carry long-term geopolitical ramifications by establishing different trade relationships," Medlock said.

Chinese petroleum consumption averaged 13.55 million b/d in May, up 440,000 b/d from a year earlier and up 2.37 million b/d form five years ago, according to the EIA. EIA projects Chinese petroleum EIA demand to average 14.10 million b/d by the end of 2019.

-----

Earlier:

2018, June, 13, 13:00:00

CHINA - IRAN PARTNERSHIPPLATTS - China and Iran have agreed to strengthen strategic cooperation during Iranian President Hassan Rouhani's visit to China, possibly paving the way for steady crude flows between the two countries. |

2018, June, 8, 13:00:00

CHINA OIL IMPORTS DOWNREUTERS - May shipments were 39.05 million tonnes, or 9.2 million barrels per day (bpd), according to data released on Friday by the General Administration of Customs. That compared to 9.6 million bpd in April and 8.76 million bpd in May, 2017. |

2018, May, 30, 13:30:00

CHINA'S ECONOMY GROWTH 6.6%IMF - China’s economic growth accelerated in 2017 and is expected to weaken only slightly in 2018 to 6.6 percent and moderate gradually to about 5½ percent by 2023. |

2018, May, 28, 11:15:00

CHINA BUYS RECORDPLATTS - China's state-run oil trader Unipec has purchased around 16 million barrels of US crude oil for loading in June, marking the biggest volume ever to be lifted in a month by the company, informed sources said |

2018, May, 23, 10:35:00

U.S. - CHINA ENERGY TRADEPLATTS - China became the largest contributor to global LNG consumption growth in 2017. It surpassed South Korea as the world's second largest LNG importer and its share of global LNG demand is expected to converge with that of Japan by 2030. |

2018, May, 8, 10:55:00

CHINA'S OIL IMPORTS UP TO 9.64 MBDBLOOMBERG - The world’s biggest oil buyer imported 9.64 million barrels a day in April, according to data released by Beijing-based General Administration of Customs on Tuesday. That’s about 4 percent higher than March and beat a previous record of 9.61 million barrels per day reached in January. For the month of April, total purchases were 39.46 million metric tons. |

2018, May, 4, 15:25:00

CHINA'S OIL DEMAND UP 6.8%PLATTS - China ended the first quarter of 2018 with robust apparent oil demand growth of 6.8% year on year, as stronger-than-expected GDP growth boosted consumption from the industrial and construction sectors and outweighed concerns over rising oil prices |