VENEZUELA'S OIL PRODUCTION DOWN

PLATTS - Venezuela's near economic collapse has taken a toll on the country's oil production, causing shifts in oil flows as buyers look to secure alternative supplies.

As workers have fled the country, state-owned oil company PDVSA has had a difficult time maintaining crude output, let alone boosting production. PDVSA's refining sector has also deteriorated on a lack of funds and manpower.

PDVSA has had difficulty pulling crude from storage because its supplies are subject to seizure by creditors. Most notably, on April 26 the International Trade Court ordered PDVSA to pay $2.04 billion to ConocoPhillips for the 2007 expropriation of ConocoPhillips' 50.1% interest in its Petrozuata joint venture in PDVSA, and its 40% stake in the Hamaca project, both of which were heavy oil installations in the Orinoco Belt of eastern Venezuela.

And US has sanctioned individuals in Venezuela, including President Nicolas Maduro, prohibited the purchase and sale of any Venezuelan government debt, including any bonds issued by PDVSA, and banned the use of the Venezuela-issued digital currency known as the petro.

CRUDE OUTPUT, EXPORTS FALLING

Venezuela crude production could be on the verge of sinking to 1 million b/d, and a drop in crude exports is causing a shift in trade flows.

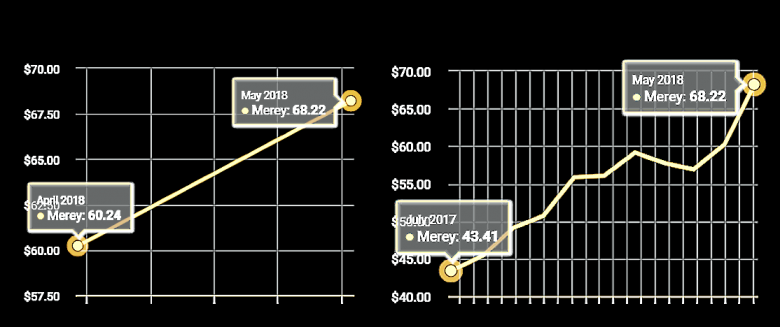

Venezuela's crude output averaged 1.36 million b/d in May, down from 1.41 million b/d in April, and 1.9 million b/d in May 2017, according to S&P Global Platts. The International Energy Agency said it could fall to 800,000 b/d or even lower next year.

S&P Global Platts Analytics sees Venezuelan production remaining above 1 million b/d during 2019. "They have a certain amount of production that they can keep going although the heavier grades would get impacted if they can no longer buy diluents," said Chris Midgley, head of Platts Analytics.

In early June, PDVSA notified 11 international customers that it would not be able to meet its crude supply commitments in full, a PDVSA official said. It is contractually obliged to supply 1.495 million b/d to these customers in June, but only has 694,000 b/d available. The customers either would not comment, or could not be reached for comment.

Venezuela's rig count has fallen to 28 in May from 36 in April, and 49 in January, according to Baker Hughes International Rig Counts.

PDVSA has experienced similar drops in the past. In the 1980s, the number of rigs fell to less than 30, causing crude production to fall to 1.3 million b/d.

Production has slowed largely because of a lack of maintenance and as skilled employees have fled the country. For instance, PDVSA Friday was operating its 202,000 b/d Petrocedeno extra heavy crude upgrader at just 39.6% of capacity, due to delayed maintenance, lack of spare parts, and electrical failures, according to an operator at the facility.

PDVSA's three other upgraders -- the 120,000 b/d Petrosanfelix, 120,000 b/d Petromonagas and 190,000 b/d Petropiar upgraders -- are expected to be operating below capacity in June.

PDVSA planned to build a 200,000 b/d upgrader at an estimated cost of $5 billion-$6 billion in the PetroCarabobo project. However, India's ONGC Videsh has put on hold plans to invest in the upgrader until it has received full payment for its equity oil sales.

SHIFTING CRUDE FLOWS

US Gulf Coast refiners have been increasing their imports of Canadian and Iraqi crude, likely making up for the Venezuelan shortage. * US Gulf Coast imports of Venezuelan heavy sour crude have averaged roughly 249,100 b/d so far this year, down from nearly 529,760 b/d in the same period in 2017 and 658,600 b/d in 2016.

Iraq, which had long blended its heavier sour crude with medium grades, exported 301,600 b/d of heavy crude to the US Gulf Coast in March, according to the latest EIA data. It was the highest average since January 2017, when about 341,650 b/d of Iraqi heavy sour crude was shipped to the Gulf Coast, an all-time high, according to the EIA data. * Through May, roughly 35.5 million barrels of Basrah Heavy crude had been imported by US Gulf Coast refiners, up about 1 million barrels compared with the first five months of 2017, but more than double imports in the same time period in 2016, according to the latest US Customs and Border Protection data.

Canadian crude producers are of late stepping up supplies to the US Gulf Coast, with the bulk of the increase being shipped on rail cars.

Crude exports to the USGC are currently around 530,000 b/d, said Dinara Millington, vice president of research with the Canadian Energy Research Institute said Thursday in Calgary. That's up from 443,000 b/d in March, and 336,000 b/d in January 2017, according to EIA data.

Canadian crude is competitive because of deep price discounts. The Western Canadian Select coking margin on the USGC has averaged $21.29/b so far in June, compared to a $5.94/b margin for Mexican Maya. The bulk of that WCS advantage comes from the deep spot price discounts for the grade.

China's independent refiners are looking for alternative sources of heavy crude, with Mexican Maya, Colombia's Castilla and Canadian Cold Lake Blend options being considered.

Independent refiners are major buyers of Venezuelan crudes, taking around 69% of the Latin American shipment to China, mainly through CNPC, which is the solo buyer under the oil-for-loan deal between the countries. China imported 4.7 million mt crude from Venezuela in Q1, out of which 3.22 million mt was taken by the independent refiners, data from the General Administration of Customs and S&P Global Platts showed.

Venezuelan crudes are mainly used for asphalt production in China, the demand for which peaks over September-November.

A CNPC source said it is difficult to find good alternatives for Venezuelan Merey crude, which with an API of 16 degrees and 2.46% sulfur content is a good feedstock for asphalt production. Some heavy crudes, like Maya from Mexico, can be used as an alternate to produce asphalt, a source with independent Wonfull Petrochemical said. But no crudes have been imported from Mexico by independent refineries since 2016.

REFINED PRODUCTS IMPORTS

Venezuela's imports of oil products have been rising as output from its refineries has been declining due to lack of crude feedstock, accidents, unscheduled shutdowns, and delays in maintenance of various facilities.

PDVSA will process just 499,000 b/d of crude at its domestic refineries in June, accounting for just 31% of its 1.6 million b/d of refining capacity. This would be 144,000 b/d lower from the same month in 2017.

PDVSA's system is comprised of five refineries: Amuay, Cardon, El Palito, Puerto La Cruz, and Isla, which it operated in an agreement with the Curacao government. The government of Curacao is open to a third party operating the PDVSA-run Isla refinery.

PDVSA plans to import 9.735 million barrels of oil products in June, up from 6.188 million barrels in May, and the highest since 2016, according to an internal PDVSA report seen by S&P Global Platts.

PDVSA sources its imports from Russia's Rosneft, India's Reliance Industries Ltd., and Citgo, PDVSA's US-based refining arm.

The decline in refinery utilization has also forced PDVSA to suspend oil product exports to eight countries in the Caribbean as part of its long standing Petrocaribe agreement. PDVSA has indefinitely suspended delivery of 38,000 b/d of oil products to Antigua and Barbuda, Belize, Dominica, El Salvador, Haiti, Nicaragua, San Vicente and St Kitts.

-----

Earlier:

2018, June, 8, 12:55:00

VENEZUELA IRAN SANCTIONSBLOOMBERG - Venezuela wrote to fellow OPEC members urging them to unite against U.S. sanctions, echoing a similar letter from Iran, according to people with knowledge of the matter. |

2018, March, 14, 11:15:00

VENEZUELA'S OIL PRODUCTION DOWNEIA - Venezuela’s crude oil production has been on a downward trend for two decades, but it has experienced significant decreases over the past two years. Crude oil production in Venezuela decreased from 2.3 million barrels per day (b/d) in January 2016 to 1.6 million b/d in January 2018. A combination of relatively low global crude oil prices and the mismanagement of Venezuela’s oil industry has led to these accelerated declines in production. |

2018, March, 12, 08:30:00

VENEZUELA'S RATINGS DOWNMOODY'S - Moody's Investors Service has downgraded the Government of Venezuela's foreign currency and local currency issuer ratings, foreign and local currency senior unsecured ratings, and foreign currency senior secured rating to C from Caa3. Concurrently, the foreign currency senior unsecured medium term note program has also been downgraded to (P)C from (P)Caa3. The outlook has been changed to stable from negative. |

2018, January, 15, 09:45:00

VENEZUELA'S OIL UPREUTERS - Venezuela’s oil production has increased to near 1.9 million barrels per day (bpd) after hitting a historic low last year, according to Manuel Quevedo, oil minister and head of state oil firm PDVSA, who vowed 2018 will see output rise to more than 2.4 million bpd. |

2018, January, 10, 12:45:00

VENEZUELA'S OIL DOWN TO 1.7 MBDPLATTS - Venezuelan crude output plummeted in December to 1.70 million b/d, according to the latest S&P Global Platts OPEC survey released Monday. |

2018, January, 8, 19:20:00

U.S. - VENEZUELA SANCTIONSU.S.DT - “President Maduro and his inner circle continue to put their own interests above those of the Venezuelan people,” said Treasury Secretary Steven T. Mnuchin. “This action underscores the United States’ resolve to hold Maduro and others engaged in corruption in Venezuela accountable. We call on concerned parties and international partners around the world to join us as we stand with the Venezuelan people to further isolate this oppressive regime.” |

2017, November, 22, 11:25:00

РУССКИЙ ДОЛГ ВЕНЕСУЭЛЫ: $3.15 МЛРД.МИНФИН РОССИИ - Сумма консолидированного долга Венесуэлы составила 3,15 млрд. долл. США, новый график погашения задолженности предусматривает платежи в течение 10 лет, объем которых в первые 6 лет минимален. |