GERMANY'S GDP UP BY 2.5%

IMF - On June 29, 2018, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Germany.

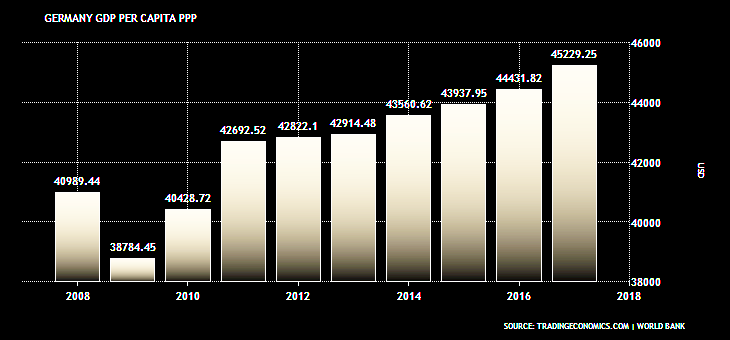

Germany's economic performance was strong in 2017, underpinned by solid domestic demand and a rebound in exports in the second half of the year. Despite a slowdown in public consumption due to the stabilization of refugee-related expenditures, real GDP grew by 2.5 percent. Already-high capacity utilization continued to rise and the labor market tightened further putting incremental pressure on wages. Reflecting this, headline and core inflation reached 1.5 percent at the end of 2017. The general government surplus reached 1.2 percent of GDP, the highest level since reunification, but the fiscal stance remained broadly neutral. The current account surplus declined to 8 percent in 2017, from 8.5 percent in 2016, as both the trade and income balances deteriorated.

The financial system was characterized by moderate credit growth and weak profitability. Total credit accelerated in 2017, as households and firms took advantage of the low interest rate environment, but it remained broadly in line with nominal GDP growth. Against the backdrop of continued urbanization, an inelastic housing supply, and easy financing conditions, house prices accelerated further in dynamic urban areas. In the banking sector, regulatory capital remained adequate, but profitability continued to be weak, reflecting structural factors, some crisis legacies, and the low interest rate environment. Some banks remain under close supervisory scrutiny. The low interest rate environment also forced some restructuring in the life insurance sector where profitability remains an issue due to the extensive reliance on guaranteed products.

The outlook is for the expansion to continue in the near term but slow markedly over the medium to long term, reflecting unfavorable demographics and productivity trends. Short-term risks are substantial, as a significant rise in global protectionism, a hard Brexit, or a reassessment of sovereign risk in the euro area, leading to renewed financial stress, could affect Germany's exports and investment.

Executive Board Assessment

The Executive Directors commended Germany's strong economic performance and welcomed the prospects for continued solid growth in the near term, underpinned by robust domestic demand amid a tight labor market and accelerating wages. They noted, however, that external imbalances remain sizable and important risks are clouding the outlook. Rising protectionist trends, geopolitical uncertainty, or a reassessment of sovereign risk in the euro area could lead to bouts of financial turbulence, negatively affect export prospects, and weigh on investment.

Directors stressed that the positive near‑term economic outlook provides an opportunity for Germany to more forcefully address its long‑term challenges. Given unfavorable demographic prospects, they agreed that Germany's policies should focus on bolstering potential growth. In this regard, Directors recommended further expanding public investment in physical and human capital, and prioritizing measures that incentivize labor supply and help improve the environment for private investment. Such measures would bolster productivity growth, further lift long‑term output, and reduce Germany's large current account surplus.

In this context, Directors welcomed the new government's initiatives to support long‑term growth. Many Directors urged using Germany's fiscal space to further raise public investment (while alleviating bottlenecks at the municipal level), expand childcare and after‑school programs, reduce the labor tax wedge, and provide additional funding for primary education and life‑long learning. A number of Directors, however, emphasized a need to balance spending to raise potential growth with maintaining strong buffers for potential economic risks and upcoming demographic challenges. Directors also stressed that pension and labor market reforms that make it more attractive to extend working lives would lower the public pension bill, raise growth, and reduce the need to save.

Directors noted the slow labor productivity growth and a declining trend in entrepreneurship. They recommended further improving access to venture capital, providing tax incentives for R&D to small‑ and medium‑size enterprises, and reducing administrative burdens. They also urged the authorities to ensure that incentives, regulations, and funding availability are appropriate to complete Germany's digital transformation. Directors also renewed calls for accelerating competition‑enhancing reforms in parts of the services sector and network industries.

Directors emphasized that accelerating house prices in Germany's most dynamic cities deserve close monitoring. They noted that the lack of granular data at the city level prevents a full assessment of developments. In this context, they recommended strengthening the macroprudential toolkit and urgently addressing data gaps to guard against the risk that pockets of financial vulnerability might emerge.

Directors noted that profitability in the bank and life insurance sectors remains low and that restructuring efforts must be accelerated to durably strengthen resilience and reduce risks. They stressed the importance of continued supervisory attention to progress in implementing restructuring plans and reducing interest rate risk in banking and insurance.

Germany's Economic Outlook in Six Charts

1. Germany's economic momentum is expected to persist in 2018 . Business investment is expected to be dynamic. With strong job growth and unemployment falling to new post-reunification lows, rising wages should provide a boost to private consumption. Higher wage growth and stronger imports would also help bring down Germany's large current account surplus, which stood at 8¼ percent of GDP in 2017.

2. Public finances have improved significantly. The budget surplus rose to 1.2 percent in 2017 – the highest level since reunification. Fiscal surpluses are projected to remain high over the medium term, pushing debt down to 42 percent of GDP by 2023.

3. The strong fiscal position can be used to increase investment in physical, digital, and human capital. Public investment in infrastructure, especially at the municipal levels, can help crowd in private investment and support external rebalancing. New government plans to increase investment in digital infrastructure, especially high-speed nationwide internet connections, are essential to keep Germany's edge as an innovation leader. And with the high probability of an average German job of being lost to automation, investment in life-long learning is key to boosting productivity and long-run growth.

4. Public finances can also be used to boost labor force participation. Germany's workforce will begin shrinking in 2020. Policies to tap into the potential of women, older workers, and migrants can help offset this decline. Expanding childcare and after-school programs would provide greater opportunities for women to pursue full-time employment. Pension and labor market reforms that make it more attractive to stay in the workforce longer can also reduce the need to save and lift growth.

5. Fostering entrepreneurship can raise productivity growth and investment . Germany is an innovation leader, but with a relative weakness in venture capital. The government should encourage the provision of scale-up capital to support startups at the growth stage. New business creation and expansion is essential for technological diffusion and productivity growth.

6. Strong policies are needed to curb financial excesses in the housing market. Rising wages, large immigration flows, and low interest rates are driving up the demand for housing. House prices in Germany's major cities such as Munich, Hamburg and Frankfurt, have risen much faster than in other European Union cities. Lowering the burden on new construction can ease supply constraints, and strengthening the prudential toolkit can help preserve financial stability.

-----

Earlier:

2018, July, 2, 11:55:00

NORD STREAM-2: NO SANCTIONSREUTERS - Germany has been assured by the United States that any sanctions imposed on Russia will not affect the building of a gas pipeline to bring Russian gas to Europe, a spokeswoman for the German economy ministry said on Friday. |

2018, June, 22, 13:15:00

GAZPROM FOR GERMANY: +13%GAZPROM - The meeting highlighted that Germany continued to ramp up its imports of Russian gas. According to preliminary data, from January 1 through June 19, 2018, Gazprom supplied Germany with 28.2 billion cubic meters of gas, an increase of 13.1 per cent from the same period of 2017. |

2018, May, 18, 08:50:00

NORD STREAM TO GERMANYREUTERS - A consortium of western companies and Russia’s Gazprom that is due to build the controversial subsea Nord Stream 2 gas pipeline to Germany said on Tuesday it was starting preparatory work in the Greifswald bay off Germany’s Baltic coast. |

2017, December, 22, 22:20:00

GERMAN OIL & GAS: 58.3%PLATTS - Germany's total primary energy consumption for 2017 is forecast to rise by 0.8%, mainly due to strong economic growth, with oil and gas further boosting their market share to 58.3% of the energy mix, German research group AG Energiebilanzen (AGEB) said Thursday. |

2017, December, 1, 12:45:00

RUSSIAN GAS TO GERMANY: 200 BLNGAZPROM - the Nord Stream gas pipeline transmitted its 200 billionth cubic meter of gas from Russia to Germany via the Greifswald delivery point. |

2017, February, 18, 19:00:00

GAZPROM - GERMANY: UP 37%It was noted that Gazprom’s gas supplies to the German market had reached a record of 49.8 billion cubic meters in 2016. The upward trend in gas demand continues in early 2017. In January, gas exports grew by 23.2 per cent versus the corresponding month of 2016. Between February 1 and February 15, gas deliveries added 37 per cent compared to the same period of last year. |

2016, November, 9, 18:30:00

RUSSIAN GAS FOR GERMANY: UP TO 23%Gazprom’s supplies to the German market continued to grow, rising 23 per cent this September and 20.4 per cent this October versus the corresponding months of 2015. |