IEA: OIL SUPPLY ISSUES

IEA - OPEC oil ministers and ten non-OPEC oil ministers have met and agreed to achieve 100% compliance with the Vienna Agreement (i.e. they will increase production). What this means in terms of volume and timing remains to be seen as the official communique contained little detail, but there are already indications from leading producers, particularly Saudi Arabia, its Gulf allies, and Russia, that production is climbing and may reach record levels. Such determination to ensure the steady supply of oil to world markets in the face of multiple challenges to stability is very welcome. The prospect of higher supply might be thought to have sent oil prices down, but in fact WTI prices have risen close to levels not seen since November 2014 and Brent prices have recently made a renewed attempt to reach $80/bbl. Higher prices are prolonging the fears of consumers everywhere that their economies will be damaged. In turn, this could have a marked impact on oil demand growth.

That prices have remained relatively high reflects various supply concerns, some of which will be with us for some time to come, e.g. Iran and Venezuela, and others that are probably shorter term. The clearly expressed determination of the United States to reduce Iran's exports by as much as possible suggests that shipments could be reduced by significantly more than the 1.2 mb/d seen in the previous round of sanctions. In June, Iran's crude exports fell back by about 230 kb/d, albeit from a relatively high level in May, as European purchases dropped by nearly 50%. Most of Iran's oil goes to Asia, however, with China and India currently taking over 600 kb/d each. When you also consider that both China and India are exposed to Venezuela, importing respectively 250 kb/d and 325 kb/d, it is clear that the world's second and third biggest oil consumers could face major challenges in sourcing alternative compatible barrels.

The re-emergence of Libya as a risk factor in global supply follows a series of attacks on key infrastructure that saw production plummet to around 500 kb/d in July from close to the 1 mb/d level seen for about a year. At the time of writing, the situation seemed to be improving, but we cannot know if stability will return. The fact that so much production is vulnerable is clearly a cause for concern. Incidentally, China receives nearly 140 kb/d of oil from Libya. Two other supply disruptions are likely to be short-lived. In Alberta, 360 kb/d of output from Syncrude's heavy crude upgrading facility was shut-in from 20 June and in the North Sea oil production fell sharply in May by nearly 360 kb/d and output likely remained constrained due to summer maintenance and strike action in Norway. In addition, Brazilian production growth so far in 2018 has been lower than expected. At the same time, refiners' thirst for crude oil will remain high during the summer period before seasonal maintenance kicks in.

Some of these supply issues are likely to be resolved, but the large number of disruptions reminds us of the pressure on global oil supply. This will become an even bigger issue as rising production from Middle East Gulf countries and Russia, welcome though it is, comes at the expense of the world's spare capacity cushion, which might be stretched to the limit. This vulnerability currently underpins oil prices and seems likely to continue doing so. We see no sign of higher production from elsewhere that might ease fears of market tightness. Indeed, our overall growth outlook for non-OPEC production in 2018 has been reduced slightly to 1.97 mb/d, although in turn our 2019 growth estimate shows a modest increase to 1.84 mb/d. On the demand side, although there are emerging signs of reduced economic confidence, and consumers are unhappy at higher prices, we retain our view that growth in 2018 will be 1.4 mb/d, and about the same next year.

The northern hemisphere summer promises to be anything but quiet as markets adjust to the ever-changing geopolitical and physical climate. We continue to be in a close dialogue with major producers and consumers, both inside and outside the IEA family, and are monitoring market developments in order to be prepared to advise on any support that might be needed.

-----

Earlier:

2018, July, 12, 10:45:00

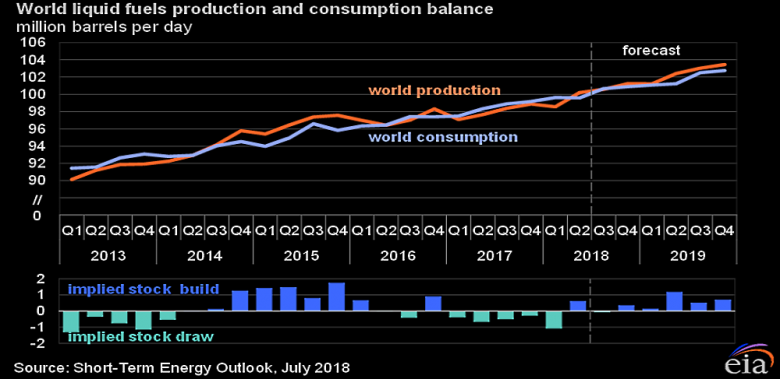

OPEC: OIL DEMAND UP BY 1.65 MBDOPEC - In 2018, oil demand is expected to grow by 1.65 mb/d, unchanged from the previous month’s assessment, with expectations for total world consumption at 98.85 mb/d. In 2019, the initial projection indicates a global increase of around 1.45 mb/d, with annual average global consumption anticipated to surpass the 100 mb/d threshold. The OECD is once again expected to remain in positive territory, registering a rise of 0.27 mb/d with the bulk of gains originating in OECD America. The non-OECD region is anticipated to lead oil demand growth in 2019 with initial projections indicating an increase of around 1.18 mb/d, most of which is attributed to China and India. Additionally, a steady acceleration in oil demand growth is projected in Latin America and the Middle East. |

2018, July, 12, 10:35:00

OPEC & RUSSIA 1 MBD: INSUFFICIENTPLATTS - OPEC's recent decision with Russia and other allies to boost crude output by a combined 1 million b/d may be insufficient to meet global demand in the months ahead, according to the producer group's own forecast. |

2018, July, 11, 09:30:00

OPEC LISTEN TO CONSUMERSBLOOMBERG - “We need to just give it time to enter the market,” Al Mazrouei said of the extra supply. “When a major consuming country speaks, we listen -- we listen to the United States, we listen to China, we listen to India.” |

2018, July, 11, 09:25:00

OIL PRICES 2018 - 19: $73 - $69EIA - Brent crude oil spot prices averaged $74 per barrel (b) in June, a decrease of almost $3/b from the May average. EIA forecasts Brent spot prices will average $73/b in the second half of 2018 and will average $69/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average $6/b lower than Brent prices in the second half of 2018 and $7/b lower in 2019. NYMEX WTI futures and options contract values for October 2018 delivery that traded during the five-day period ending July 5, 2018, suggest a range of $56/b to $87/b encompasses the market expectation for October WTI prices at the 95% confidence level. |

2018, July, 9, 15:15:00

LIBYA'S OIL PRODUCTION DOWN TO 527 TBDREUTERS - Libya’s national oil production fell to 527,000 barrels per day (bpd) from a high of 1.28 million bpd in February following recent oil port closures, the head of the National Oil Corporation (NOC) said in a statement on Monday. |

2018, July, 6, 11:55:00

КОРРЕКТИРОВКА ДО 100%МИНЭНЕРГО РОССИИ - В ходе телефонного разговора Министр энергетики Российской Федерации Александр Новак и Министр энергетики, промышленности и природных ресурсов Саудовской Аравии Халид аль-Фалих обсудили последние тенденции на мировом рынке нефти. Министры обменялись информацией о планах своих стран по производству нефти для удовлетворения спроса в летний период в свете решений, принятых в последние месяцы на 174-й встречи Конференции ОПЕК и 4-й Министерской встречи стран ОПЕК и не входящих в ОПЕК государств в Вене, направленных на корректировку коллективного уровня снижения добычи нефти со 147 процентов в мае 2018 до 100 процентов, начиная с 1 июля 2018 г., что соответствует увеличению добычи примерно на один миллион баррелей нефти в день. |

2018, June, 25, 12:10:00

LIBYA RETAKES OILPLATTS - The Libyan National Army has retaken the key eastern oil terminals of Ras Lanuf and Es Sider that shut 450,000 b/d of crude production, the head of the state-owned National Oil Corp. said Friday. |