OPEC & RUSSIA 1 MBD: INSUFFICIENT

PLATTS - OPEC's recent decision with Russia and other allies to boost crude output by a combined 1 million b/d may be insufficient to meet global demand in the months ahead, according to the producer group's own forecast.

OPEC's recent decision with Russia and other allies to boost crude output by a combined 1 million b/d may be insufficient to meet global demand in the months ahead, according to the producer group's own forecast.

The so-called call on OPEC crude is expected to average 33.34 million b/d in the third quarter, rising to 33.58 million b/d in the fourth quarter, OPEC said in its closely watched monthly oil market report Wednesday.

That is 1.01 million b/d and 1.25 million b/d, respectively, higher than OPEC's June production level of 32.33 million b/d, as estimated by independent secondary sources used by the organization to track output.

Either OPEC would need to raise its output by more than it committed to, or crude would have to come out of storage, if it wishes to avoid a market squeeze.

But fears of a shortage in global spare capacity are perhaps overdone, the report hinted, as a rush of non-OPEC supplies in 2019 will reduce the pressure on OPEC to keep the taps open, even as world oil demand is set to rise above 100 million b/d for the first time.

Demand will grow 1.45 million b/d to 100.30 million b/d in 2019, but will be outpaced by the increase in non-OPEC supply of 2.10 million b/d, OPEC said in its report, which provided the organization's first forecast of 2019 fundamentals.

As a result, OPEC sees the call on its crude falling to 31.82 million b/d in the first quarter and 32.14 million b/d in the second quarter.

"Therefore, if the world economy performs better than expected, leading to higher growth in crude oil demand, OPEC will continue to have sufficient supply to support oil market stability," OPEC said, though it cautioned that brewing trade disputes around the world could have a chilling effect on consumer spending, investment and capital flows.

OECD commercial oil inventories stood at 2.82 billion barrels as of the end of May, 236 million barrels lower than year-ago levels and 40 million barrels below the latest five-year average, OPEC said.

PRODUCTION PLANS IN FLUX

OPEC has come under pressure from US President Donald Trump, as well as leaders from major oil consuming countries China and India, to supply more barrels to cool the market ahead of the peak summer demand season, and Saudi Arabia, OPEC's largest producer, has indicated that it may be heeding those calls.

The kingdom self-reported June production of 10.49 million b/d, according to the OPEC report, a 460,000 b/d increase from May and far in excess of its quota of 10.06 million b/d. Secondary sources pegged Saudi production a touch lower, at 10.42 million b/d.

The figures suggest the kingdom was ramping up its output long before the OPEC and its 10 non-OPEC partners, led by Russia, met in Vienna on June 23 to decide on production policy.

With the coalition leaving unsettled how to allocate its agreed 1 million b/d supply increase, a six-country OPEC/non-OPEC Joint Technical Committee will meet Tuesday in Vienna to assess market conditions and discuss next steps. The committee of non-minister delegates is chaired by Saudi Arabia and also includes Russia, Kuwait, Venezuela, Algeria and Oman.

Sanctions-hit Iran and Venezuela have insisted that countries are not permitted to produce above their individual quotas that have been in force since January 2017 or else the agreement will be breached.

Saudi Arabia, however, has said that individual quotas no longer apply and that members with spare capacity -- mostly the kingdom and its Gulf allies -- will account for the output increase, to meet expected robust demand and offset any supply disruptions.

OPEC's June production figure of 33.32 million b/d includes the Republic of Congo, which joined the organization last month, and is a 170,000 b/d increase from May's output level.

Second-largest producer Iraq said it produced 4.36 million b/d in June, its 10th straight month at that level. Secondary sources estimated Iraq's production much higher at 4.53 million b/d, a 70,000 b/d month-on-month increase and 180,000 b/d above its 4.35 million b/d quota.

Iran self-reported June output of 3.80 million b/d, unchanged from May and right at its quota. Secondary sources also pegged the country's output at 3.80 million b/d, but said it represented a 20,000 b/d month-on-month decline.

Libya, wracked by internal divisions, suffered a 250,000 b/d decline in crude production to 710,000 b/d, according to secondary sources, while Angola saw a 90,000 b/d decline and Venezuela posted a 50,000 b/d drop.

-----

Earlier:

2018, July, 11, 09:35:00

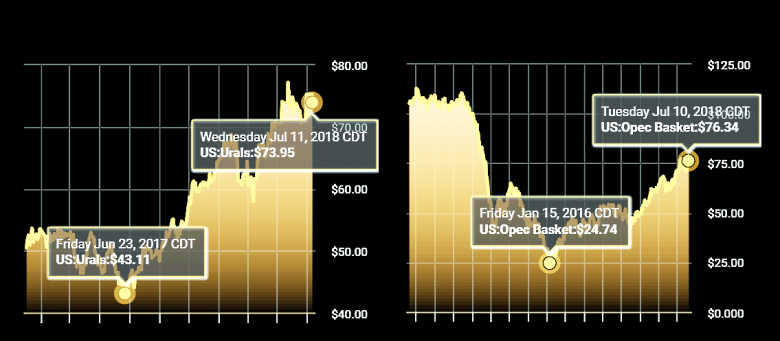

OIL PRICE: NEAR $78 YETREUTERS - Brent crude futures LCOc1 were down 75 cents, or 1 percent, at $78.11 a barrel by 0308 GMT, having fallen as low as $77.60. U.S. crude CLc1 was down 55 cents, or 0.7 percent, at $73.56. |

2018, July, 11, 09:30:00

OPEC LISTEN TO CONSUMERSBLOOMBERG - “We need to just give it time to enter the market,” Al Mazrouei said of the extra supply. “When a major consuming country speaks, we listen -- we listen to the United States, we listen to China, we listen to India.” |

2018, July, 11, 09:25:00

OIL PRICES 2018 - 19: $73 - $69EIA - Brent crude oil spot prices averaged $74 per barrel (b) in June, a decrease of almost $3/b from the May average. EIA forecasts Brent spot prices will average $73/b in the second half of 2018 and will average $69/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average $6/b lower than Brent prices in the second half of 2018 and $7/b lower in 2019. NYMEX WTI futures and options contract values for October 2018 delivery that traded during the five-day period ending July 5, 2018, suggest a range of $56/b to $87/b encompasses the market expectation for October WTI prices at the 95% confidence level. |

2018, July, 6, 11:55:00

КОРРЕКТИРОВКА ДО 100%МИНЭНЕРГО РОССИИ - В ходе телефонного разговора Министр энергетики Российской Федерации Александр Новак и Министр энергетики, промышленности и природных ресурсов Саудовской Аравии Халид аль-Фалих обсудили последние тенденции на мировом рынке нефти. Министры обменялись информацией о планах своих стран по производству нефти для удовлетворения спроса в летний период в свете решений, принятых в последние месяцы на 174-й встречи Конференции ОПЕК и 4-й Министерской встречи стран ОПЕК и не входящих в ОПЕК государств в Вене, направленных на корректировку коллективного уровня снижения добычи нефти со 147 процентов в мае 2018 до 100 процентов, начиная с 1 июля 2018 г., что соответствует увеличению добычи примерно на один миллион баррелей нефти в день. |

2018, July, 4, 12:20:00

SAUDI ARABIA & RUSSIA: +1 MBDBLOOMBERG - Saudi Arabia and Russia reaffirmed an agreement between OPEC and its allies, which they say will mean increasing oil production by 1 million barrels a day. |

2018, July, 2, 12:20:00

РОССИЯ МОЖЕТ ДОБАВИТЬ 200 000ПРАЙМ - Россия готова нарастить свою добычу нефти более чем на 200 тысяч баррелей в сутки, если это будет нужно для достижения общей цели ОПЕК+ по увеличению добычи в 1 миллион баррелей, сообщил журналистам министр энергетики РФ Александр Новак. |

2018, June, 22, 13:25:00

RUSSIA - SAUDIS SUPER OPECBLOOMBERG - Russian Oil Minister Alexander Novak said in a speech yesterday that “we need to build upon our successful cooperation model and institutionalize its success through a broader and more permanent strategically focused framework.” His Saudi counterpart Khalid Al-Falih echoed those comments. |