U.S. FOREIGN DIRECT INVESTMENT: $259.6 BLN

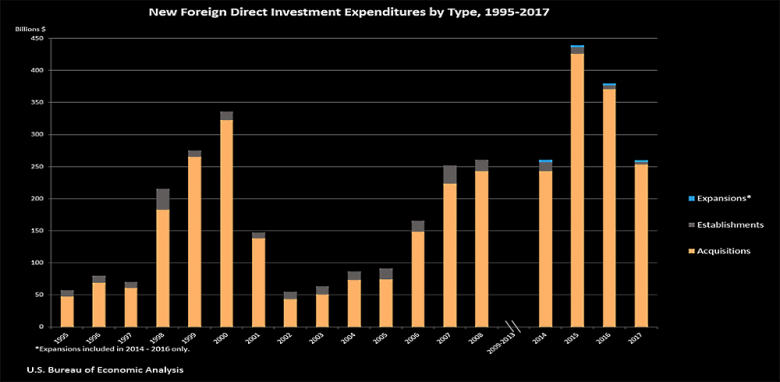

U.S. BEA - Expenditures by foreign direct investors to acquire, establish, or expand U.S. businesses totaled $259.6 billion (preliminary) in 2017. Expenditures were down 32 percent from $379.7 billion (revised) in 2016 and were below the annual average of $359.9 billion for 2014-2016. As in previous years, acquisitions of existing businesses accounted for a large majority of total expenditures.

In 2017, expenditures for acquisitions were $253.2 billion, expenditures to establish new U.S. businesses were $4.1 billion, and expenditures to expand existing foreign-owned businesses were $2.4 billion. Planned total expenditures, which include both first-year and planned future expenditures until completion for projects initiated in 2017, were $278.0 billion.

Expenditures by industry, country, and state in 2017

By industry, expenditures for new direct investment were distributed widely. Expenditures in manufacturing, at $103.7 billion, accounted for 40 percent of total expenditures, the largest share among major industries. Within manufacturing, expenditures were largest in food manufacturing ($34.0 billion). There were also large expenditures in information ($25.7 billion) and in real estate, rental, and leasing ($17.0 billion).

By country of ultimate beneficial owner (UBO), a small number of countries accounted for most of the investment. The largest investing country was Canada, with expenditures of $66.2 billion, followed by the United Kingdom ($40.9 billion), Japan ($34.0 billion), and France ($23.1 billion). By region, Europe contributed 40 percent of the new investment in 2017.

By U.S. state, the largest expenditures were in California ($41.6 billion), Texas ($39.7 billion), and Illinois ($26.0 billion).

Greenfield expenditures

Greenfield investment expenditures–expenditures to establish new U.S. businesses and to expand existing foreign-owned U.S. businesses–were $6.4 billion in 2017. Total planned expenditures until completion for greenfield investment initiated in 2017, which include both first-year and future expenditures, were $24.8 billion.

By U.S. industry, greenfield expenditures in 2017 were largest in manufacturing at $1.6 billion, accounting for 24 percent of total greenfield expenditures. By U.S. state, greenfield expenditures in 2017 were largest in Delaware ($1.2 billion) and New York ($0.6 billion).

Employment by newly acquired, established, or expanded foreign-owned businesses

In 2017, employment at newly acquired, established, or expanded foreign-owned businesses in the United States was 554,300 employees. Current employment of acquired enterprises was 549,700. Total planned employment, which includes the current employment of acquired enterprises, the planned employment of newly established business enterprises when fully operational, and the planned employment associated with expansions, was 577,200.

By industry, accommodation and food services accounted for the largest number of employees (255,100), followed by manufacturing (109,000) and administration, support, and waste management services (55,500). By country of UBO, France accounted for the largest number of employees (47,700), followed by the United Kingdom (42,100) and Canada (39,400).

By U.S. state, Virginia was in the largest employment category, but the employment value is suppressed due to confidentiality. The next largest states in employment were Missouri (63,000), California (55,700), and Florida (55,500). Employment for acquired entities that operate in multiple states is attributed to the state where the greatest number of employees are based.

-----

Earlier:

2018, July, 9, 15:10:00

U.S. DEFICIT DOWN $3 BLN TO $43.1 BLNU.S. BEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $43.1 billion in May, down $3.0 billion from $46.1 billion in April, |

2018, July, 9, 14:55:00

U.S. UNEMPLOYMENT UP TO 4%U.S. BLS - Total nonfarm payroll employment increased by 213,000 in June, and the unemployment rate rose to 4.0 percent, |

2018, July, 4, 12:10:00

U.S. ECONOMY UP AGAINIMF - The near-term outlook for the U.S. economy is one of strong growth and job creation. Unemployment is near levels not seen in 50 years, and growth is set to accelerate, aided by a fiscal stimulus, a recovery of private investment, and supportive financial conditions. These positive outturns have supported, and been reinforced by, a favorable external environment. The balance of evidence suggests that the U.S. economy is beyond full employment. |

2018, June, 29, 10:05:00

U.S. GDP UP OF 2%U.S. BEA - Real gross domestic product (GDP) increased at an annual rate of 2.0 percent in the first quarter of 2018 , according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.9 percent. |

2018, June, 27, 10:35:00

U.S. WANT NORWAY'S MONEYREUTERS - Norway, which shares an Arctic border with Russia, lacks a “credible plan” how to meet NATO’s spending target, U.S. President Donald Trump said in a letter to the country’s prime minister, the Norwegian daily VG reported on Tuesday. |

2018, June, 22, 13:05:00

U.S. DEFICIT UP FROM $116.1 BLN TO $124.1 BLNU.S. BEA - The U.S. current-account deficit increased to $124.1 billion (preliminary) in the first quarter of 2018 from $116.1 billion (revised) in the fourth quarter of 2017, according to statistics released by the Bureau of Economic Analysis (BEA). The deficit was 2.5 percent of current-dollar gross domestic product (GDP) in the first quarter, up from 2.4 percent in the fourth quarter.

|

2018, June, 20, 13:00:00

U.S. TRADE WARSAPI - “Instead of utilizing a transparent decision-making process that provided room for input from key stakeholders, the administration continues to take serious missteps in the trade arena that could undermine American jobs and America’s role on the global energy stage. Trade wars with key trading partners will be detrimental to the U.S. economy and consumers.” |