SAUDI ARAMCO'S PROFIT $68.2 BLN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

SAUDI ARAMCO'S PROFIT $68.2 BLN

GULF NEWS- November 04, 2019 - Saudi Aramco's nine-month profit fell 18 per cent as lower oil prices eroded sales ahead of a share sale that could be the world's largest.

The oil giant earned net income of $68.2 billion compared with $83.1 billion for the same period a year ago, it said in a statement posted on its website. The state company's revenue slipped to $217 billion from $233 billion.

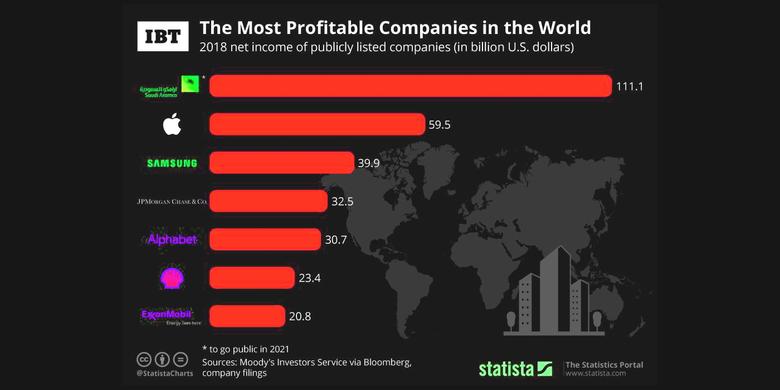

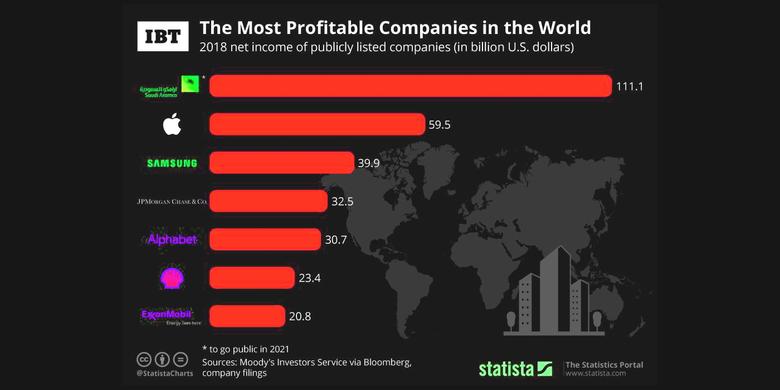

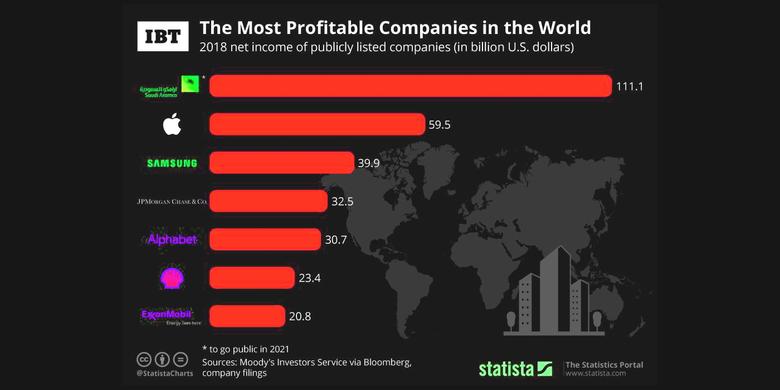

Aramco gave no explanation for the decline in its results, though its nine-month income alone exceeded the 2018 net posted by Apple Inc., the most profitable publicly traded company. Average Brent crude dropped about 11 per cent over the nine-month period compared with the previous year. Saudi Arabia has been cutting oil output along with other global producers to shore up prices amid a surplus and signs of weaker demand.

Aramco kicked off an oft-delayed initial public offering on Sunday, revealing potential tax cuts and dividends to lure investors. The Saudi government has conceded the company probably isn't worth the $2 trillion valuation Crown Prince Mohammed bin Salman has long targeted.

Saudi Aramco's $111 billion annual net income for 2018 made it the world's most profitable firm. The Crown Prince is counting on those earnings and Saudi Arabia's vast oil reserves — the world's biggest deposits of conventional crude — to attract investors. The kingdom is seeking funds to build job-generating industries that it hopes will help wean the economy off of its overwhelming reliance on crude sales.

-----

Earlier:

2019, November, 1, 13:40:00

SAUDI ARABIA'S POWER PLANT $11.5 BLN

Saudi Aramco announced its intention to establish the Jazan Power Joint Venture. The JV will be 46% owned by Air Products, 25% by ACWA Power, 20% by Saudi Aramco and 9% by Air Products Qudra.

2019, October, 21, 13:10:00

SAUDI'S INVESTMENT FOR BANGLADESH $3 BLN

Saudi Aramco and Saudi utilities developer Acwa Power have signed a memorandum of understanding (MoU) with the Bangladesh government to develop a $3bn liquefied natural gas (LNG) terminal and power plant in the South Asian country.

All Publications »

Tags:

SAUDI,

ARAMCO