JAPAN STOCKS DOWN

REUTERS - DECEMBER 11, 2020 - Asian shares rose on Friday as progress on COVID-19 vaccines boosted investor sentiment, but tricky Brexit negotiations and U.S. stimulus talks capped gains in riskier assets.

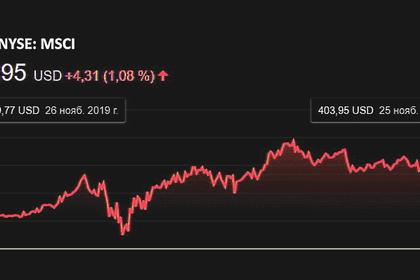

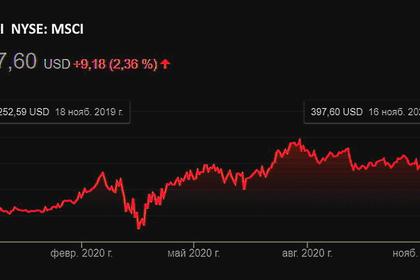

MSCI’s ex-Japan Asia-Pacific index firmed 0.3%, on track for its sixth straight week of gains, while Japan’s Nikkei eased 0.4%.

Investors bet on stronger economic growth next year as more countries prepare for vaccinations. U.S. authorities voted overwhelmingly to endorse emergency use of Pfizer’s coronavirus vaccine while doses of a COVID-19 vaccine made by China’s Sinovac Biotech SVA.O are rolling off a Brazilian production line.

European stocks are seen dipping with Euro Stoxx 50 futures down 0.3% and Britain’s FTSE futures trading 0.2% lower.

Buying fizzled out in some markets as talks on U.S. stimulus failed to make progress and after British Prime Minister Boris Johnson said on Thursday there was “a strong possibility” Britain and the EU would fail to strike a trade deal.

Britain and the EU have set a deadline of Sunday to find an agreement, ahead of Jan. 1, when the United Kingdom finally exits the bloc’s orbit.

“We have the Brexit deadline. Some people say Democrats are gaining momentum in Georgia’s Senate election while we are near the end of year,” said Masaru Ishibashi, joint general manager of trading at Sumitomo Mitsui Bank.

“Put all this together, you would think we are likely to see more profit-taking even though no one thinks we will be entering a bear market.”

Investors have in recent weeks bet that Republicans would win at least one of the two contested seats in the state of Georgia, enabling them to control the U.S. Senate and block some policies favoured by Dermocrats, such as higher corporate taxes.

Overnight on Wall Street, the Dow Jones Industrial Average fell 0.23%, the S&P 500 lost 0.13% and the Nasdaq Composite added 0.54%.

U.S. stocks were mixed as near-term U.S. fiscal stimulus appeared unlikely after Democrat House Speaker Nancy Pelosi suggested wrangling over a spending package and coronavirus aid could drag on through Christmas.

“U.S. policymakers are still trying to hammer out a coronavirus relief package,” wrote Joseph Capurso, a strategist with the Commonwealth Bank of Australia. “The U.S. economy needs fiscal relief because lockdowns continue to spread. The lockdowns are closing businesses and preventing spending.”

The number of Americans filing first-time claims for unemployment benefits increased more than expected last week as mounting COVID-19 infections have led to more business restrictions.

Still, strong appetite for recent initial public offerings showed investors were generally upbeat on equity markets.

“When you look at the popularity of recent IPOs, it is clear investors have positive bias,” said Takeo Kamai, head of execution services at CLSA.

Shares of Airbnb Inc more than doubled in their stock market debut on Thursday, valuing the home rental firm at just over $100 billion in the biggest U.S. initial public offering (IPO) of 2020. Shares in delivery company DoorDash Inc doubled in their first day of trading.

In the currency market, Brexit uncertainties overshadowed trading in sterling. The British pound traded at $1.3307, flat on day but having lost 0.9% so far this week against a generally weaker dollar.

The euro held not far from 2 1/2-year highs of $1.2154 after the European Central Bank delivered a fresh stimulus package that was broadly in line with market expectations on Thursday.

The ECB increased the overall size of its Pandemic Emergency Purchase Programme (PEPP) by 500 billion euros to 1.85 trillion euros and extended the scheme by nine months to March 2022.

The yen edged up 0.2% to 104.00 while the Australian dollar extended its gains to $0.7557, hitting its highest since June 2018.

Oil prices climbed further, with Brent hitting levels not seen since early March, as coronavirus vaccination rollouts fuelled hopes that crude demand would pick up in 2021.

Brent crude rose 0.2% to $50.34 per barrel while U.S. West Texas Intermediate (WTI) crude gained 0.2% to $46.89 a barrel.

-----

Earlier: