GLOBAL OIL DEMAND DOWN 9.77 MBD

OPEC - 14 December 2020 - OPEC MONTHLY OIL MARKET REPORT

Oil Market Highlights

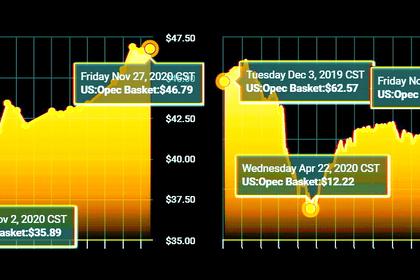

Crude Oil Price Movements

The OPEC Reference Basket (ORB) rose by $2.53, or 6.3%, month-on-month (m-o-m), to stand at $42.61/b in November. Year-to-date (y-t-d), the ORB has averaged $40.75/b, down by $23.07 compared to the same period last year. Spot crude prices bounced back in November, following a rally in crude futures contracts after positive news on COVID-19 vaccines raised optimism about a recovery in oil demand. Crude oil futures prices on both sides of the Atlantic settled higher in November, with front-month ICE Brent increasing $2.46, m-o-m, to average $43.98/b, and NYMEX WTI $1.79 higher to settle at $41.35/b, m-o-m. Consequently, the Brent-WTI spread widened slightly by 66¢, m-o-m, to average $2.63/b. The contango structure of crude oil futures prices flattened considerably in November, and prompt time-spreads of DME Oman flipped into backwardation in the second half of the month. In November, hedge funds and other money managers turned more positive on the outlook for oil prices, amid prospects for improving global oil demand fundamentals in the coming months.

World Economy

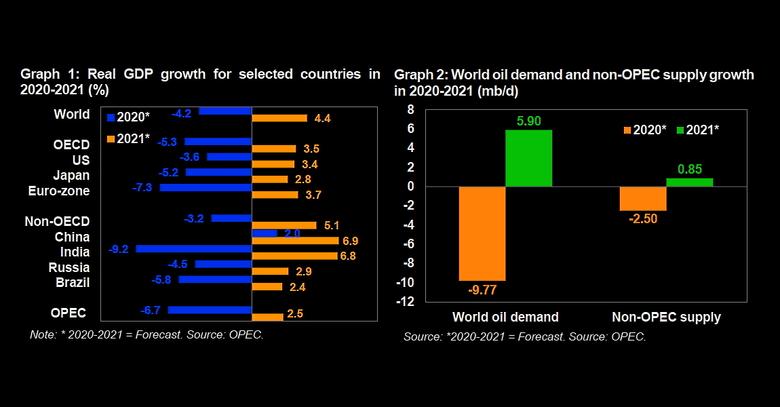

Global economic growth is revised up slightly for 2020, after a better-than-expected performance in 3Q20, now showing a contraction of 4.2% y-o-y, compared to the previous month’s forecast of -4.3%. While the 2021 forecast remains at 4.4%, recent positive news about faster-than-anticipated vaccination programmes in major economies provides potential upside for next year’s growth forecast. US economic growth remains unchanged at -3.6% for 2020 and at 3.4% for 2021. The Euro-zone forecast is revised down to -7.3%, while the 2021 growth forecast remains at 3.7%. Japan’s economic forecast is revised up to -5.2% for 2020 but remains at growth of 2.8% for 2021. China’s economic growth remains at 2.0% for 2020 and at 6.9% in 2021. The forecast for India remains at -9.2% for 2020 and 6.8% for 2021. Brazil’s 2020 forecast is revised up to -5.8%, but remains at 2.4% for 2021. Russia’s economic growth forecast in 2020 is revised up to -4.5%, while the growth forecast for 2021 remains unchanged at 2.9%.

World Oil Demand

World oil demand for 2020 is expected to decline by 9.77 mb/d, marginally lower than in last month’s assessment. Weaker-than-expected data in the OECD in 3Q20, mainly due to lower transportation fuel demand in the US and OECD Europe, led to a downward revision of around 0.18 mb/d for the OECD group. However, this is mostly offset by an upward revision to the non-OECD, by 0.16 mb/d. Better-than-expected oil demand in China, amid a steady recovery across various economic sectors, and improving oil demand from India support this upward revision. Total oil demand is estimated to reach 89.99 mb/d in 2020. For 2021, world oil demand growth is revised lower by 0.35 mb/d, to growth of 5.90 mb/d. This is due to the uncertainty surrounding the impact of COVID-19 and the labour market on the OECD transportation fuel outlook for 1H21. Petrochemical feedstock and industrial fuels are forecast to gain momentum on the back of improving economic activities, with total oil demand projected to reach 95.89 mb/d in 2021.

World Oil Supply

Non-OPEC liquids production in 2020 is revised down by 0.08 mb/d, m-o-m, contracting by 2.50 mb/d, to average 62.67 mb/d. This is mainly due to downward revisions in Brazil, the US, the UK and Norway, following lower-than-expected output in 4Q20, although partially offset by upward revisions to production in Russia and Canada. For the year, oil supply shows declines mainly in Russia, the US and Canada, while production in Norway, Brazil, China and Guyana is estimated to have grown. Non-OPEC supply for 2021 is adjusted down by 0.1 mb/d and is now forecast to grow by 0.85 mb/d to average 63.52 mb/d, mainly due to downward revisions in Russia’s output. The US liquids supply forecast remains unchanged at 0.3 mb/d, while uncertainties persist. The main drivers for supply growth are expected to be the US, Canada, Brazil and Norway. OPEC NGLs in 2020 are estimated to decline by 0.1 mb/d y-o-y, and forecast to grow by 0.1 mb/d y-o-y in 2021, to average 5.2 mb/d. OPEC crude oil production in November increased by 0.71 mb/d, m-o-m, to average 25.11 mb/d, according to secondary sources.

Product Markets and Refining Operations

Refining margins globally showed mixed movement. The USGC, the only positive performing region, benefitted from strength at the middle and bottom of the barrel, due to sharp declines in diesel floating storage, reduced jet/kerosene refinery output, and an uptick in transportation activity during the Thanksgiving holidays. In Europe and in Asia, margins weakened with solid losses witnessed at the top of the barrel, affected by lower regional naphtha and gasoline consumption amid closed arbitrage and higher feedstock prices.

Tanker Market

Dirty tanker rates remained weak in November, with historically low levels so far in 2H20, amid ample tonnage lists. However, signs indicating that November could be the bottom of the market have provided some hope for ship owners as they look to the coming year. Clean tanker rates picked up from multi-year lows, supported by improving West of Suez activities.

Crude and Refined Products Trade

Preliminary data shows that US crude imports remained near a three-decade low for the second consecutive month, averaging 5.3 mb/d in November. US crude exports picked up from an almost two-year low in October, to average just under 3 mb/d in November, supported by a return of Chinese purchases, with the release of 2021 import quotas. US product exports fell below 5 mb/d for the first time in five months, as diesel outflows declined, amid lower demand from Mexico. Japan’s crude imports recovered from a decline the month before to average 2.3 mb/d in October, on the back of demand for heating. China’s crude imports averaged 10.0 mb/d in October, falling below 11 mb/d for the first time in six months. The decline came as independent refineries awaited new quotas and amid a pause due to the Golden Week holiday, which also reduced product imports. In contrast, China’s product exports jumped 40% to average almost 1.5 mb/d as refiners pushed out gasoline and diesel amid high inventory levels. India’s crude imports declined further, although at a slower pace, to average 3.4 mb/d in October. India’s product imports plunged by almost half to average 0.6 mb/d in October, as inflows were almost solely limited to LPG.

Commercial Stock Movements

Preliminary October data shows total OECD commercial oil stocks down by 46.3 mb, m-o-m. At 3,145 mb, they were 252.5 mb higher than the same time one year ago and 200.3 mb above the latest five-year average. Within the components, crude and product stocks declined by 21.5 mb and 24.8 mb, m-o-m, respectively. In terms of days of forward cover, OECD commercial stocks fell by 1.0 days, m-o-m, in October to stand at 72.2 days. This is 11.1 days above the October 2019 level and 10.1 days above the latest five-year average.

Balance of Supply and Demand

Demand for OPEC crude in 2020 is revised up by 0.1 mb/d from the previous month to stand at 22.2 mb/d, around 7.1 mb/d lower than in 2019. Demand for OPEC crude in 2021 is revised down by 0.2 mb/d from the previous month to stand at 27.2 mb/d, around 5.0 mb/d higher than in 2020.

-----

Earlier: