CORONAVIRUS BRIEFLY: ARAMCO

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

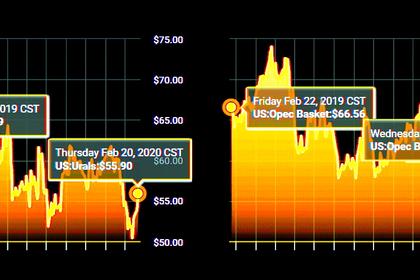

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

CORONAVIRUS BRIEFLY: ARAMCO

MEOG - The global impact of coronavirus will only be "short term", according to the CEO of Saudi Aramco.

Amin Nasser is confident that demand will improve in H2 2020, particularly in China, he told Reuters newswire on Monday.

"We think this is short term and I am confident that in the second half of the year there is going to be an improvement on the demand side, especially from China," Nasser said.

"I do not think it is going to have a long-term impact."

Nasser said that Aramco, the world's biggest oil-producing company, has not evacuated its staff from China.

Saudi Arabia has held talks with other OPEC members and Russia to discuss potential deeper oil supply cuts to counter the impact on crude prices.

But Russia has yet to announce its final position on the proposal.

OPEC and allies are due to meet over March 5-6 to decide on production policy.

-----

Earlier:

2020, February, 21, 12:35:00

OIL PRICE: ABOVE $58 YET

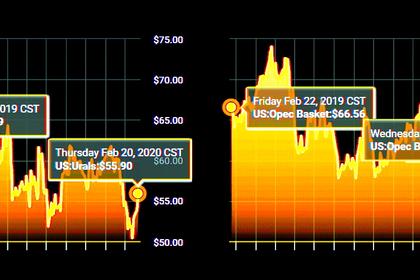

Brent was down 64 cents, or 1.1%, at $58.67 a barrel, WTI dropped 54 cents, or 1%, at $53.34 a barrel.

2020, February, 21, 12:30:00

OIL MARKET: NOTHING URGENT

Despite the partial recovery, oil prices are still far below the level many OPEC members need for their budgets to balance.

2020, February, 19, 11:55:00

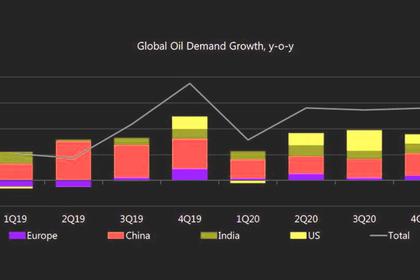

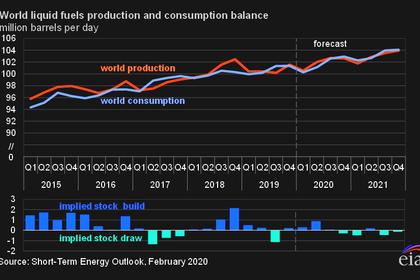

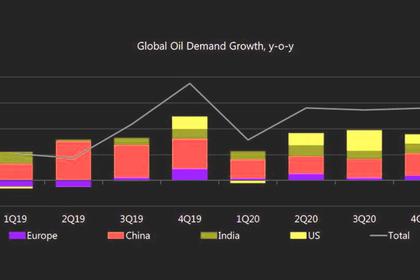

GLOBAL OIL DEMAND 2020: 100.73 MBD

Oil demand growth in 2020 is revised down by 0.23 mb/d from the previous month’s assessment. With this, global oil demand is now forecast to grow by 0.99 mb/d and average 100.73 mb/d for 2020,

2020, February, 19, 11:50:00

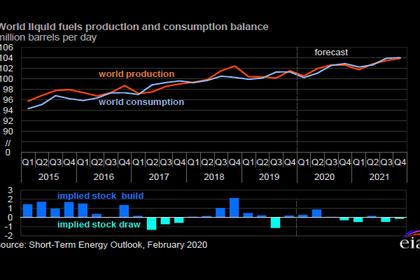

GLOBAL PETROLEUM DEMAND WILL UP BY 1.0 MBD

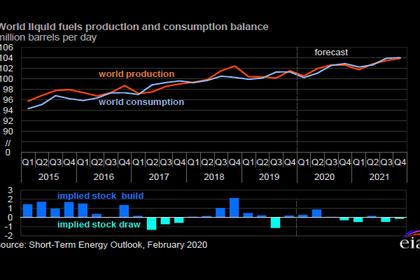

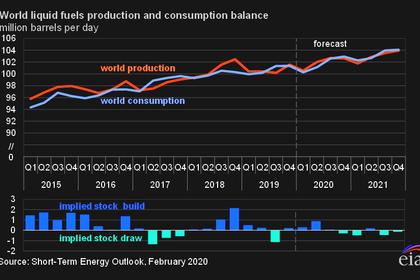

EIA now expects global petroleum and liquid fuels demand will rise by 1.0 million b/d in 2020, which is lower than the forecast increase in the January STEO of 1.3 million b/d in 2020, and by 1.5 million b/d in 2021.

2020, February, 14, 12:10:00

CHINA'S CORONAVIRUS: NO AFFECT

The coronavirus epidemic in China has had a marginal impact on energy markets and is unlikely to dramatically affect oil prices even if Chinese demand falls by 500,000 barrels per day, U.S. Energy Secretary Dan Brouillette told

2020, February, 12, 12:12:00

OIL PRICES 2020-21: $61-68

EIA forecasts Brent prices will average $61/b in 2020; with prices averaging $58/b during the first half of the year and $64/b during the second half of the year. EIA forecasts the average Brent prices will rise to an average of $68/b in 2021.

All Publications »

Tags:

CORONAVIRUS,

SAUDI,

ARABIA,

ARAMCO,

RUSSIA,

OPEC,