CANADA'S OIL INDUSRTY DOWN

PE - 7 May 2020 - The high-cost Canadian oil industry is being hammered by the dual effects of Covid-19 and the fallout from unconstrained supply. Producers have rapidly slashed capital spending and drilling programmes and braced themselves for survival mode.

More recently, with North American storage tanks brimming and regional crude prices falling into single digits or worse, operators are being forced to shut-in substantial amounts of uneconomic oil.

In desperation, Jason Kenney, the premier of Alberta, Canada's dominant oil-producing province, has been promoting a number of policies to protect the country's oil industry, including a greater degree of cooperation with Opec+ and an oil tariff and curtailment regime in concert with the US.

At the same time, Kenney has been, in effect, begging the federal government for a substantial oil industry-specific bailout programme. Prime Minister Justin Trudeau's Liberal government was reported to have been close to providing one in mid-March, prior to a groundswell of environmental opposition derailing it. The Canadian oil industry has since had to settle for a scaled-back bailout programme with significant concessions to the environmental lobby.

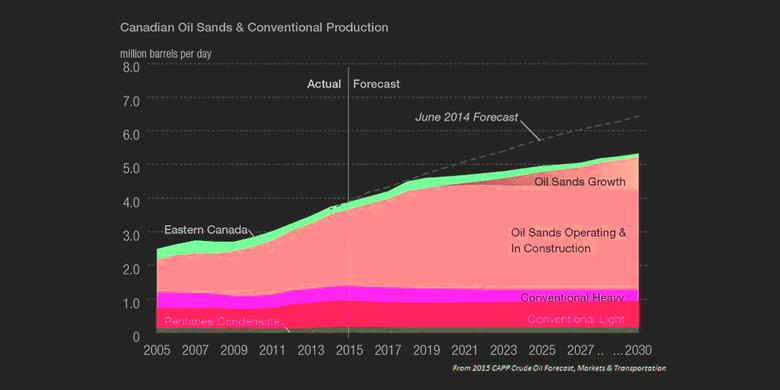

It is important to note the Canadian industry had only partially recovered from the 2014-16 price war when the double whammy hit. This was in large part due to lack of pipeline capacity exiting western Canada, where most of the country's oil is produced, weighing on regional production and prices in the interim.

A number of Canadian companies have announced voluntary shut-ins of oil production in recent weeks, including industry heavyweights such as Suncor and Cenovus. But these announcements are likely just the tip of the iceberg, based on latest short-term forecast for Canadian oil production from the International Energy Agency (IEA).

The IEA predicts Canadian oil production will drop to a low of 4.6mn bl/d in June, after producing roughly 5.5mn bl/d in March and 5.7mn bl/d in December 2019. At this trough, the reduction will represent roughly a quarter of western Canada's oil production, with heavy grades especially hit hard. The agency is assuming Canadian output rebounds in the second half of the year as regional oil product consumption, and hence refinery runs, recover.

Massive Canadian shut-ins such as those forecast by the IEA should not come as a big surprise based on a recent analysis by US broker Sanford C. Bernstein. In early April, the firm produced a report estimating the amount of onshore 'marginal barrels'—a term used by economists for oil that is most likely to be shut-in at low oil prices—for producing countries. Bernstein analysts estimated Canada to have just over 2.7mn bl/d of marginal barrels, easily the most globally, followed by China at a shade under 1.75mn bl/d and the US at slightly north of 700,000bl/d.

Canadian oil firms were extremely quick to cut capital spending and drilling once Saudi Arabia opened the taps following the failed Opec+ meeting in early March. By 23 March, Canadian producers had already cut C$6.25bn ($4.44bn) in spending, roughly a quarter of what was originally planned for 2020, with just two companies, Suncor and Canadian Natural Resources Ltd (CNRL), accounting for over 40pc of these cuts—C$1.5bn and C$1.1bn, respectively.

Since then, Imperial Oil has reduced its capital spending plan for this year by C$500bn to C$1.1-1.2bn. And Cenovus and Husky Energy's spending saw a second round of cuts—Cenovus by another C$150mn for a total of C$600mn, and Husky effectively slashing spending in half to C$1.6-1.8bn.

In early April, Mark Scholz, president of the Canadian association of oilwell drilling contractors (CAODC), said work for his members, which includes drillers, frackers and other service contractors, has "completely evaporated", Capex cuts have been so extreme that Scholz suggested up to two-thirds of drilling activity for the year may have occurred in the first quarter. In the week ending 24 April, there were just 26 rotary drilling rigs active in western Canada, roughly half the number as the same week in 2019—activity is always relatively low at this time of year as its difficult to move rigs during spring thaw.

Radical remedies

In early April, in response to US President Donald Trump prematurely announcing an agreement between Saudi Arabia and Russia to end their oil price war, Kenney was open that Alberta was prepared to consider participating in internationally coordinated supply reductions. This is unsurprising, given the province has been independently curtailing crude production since the beginning of 2019 to support regional crude prices—following a price collapse at the end of the previous year due to a lack of egress and storage capacity.

Alberta energy minister Sonya Savage took part in the virtual G20 oil meeting on 10 April 10, in support of Opec+ efforts to cut production. Despite Opec+ agreeing to slash production by 9.7mn bl/d in May and June as part of a two-year deal, Alberta and the other major producers at the G20 meeting that are not part of Opec+—such as the US—were not required to make formal commitments, in part given the likelihood that economics would do the job of mandated cuts anyway.

Shortly before the April Opec+ meeting, Premier Kenney admitted he had been in discussions with key policymakers in Washington about the need for coordinated action between the two countries to defend their energy industries from low prices. Speaking at the 2020 Scotiabank-Canadian association of petroleum producers (CAPP) virtual energy symposium on 7 April, Kenney argued that the energy industry is a vital part of the continent's economy and national security. A combination of tariffs on oil imports and coordinated production curtailment by the two countries would be needed to protect it, he added.

In the middle of March, the Trudeau government was widely reported to be on the verge of providing the Canadian oil industry with a C$15-20bn bail-out. This package was to include means to provide immediate liquidity to the cash-strapped industry and a potential programme for Ottawa to take direct ownership stakes in companies by purchasing shares. The federal government bailed out Ontario's automotive industry in a similar fashion during the 2008-09 global financial crisis.

However, the speculation alone was enough to energise Canadian environmental groups against any oil industry bail-out, with a coalition of 84 environmental groups sending Trudeau an open letter in late March asking him to reconsider any government willingness to assist.

"Giving billions of dollars to failing oil and gas companies will not help workers and only prolongs our reliance on fossil fuels," the coalition wrote in its letter. "Oil and gas companies are already heavily subsidised in Canada and the public cannot keep propping them up with tax breaks and direct support forever."

As environmentalists tend to be an important part of the Liberal Party's base, the Trudeau government instead announced a C$1.7bn programme in mid-April to help clean up inactive and orphan oil and gas wells in oil-producing provinces, and a C$750mn fund to help the industry reduce its methane emissions.

-----