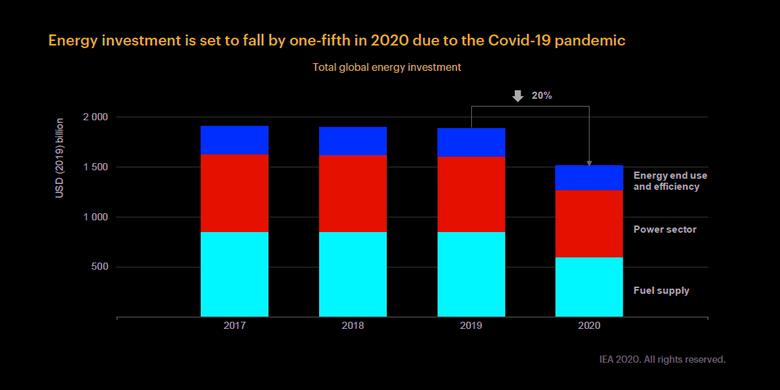

GLOBAL ENERGY INVESTMENT WILL DOWN $400 BLN

IEA - World Energy Investment 2020

The speed and scale of the fall in energy investment activity in the first half of 2020 is without precedent. Many companies reined in spending; project workers have been confined to their homes; planned investments have been delayed, deferred or shelved; and supply chains interrupted.

At the start of the year, our tracking of company announcements and investment-related policies suggested that worldwide capital expenditures on energy might edge higher by 2% in 2020. This would have been the highest uptick in global energy investment since 2014.

The spread of the Covid-19 pandemic has upended these expectations, and 2020 is now set to see the largest decline in energy investment on record, a reduction of one-fifth – or almost USD 400 billion – in capital spending compared with 2019.

Almost all investment activity has faced some disruption due to lockdowns, whether because of restrictions on the movement of people or goods, or because the supply of machinery or equipment was interrupted. But the larger effects on investment spending in 2020, especially in oil, stem from declines in revenues due to lower energy demand and prices, as well as more uncertain expectations for these factors in the years ahead.

Oil (50%) and electricity (a further 38%) were the two largest components of worldwide consumer spending on energy in 2019.

However, we estimate that spending on oil will plummet by more than USD 1 trillion in 2020, while power sector revenues drop by USD 180 billion (with demand and price effects accompanied in many countries by a rise in non-payment). Among other implications, this would mean an historic switch in 2020 as electricity becomes the largest single element of consumer spending on energy.

Not all of these declines are felt directly by the energy industry. Energyrelated government revenues – especially in the main oil and gas exporting countries – have been profoundly affected, with knock-on effects on the budgets available to state-owned energy enterprises.

The revisions to planned spending have been particularly brutal in the oil and gas sector, where we estimate a year-on-year fall in investment in 2020 of around one-third. This has already triggered an increase in borrowing as well as the likelihood that restrained spending will continue well into 2021.

The power sector has been less exposed to price volatility, and announced cuts by companies are much lower, but we estimate a fall of 10% in capital spending. In addition, sharp reductions to auto sales and construction and industrial activity are set to stall progress in improving energy efficiency.

Overall, China remains the largest market for investment and a major determinant of global trends; the estimated 12% decline in energy spending in 2020 is muted by the relatively early restart of industrial activity following strong lockdown measures in the first quarter. The United States sees a larger fall in investment of over 25% because of its greater exposure to oil and gas (around half of all US energy investment is in fossil fuel supply). Europe’s estimated decline is around 17%, with investments in electricity grids, wind and efficiency holding up better than distributed solar PV and oil and gas, which see steep falls.

Developing countries, especially those with significant hydrocarbon industries, see the most dramatic effects of the crisis, as falling revenues pass through more directly to lower funds for investment.

-----