LNG TRADE WILL UP

PLATTS - 09 Jul 2020 - Global LNG trade is expected to grow by 3%-3.5% in 2020 followed by faster growth in 2021 before a slowdown in the subsequent two years, the head of the Gas Exporting Countries Forum (GECF) said July 9.

Global LNG trade surged 13% year on year in 2019 to 354.7 million mt, according to industry group GIIGNL, on the back of increased supply capacity.

While the GECF expects global gas demand to fall in 2020 by up to 6% in a worst-case scenario, LNG has shown some resilience.

"In terms of LNG trade, we expect a slowdown in growth to around 3%-3.5% in 2020," ahead of a recovery to growth of 6.5%-7% in 2021, GECF secretary general Yury Sentyurin said in a webcast.

"However in 2022-2023, LNG trade growth is projected to slow to around 1.5%-2% per year, driven by a slowdown in new LNG capacity, which is expected to support a recovery in global spot gas and LNG prices," he said.

'Uncharted waters'

Sentyurin said the exporters' group would continue to advocate for a "fair" gas price. He said the gas industry had been "plunged into uncharted waters" due to the combination of slowdown in the global economy driven by the COVID-19 pandemic and the persistent mild winter weather, which have impacted heavily on gas demand.

The market, he said, was already experiencing a period of low spot prices prior to the pandemic due to LNG oversupply, while oil-indexed prices have also taken a hit from lower oil prices.

"This has impacted the revenue streams of gas exporting countries, forcing many stakeholders, both International Oil Companies and National Oil Companies, to postpone or even abandon investment in the industry, which could lead to serious imbalances between gas supply and demand in the future," Sentyurin said.

He also pointed to the need for long-term investment in gas projects. "It's a well-known fact that the gas industry is capital intensive and requires a healthy return on investment to develop projects," he said.

"In this regard, the GECF continues to advocate for a fair price for gas through policies creating a level playing field considering the environmental credentials and versatility of gas," he said.

Sentyurin also warned of a risk to spending due to financial investors moving away from oil and gas.

"An 'all hands on deck' approach is required to adapt to the new market post-COVID reality, as well as ensuring stable investment in the gas industry at a time when many banks are reducing their exposure to oil and gas projects," he said.

"As we continue to strive toward our long-term strategy, GECF producers continue to be highly resilient as they try to optimize along the value chain and maintain valuable long-term relationships with our customers," he said.

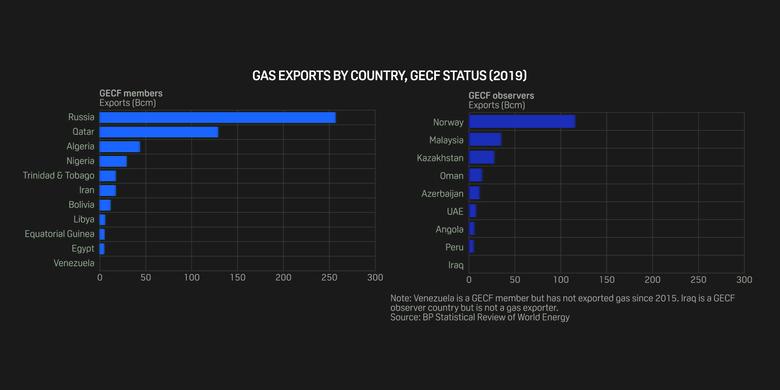

The GECF has 11 full members, including heavyweights Russia, Qatar and Iran, and nine observer members, which together jointly control 72% of the world's proven gas reserves, 46% of its marketed production, 55% of pipeline exports and 61% of LNG exports.

'Good news'

Sentyurin said that while current market conditions had created some setbacks for the expansion of the gas sector, there are positives and gas demand would continue to grow in the coming decades.

"It's not all doom and gloom," he said, pointing to initiatives launched by countries before the pandemic that sought to achieve the goals of the Paris agreement.

"There is good news if we look at the tendencies of energy policies worldwide in terms of nuclear phase-outs, coal retirements, and taxes on coal," he said.

"These are all contributing to the right positioning of gas."

He added that lower prices could help encourage governments to increase the share of gas in countries' energy mixes.

"A prolonged period of increased affordability provides strong economic and environmental reasons for governments in consuming countries to strategically realign energy policy toward gas," Sentyurin said.

He said the increased availability of LNG would also make it a more competitive fuel able to penetrate new markets.

-----

Earlier: