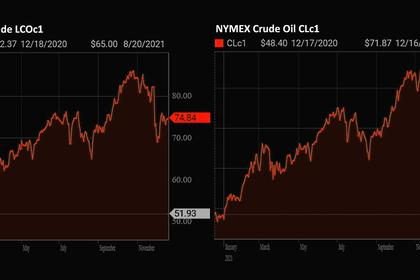

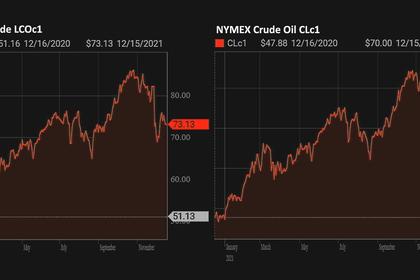

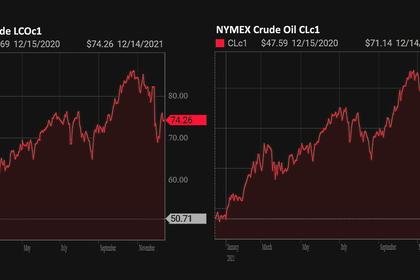

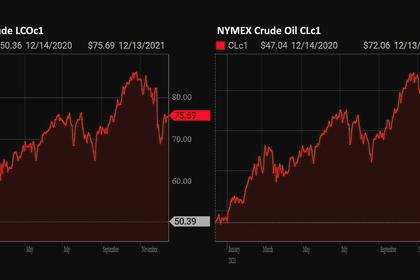

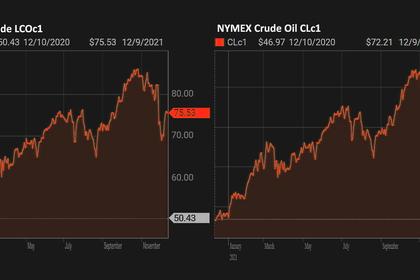

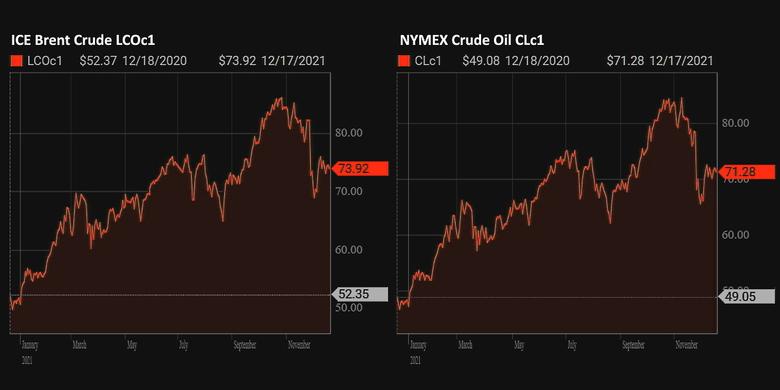

OIL PRICE: NEAR $74

REUTERS - Dec 17 - Oil prices dipped on Friday, putting the market on track for a narrow weekly loss, as surging cases of the Omicron coronavirus variant raised fears new curbs may hit fuel demand, while a weaker dollar supported commodity markets broadly.

Brent crude futures fell 59 cents, or 0.8%, to $74.43 a barrel at 0707 GMT while U.S. West Texas Intermediate (WTI) crude futures dropped 67 cents, or 0.9%, to $71.71 a barrel. Brent is headed for a 1% loss this week, while WTI is poised to finish the week nearly flat.

"Look at what's happening with Omicron - that's a negative which people are trying to digest," said Commonwealth Bank commodities analyst Vivek Dhar. "Are we going to be in line for some new restrictions? That's what the market's trying digest."

In Denmark, South Africa and the United Kingdom, the number of new Omicron cases has been doubling every two days. Denmark's Prime Minister Mette Frederiksen on Thursday warned the government may impose further curbs to limit the spread of Omicron.

In the United States, the rapid spread of the Omicron variant has led some companies to pause plans to get workers back into offices.

"Messages of caution and warnings of a worsening COVID wave are starting to ring louder with the approach of the year-end holiday season, dampening market sentiment," said Vandana Hari, energy analyst at Vanda Insights. "Crude may remain in a holding pattern, albeit with plenty of price volatility around the mean, in holiday-thinned trading over the next couple of weeks."

The Organization of the Petroleum Exporting Countries, Russia and allies, together known as OPEC+, have said they could meet ahead of their scheduled Jan. 4 meeting if changes in the demand outlook warrant a review of their plan to add 400,000 barrels per day of supply in January.

But despite the Omicron threats to demand, Goldman Sachs said on Friday the new variant has had a limited impact on mobility or oil demand, adding it expects oil consumption to hit record highs in 2022 and 2023.

Oil prices have also retreated from multi-year highs earlier in the fourth quarter on improved supplies.

"Supply tightness is easing with a monthly addition of 400,000 barrels per day (bpd) from OPEC+ and U.S. oil output of 11.7 million bpd," ANZ Bank said in a note on Friday.

Benchmark Brent and WTI both gained around 2% on Thursday, buoyed by record U.S. implied demand and a weaker U.S. dollar as the Bank of England surprised markets with a rate hike, taking a more hawkish stance than the Federal Reserve.

-----

Earlier: