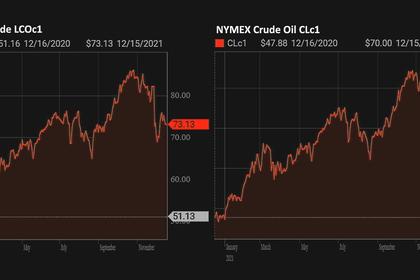

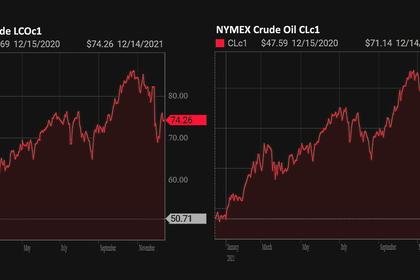

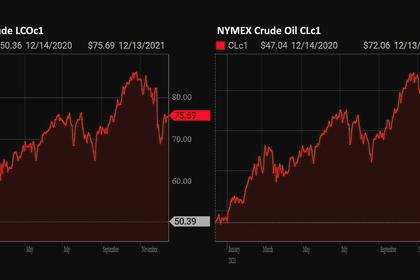

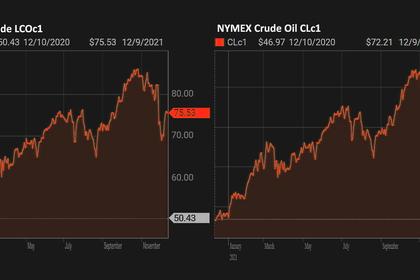

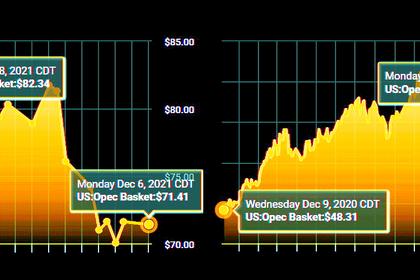

OIL PRICE: NOT BELOW $74

REUTERS - Dec 16 - Oil rose towards $75 on Thursday supported by record U.S. implied demand and falling crude stockpiles, even as the spread of the Omicron coronavirus variant threatens to put a brake on consumption globally.

Crude and other risk assets such as equities also got a boost after the U.S. Federal Reserve gave an upbeat economic outlook, which lifted investor spirits even as the Fed flagged a long-awaited end to its monetary stimulus.

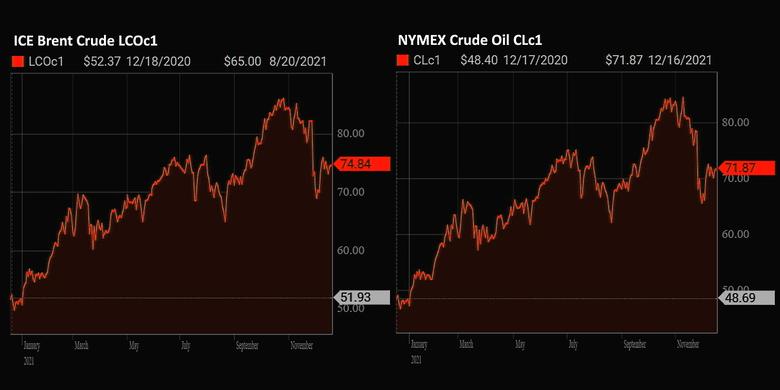

Brent crude oil rose by 62 cents, or 0.8%, to $74.50 a barrel by 0915 GMT, while U.S. West Texas Intermediate (WTI) crude gained by 65 cents, or 0.9%, to $71.52.

"Despite the current virus surge, the weekly EIA oil inventory report showed demand for petroleum products hit a record high, crude exports bounced back and national crude stocks posted a larger-than-expected draw," said Edward Moya, senior analyst at OANDA.

The U.S. Energy Information Administration (EIA) on Wednesday said crude stocks fell 4.6 million barrels, more than analysts had forecast.

Oil demand has been recovering in 2021 after last year's collapse, and the EIA also said product supplied by refineries, a proxy for demand, surged in the most recent week to 23.2 million barrels per day (bpd).

"These figures suggest a healthy economic backdrop," said Tamas Varga of oil broker PVM.

"Although the Fed's announcement triggered a jump in both oil and equity prices, the withdrawal of economic support together with the Omicron crisis are the two major headwinds the oil market is currently facing," he added.

Worries about the virus limited gains. Britain and South Africa reported record daily COVID-19 cases while many firms across the globe asked employees to work from home, which could limit demand going forward.

-----

Earlier: