OIL REVENUES WILL DOWN $9 TLN

PLATTS - 11 Feb 2021 - Growing global momentum on decarbonization could leave countries that largely depend on oil and gas revenues facing a $9 trillion drop in expected income over the next 20 years, according to analysis by an environmental think tank.

Most vulnerable are some of the world's poorest countries, including several OPEC members, London-based Carbon Trackers said in a report, calling on petrostates to urgently restructure their economies and reexamine their planned investments in oil and gas projects that could become stranded.

But producers should coordinate "an orderly wind down of production, with global supply falling in line with decreasing demand and falling oil prices" in order to minimize their financial losses, the report said. A crash in revenues could lead to humanitarian crises and geopolitical instability.

"If they go it alone and seek to monetize their existing reserves while they can, oversupply is likely to destroy value for all, with falling prices quickly outweighing the benefit of increased production," Carbon Tracker said.

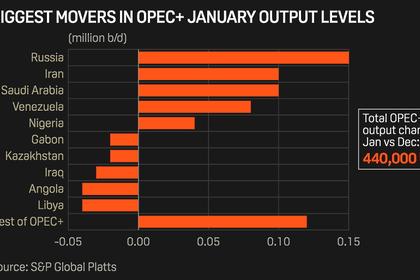

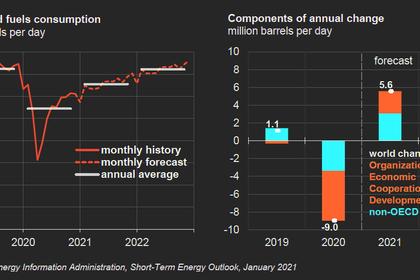

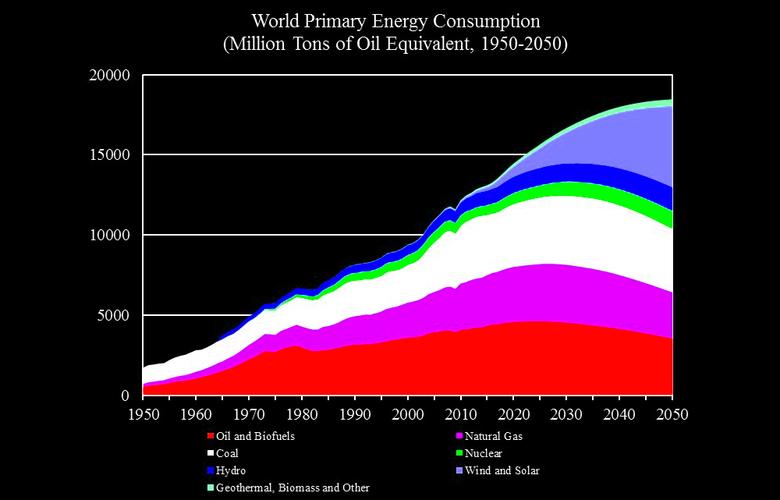

OPEC has long maintained that oil will remain a dominant energy source in the decades to come. The bloc's latest long-term forecast projects that peak demand will not occur until around 2040, when global consumption will rise from pre-pandemic levels of about 100 million b/d to hit 109.3 million b/d, before declining to 109.1 million b/d in 2045 and plateauing "over a relatively long period."

However, Carbon Tracker said that as the world commits to meeting climate targets, demand will fall much more quickly, calling its report a "wake-up call" to oil and gas producing countries.

"Government oil revenues will shift dramatically as the market shakes out during the energy transition," co-author Andrew Grant said in a statement. "Understanding the scale of the challenge and which nations are most vulnerable will help policymakers focus their efforts. Cushioning the landing for hundreds of millions will deliver better outcomes for both climate and human development."

Vulnerable producers

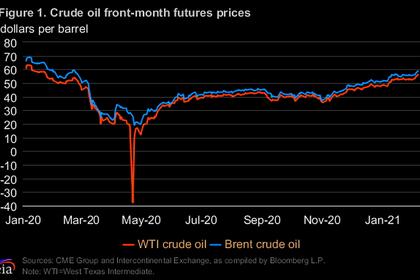

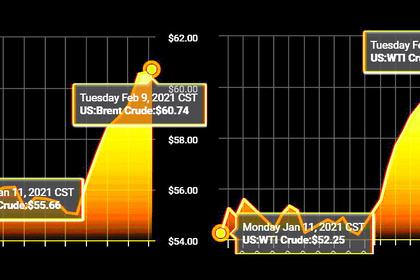

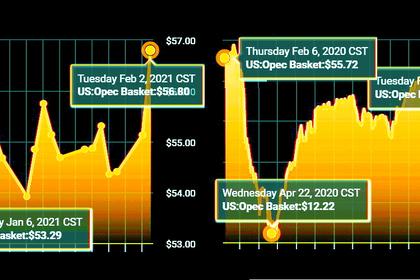

Carbon Tracker's analysis used the International Energy Agency's modelling to project expected supply and demand developments under current government policies with a long-term oil price assumption of $60/b, and compared it to the IEA's low-carbon scenario with a price assumption of $40/b.

It said that oil producing countries globally could lose a collective $13 trillion by 2040 compared with industry expectations, a 51% drop, of which the 40 petrostates that are most heavily dependent on hydrocarbon revenues face a $9 trillion shortfall, or a 46% drop.

It identified Angola and Azerbaijan among seven countries that could lose 40% or more of their government revenues from declining oil and gas demand.

Saudi Arabia, the world's largest crude exporter, along with Iraq, Kuwait, Nigeria and Algeria are among 12 countries that could lose 20-40% of their revenues, while Russia, Mexico and Iran are among 10 countries that could lose 10-20%.

"Low production costs in some countries mean that the Middle East and North Africa will be one of the least affected regions in a low-carbon world, but oil and gas revenues to 2040 are still over 40% lower than industry expectations," the report said. "Wealthy Gulf states are investing in industries like renewable energy and tourism. However, the scale of the challenge is huge, and the pace of transition accelerating."

Carbon Tracker said the international community could help vulnerable petrostates by providing financial support for emissions reductions technologies, as well as technical assistance for regulatory and tax reform.

"It is in the international community's interest to help petrostates successfully navigate the energy transition," it said. "Reducing their dependence on fossil fuel production will make it easier for the world to meet global climate targets, and also help these countries avoid instability and social unrest as the global economy is decarbonized."

-----

Earlier: