OIL PRICE: NOT BELOW $76

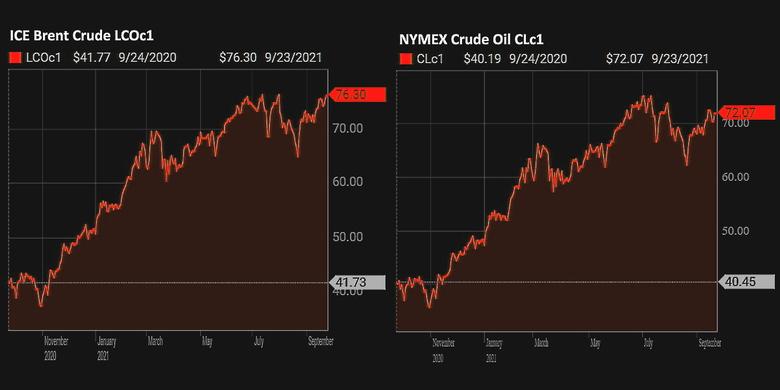

REUTERS - Sept 23 - Oil prices extended gains on Thursday, riding higher on growing fuel demand and a bigger-than-expected draw in U.S. crude inventories as production remains hampered in the Gulf of Mexico after two hurricanes.

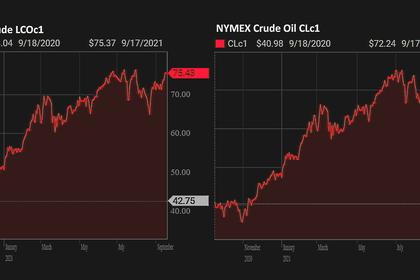

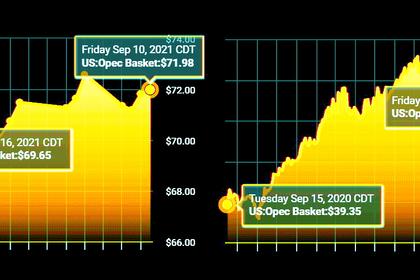

Brent crude rose 9 cents, or 0.1%, to $76.28 a barrel at 0856 GMT. U.S. West Texas Intermediate (WTI) crude was up 4 cents, or 0.1%, to $72.27 a barrel.

Both contracts jumped 2.5% on Wednesday after data from the U.S. Energy Information Administration showed U.S. crude stocks in the week to Sept. 17 fell by 3.5 million barrels to 414 million - the lowest total since October 2018.

"With Gulf of Mexico production returning slowly, and natural gas prices remaining sky high, the structural outlook for oil remains promising as OPEC+ struggles to meet even its current production quotas," said Jeffrey Halley, analyst at brokerage OANDA.

Several OPEC+ countries - including Nigeria, Angola and Kazakhstan - have struggled in recent months to raise output due to years of under-investment or maintenance work delayed by the pandemic.

The dollar, which usually has an inverse relationship with commodities prices including oil, eased slightly from a one-month high, after the U.S. Federal Reserve set the stage for rate hikes next year but left enough breathing room to slow things down if necessary.

The Fed "gave advance notice of its tapering intention, thereby confirming its economic optimism, which ultimately points to robust U.S. oil demand," said Barbara Lambrecht, analyst at Commerzbank.

The oil market was also supported by a return of appetite for risk assets as concerns eased over a dollar bond interest payment due on Thursday from property developer China Evergrande.

In a sign of strong fuel demand as travel bans ease, East Coast refinery utilisation rates in the United States rose to 93%, the highest since May 2019, EIA data showed.

Market sentiment is also being supported by surging natural gas prices, ANZ Research said.

"Supply shortage of gas could encourage power utilities to shift from gas to oil if winter turns out to be colder this year," ANZ analysts wrote in a note.

Gas prices have risen sharply around the globe in recent months due to a combination of factors, including increased demand particularly from Asia as it enters its post-pandemic recovery, low gas inventories, and tighter-than-usual gas supplies from Russia.

-----

Earlier: