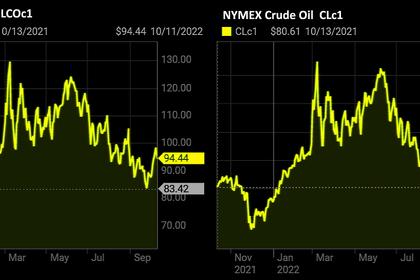

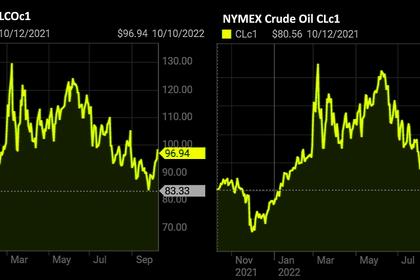

OIL PRICE: BRENT BELOW $93, WTI BELOW $88

REUTERS - Oct 13 - Oil prices firmed on Thursday, finding continued support from an OPEC+ decision last week to cut supplies, as the International Energy Agency warned that those cuts may push the global economy into recession.

Brent crude futures rose 49 cents, or 0.5%, to $92.94 a barrel by 0833 GMT. U.S. West Texas Intermediate crude was up 37 cents, or 0.4%, at $87.64 a barrel.

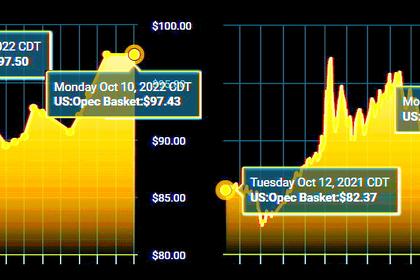

Last week, the producer group comprising the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia pushed prices higher when it agreed to cut supply by 2 million barrels per day (bpd).

"The OPEC+ ... plan ... has derailed the growth trajectory of oil supply through the remainder of this year and next, with the resulting higher price levels exacerbating market volatility and heightening energy security concerns," the IEA said on Thursday.

The IEA downgraded its oil demand growth estimates slightly for this year to 1.9 million bpd and by 470,000 bpd in 2023 to 1.7 million bpd.

This comes after OPEC on Wednesday cut its outlook for demand growth this year by 460,000 bpd to 2.64 million bpd, citing the resurgence of China's COVID-19 containment measures and high inflation. It lowered its 2023 oil demand forecast by 360,000 bpd to 2.34 million bpd.

"The prospect of sustained growth is deteriorating fast because of entrenched inflationary pressure, quantitative tightening, continuous hikes in borrowing costs, a strong dollar, and COVID-related constraints in the world’s second biggest economy, China," PVM analyst Tamas Varga said.

Worsening demand for crude oil is contributing to inventory builds. U.S. crude oil stockpiles rose by about 7.1 million barrels for the week ended Oct. 7, according to market sources citing API data.

The energy market is under pressure as well from the U.S. dollar, which has rallied broadly, including against low-yielding currencies like the yen.

The Federal Reserve's commitment to keep raising interest rates to stem high inflation has boosted yields, making the U.S. currency more attractive to foreign investors.

-----

Earlier: