LNG FOR EUROPE 70%

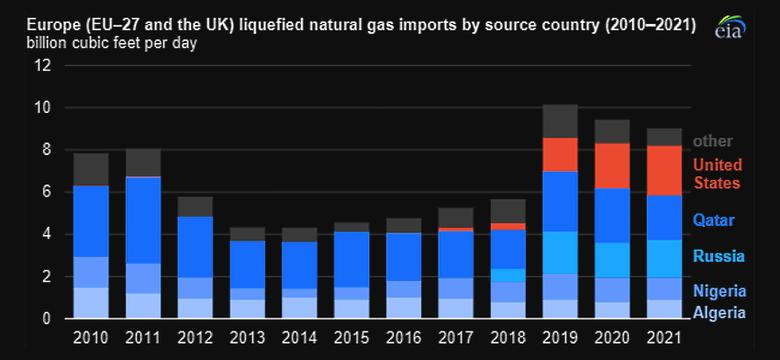

U.S. EIA - FEBRUARY 22, 2022 - In 2021, a large share of Europe’s supply of liquefied natural gas (LNG) originated in the United States, Qatar, and Russia. Combined, these three countries accounted for almost 70% of Europe’s total LNG imports, according to data by CEDIGAZ. The United States became Europe’s largest source of LNG in 2021, accounting for 26% of all LNG imported by European Union member countries (EU-27) and the United Kingdom (UK), followed by Qatar with 24%, and Russia with 20%. In January 2022, the United States supplied more than half of all LNG imports into Europe for the month.

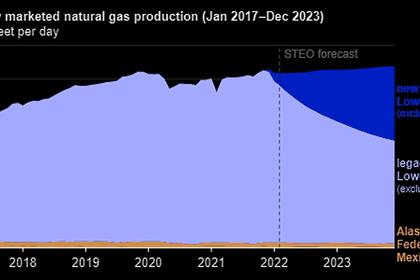

Exports of LNG from the United States to EU-27 and the UK increased from 3.4 billion cubic feet per day (Bcf/d) in November 2021 to 6.5 Bcf/d in January 2022—the most LNG shipped to Europe from the United States on a monthly basis to date, according to the U.S. Department of Energy’s LNG Monthly reports and our own estimates, which are based on LNG shipping data. Rising U.S. LNG exports are the result of both natural gas supply challenges in Europe and the sizable price differences between natural gas produced in the United States and current prices at European trading hubs.

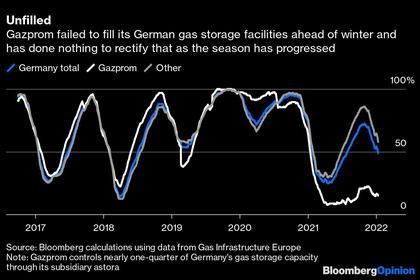

Natural gas supply constraints in Europe and the low storage inventories of the past year contributed to recent increases in U.S. LNG exports to Europe. Europe’s natural gas production has been in continuous decline because of production limits on the Groningen field in the Netherlands and declines in the mature fields in the North Sea. To meet demand, Europe’s natural gas imports, particularly from Russia, have increased in recent years.

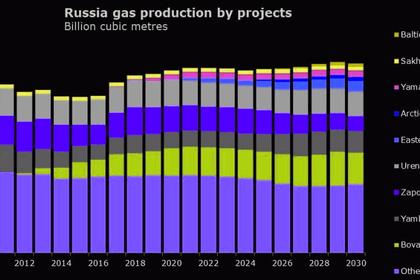

Pipeline flows of natural gas from Russia decreased during 2021. Pipeline receipts from Russia at the three main entry points (Kondratki in Poland, Greifswald in Germany, and Velke Kapusany in Slovakia, which combined account for 14.3 Bcf/d of import pipeline capacity from Russia) averaged 10.7 Bcf/d in 2021, compared with 11.8 Bcf/d in 2020 and 14.1 Bcf/d in 2019, according to data by Refinitiv Eikon. More natural gas delivered by pipeline from Norway, which increased from 10.4 Bcf/d in 2019 and in 2020 to 11.1 Bcf/d in 2021, was not enough to offset reduced pipeline receipts from Russia.

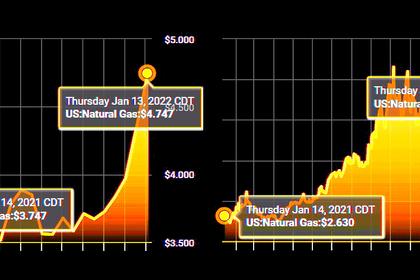

Supply challenges in the European market have led to rising regional prices for natural gas. The natural gas spot price at the Title Transfer Facility (TTF) in the Netherlands—the most liquid virtual natural gas hub in Europe—has been trading at all-time high levels. The TTF price averaged $28.52 per million British thermal units (MMBtu) from September 2021 through the first week of February 2022. The TTF price peaked at $60.20/MMBtu on December 21, 2021. Prior to this sharp price increase, the TTF price had averaged $9.28/MMBtu from January through August 2021, $3.28/MMBtu during 2020, $4.45/MMBtu during 2019, and $6.45/MMBtu from 2014 through 2018.

Historically, spot natural gas in Europe has traded at prices lower than LNG spot prices in Asia. In recent months, however, natural gas prices in Europe have closely tracked LNG prices in Asia. On some days, the natural gas price in Europe has exceeded the LNG price in Asia, attracting higher volume of flexible LNG supplies to Europe. LNG imports to Europe increased in December 2021 and January 2022, averaging 10.8 Bcf/d and 14.9 Bcf/d, respectively, partly in response to the price at TTF rising above LNG spot prices in Asia.

-----

Earlier: