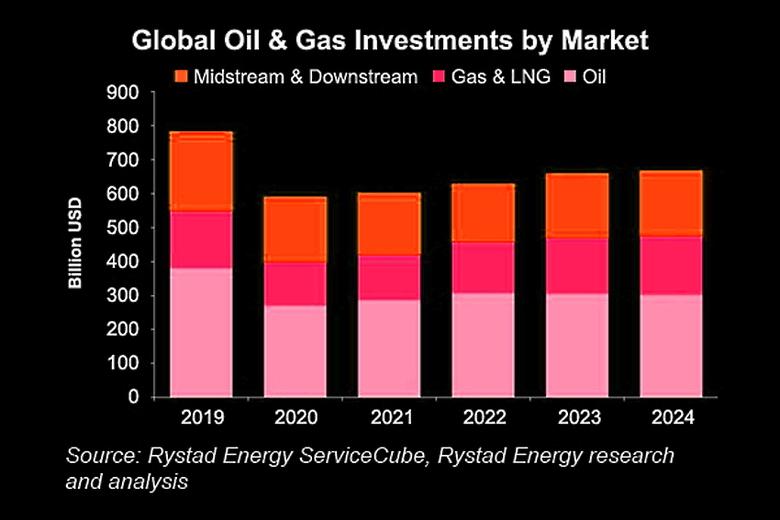

OIL, GAS INVESTMENT $55 BLN

REUTERS- Feb 14 - European banks are providing billions of dollars of funding to expand oil and gas production, a report on Monday showed, despite International Energy Agency guidance against new facilities in order to slow global warming.

During 2021, twenty five of the region's leading banks collectively provided $55 billion to energy companies planning to expand oil and gas production, responsible investment non-profit ShareAction said in the report.

Although that marked a fall from the $106 billion lent in 2020 and $83 billion in 2019, it was higher than the $49 billion and $50 billion lent in 2018 and 2017, respectively.

An IEA report in May said there should be no investment in new oil and gas fields in order to have a 50% chance of capping global warming at 1.5 degrees Celsius above the pre-industrial average.

The financing comes despite 24 of the banks themselves pledging to decarbonise their loan portfolios, the report said, adding that HSBC (HSBA.L), Barclays (BARC.L) and BNP Paribas (BNPP.PA) were among the biggest providers of finance in 2021.

ShareAction said it was calling on investors to demand the banks implement policies to restrict finance for oil and gas expansion and back climate-related shareholder resolutions in the upcoming season for annual general meetings.

"Last year shareholders were instrumental in pushing banks to adopt or strengthen restrictions on coal finance," said Kelly Shields, Senior Officer for Banking Standards at ShareAction.

"This year they need to replicate that success with oil & gas expansion," Shields added.

A HSBC spokesperson said it was working with clients over the energy transition and would publish science-based targets to align oil and gas financing with the goals and timelines of the Paris Agreement on Feb. 22.

A Barclays spokesperson said it also aimed to align its financing with the global climate deal reached in 2015, and had set a target for a 15% absolute reduction in financed emissions from its energy sector clients by 2025.

A spokesperson for BNP Paribas was not immediately available to comment when contacted by Reuters.

-----

Earlier: