OIL PRICE: ABOVE $91 ANEW

REUTERS - Feb 11 - Oil prices eased on Friday as hot U.S. inflation fanned worries about aggressive interest rate hikes and investors await the outcome of U.S.-Iran talks that could lead to increased global crude supply.

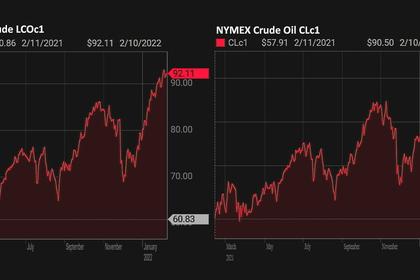

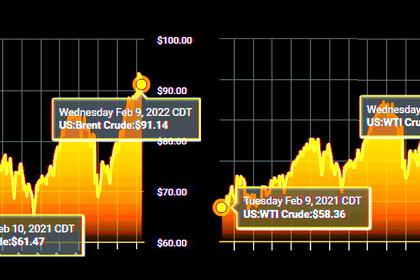

Brent crude futures fell 58 cents, or 0.6%, to $90.83 a barrel at 0730 GMT, while U.S. West Texas Intermediate crude declined 45 cents, or 0.5%, to $89.43 a barrel.

The benchmark oil prices are also in line for their first weekly decline after seven consecutive weekly gains, though both contracts had earlier climbed to a seven-year high.

"Yesterday's inflation number likely puts more pressure on the U.S. Fed to act more aggressively with rate hikes. This expectation is weighing on oil and the broader commodities complex somewhat," said Warren Patterson, ING's head of commodities research.

"In addition, Iranian nuclear talks appear to be progressing, which is another factor holding prices back."

St. Louis Federal Reserve Bank President James Bullard had said he wanted a full percentage point of interest rate hikes by July 1, following the release of U.S. inflation data that saw its biggest annual increase in 40 years.

Investors have also been eyeing indirect talks between the United States and Iran to revive a nuclear deal, which resumed this week after a 10-day break. A deal could see the lifting of sanctions on Iranian oil and ease global supply tightness.

White House spokeswoman Jen Psaki said the talks have "reached an urgent point," and that a "deal that addresses the core concerns of all sides is in sight."

"The crude price rally has finally run out of steam as optimism grows that Iran nuclear deal talks are headed in the right direction and as the dollar rallies as money markets start to price in a supersized Fed hike," said Edward Moya, senior market analyst at brokerage OANDA.

"The oil market is still very tight, but exhaustion in the crude price rally has settled in. If the dollar continues to rally, oil prices could continue to decline further."

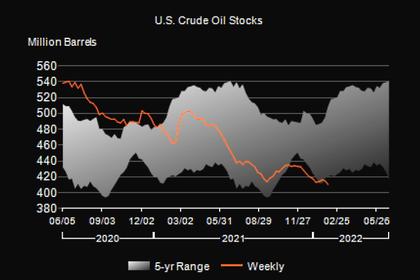

Tight supply was seen in U.S. crude oil stockpiles, which unexpectedly fell 4.8 million barrels in the week to Feb. 4 to 410.4 million barrels as overall refined product demand reached an all-time record, said the Energy Information Administration. This compares with an analyst forecast of a 369,000-barrel rise.

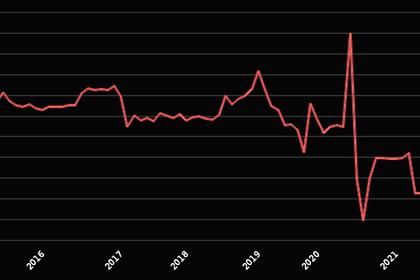

Meanwhile, the Organization of the Petroleum Exporting Countries (OPEC) said that world oil demand might rise even more steeply this year. The group forecast a gain of 4.15 million barrels per day (bpd) this year, as the global economy posts a strong recovery from the pandemic.

-----

Earlier: