COAL PRICES UP

PLATTS - 28 Mar 2022 - As Russia's ongoing war in Ukraine keeps global coal demand and prices elevated, a move by some US power generators to begin switching to gas could fuel another record season for power burns this summer.

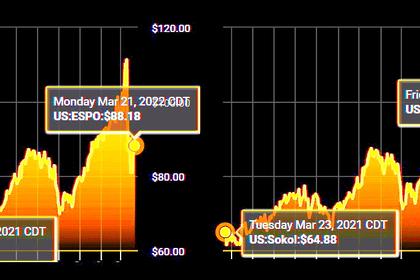

Since late February, thermal coal prices have surged globally as traders and end-users seek out potential replacements for Russian fossil fuels. In March, CIF ARA coal -- Europe's benchmark price -- has traded near record levels averaging nearly $330/mt this month, S&P Global Commodity Insights data shows.

In Appalachia, prices have followed the global market higher, trending near $140/st as of late March -- also the highest on record dating back to at least 2005 when CAPP coal data collection began.

Higher coal prices appear to have already prompted some US power generators to begin switching to gas despite rising prices for both fuels. The move toward gas has been especially noteworthy in the Central and Eastern US.

In March, gas accounts for about 28% of total power generation in the Midcontinent Independent System Operator territory, up from 26% in February. Over the same two-month period, generation share for coal has fallen by nearly three and one-half percentage points, with the fuel now accounting for about 34% of total power generation in MISO this month.

In PJM, the recent shift toward gas is even more pronounced. In March, the fuel accounts for almost 39% of the power generation share, compared with about 35% in February. Market share for coal, meanwhile, has retreated to about 18% this month from nearly 24% last month, data compiled from the ISO and regional transmission organization shows.

Summer burn

As US generators begin transitioning away from coal, the call on gas already appears to be on the rise.

Month to date, US gas-fired power burn demand has outpaced its year-ago level, averaging nearly 24.6 Bcf/d -- an increase of about 340 MMcf/d compared to last March -- despite a nearly identical population-weighted US temperature this month compared with March 2021, S&P Global data shows.

According to a recent forecast from S&P Global gas and power analysts, weather-normal US burn would average nearly 38 Bcf/d from June to August 2022 with high gas prices expected to cut demand about 900 MMcf/d compared with last summer. Given the recent and steady rise in coal prices, though, fuel switching could drive more power sector demand for gas this summer, not less.

Hot weather could add even more upside risk for power burn. Nearly all of the continental US faces a 40% to 50% risk for above-average temperatures in June, July and August, according to a seasonal forecast published by the National Weather Service this month. The probabilities are even higher in the Northeast and Texas -- both key regions for electric cooling demand.

Coal supply

During the upcoming summer months, supply and production constraints on US coal are likely to keep domestic prices elevated, regardless of the outcome of Russia's war in Ukraine.

Year to date, US coal production has averaged about 11.4 million st, 1.9 million st, or more than 14%, below the prior five-year average, data from the US Energy Information Administration shows.

Neither US nor global coal production is likely to ramp up much in response to high prices. According to market experts attending the recent CERAWeek by S&P Global conference, the coal market's diminishing size and weak long-term outlook remain major impediment to capacity growth.

US coal stocks aren't well positioned to offer even temporary supply or price relief to the US market. In the EIA's latest quarterly coal report, US inventory was estimated at just 85.1 million st for the three-month period ending in September 2021 -- its lowest level dating back at least 20 years, historical data shows.

-----

Earlier: