GLOBAL OIL DEMAND 2022: +3.7 MBD

OPEC - 12 April 2022 - OPEC Monthly Oil Market Report

Oil Market Highlights

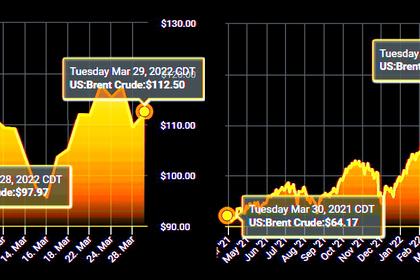

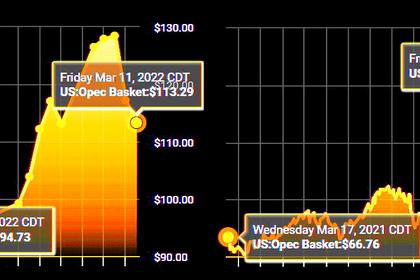

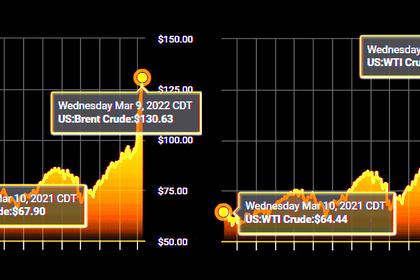

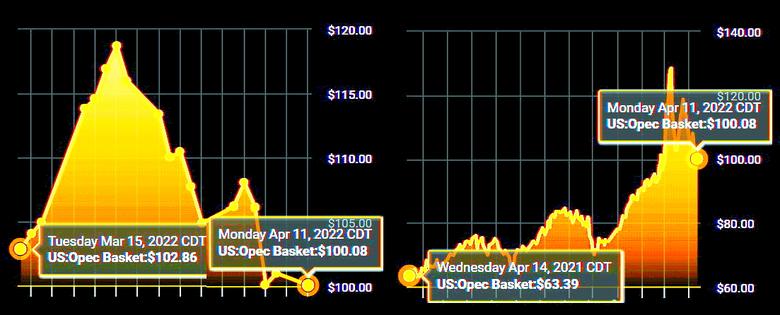

Crude Oil Price Movements

Crude oil spot prices rose for the third-consecutive month in March. The North Sea Dated benchmark gained more than $20/b on a monthly average and WTI gained almost $17/b, on the back of escalating geopolitical tensions in Eastern Europe and concerns this might result in large oil supply shortages, amid trade dislocations.

The OPEC Reference Basket price increased $19.53, or 20.8%, to settle at $113.48/b. Oil futures prices witnessed elevated volatility due to the uncertain short-term oil supply and demand outlook. The ICE Brent front month rose $18.36, or 19.5%, to average $112.46/b and NYMEX WTI gained $16.63, or 18.1%, to average $108.26/b. Consequently, the Brent/WTI futures spread widened further by $1.73 to average $4.20/b.

The market structure of all three major crude benchmarks – ICE Brent, NYMEX WTI and DME Oman – remained in steep backwardation. Hedge funds and other money managers cut net long positions in Brent and WTI-related futures contracts.

World Economy

World economic growth in 2022 is revised down to 3.9% from 4.2% in the previous month’s assessment. This takes into account the impact of the conflict in Eastern Europe, as well as the ongoing effects from the pandemic, with the risks skewed to the downside. This follows growth of 5.8% in 2021, which represents a minor revision from last month. US GDP growth for 2022 is revised down to 3.8% from 4%, after growth was reported at 5.7% for 2021. Euro-zone economic growth for 2022 is revised down to 3.5% from 3.9%, following growth of 5.3% in 2021. Japan’s economic growth for 2022 is revised down to 1.9% from 2.2%, after growth of 1.7% in 2021. China’s 2022 growth is revised down to 5.3% from 5.6%, after growth of 8.1% in 2021. India’s 2021 GDP growth is reported at 8.1%, while the growth forecast for 2022 remains at 7.2%. Brazil’s 2022 growth is revised down to 1.2% from 1.5%, following growth of 4.6% in 2021. Russia’s 2022 growth is revised down to show a contraction of 2%, following reported growth of 4.7% in 2021. The continuing pandemic, rising inflation, aggravated supply chain issues, high sovereign debt levels in many regions and expected monetary tightening by central banks in the US, the UK, Japan and the euro area require close monitoring.

World Oil Demand

World oil demand growth in 2021 is revised slightly down by 0.04 mb/d, reflecting actual data across the regions, standing now at 5.7 mb/d. The downward revision is necessitated by an upward revision to the 2020 baseline. Oil demand in the OECD increased by 2.6 mb/d in 2021, while the non-OECD showed growth of 3.1 mb/d. For 2022, world oil demand growth is revised down by 0.5 mb/d to stand at 3.7 mb/d, mostly reflecting the downward revision in world economic growth. Oil demand growth is forecast at 1.9 mb/d in the OECD and 1.8 mb/d in the non-OECD.

World Oil Supply

Non-OPEC liquids supply growth in 2021 is broadly unchanged at around 0.6 mb/d y-o-y. Total US liquids production in 2021 increased by 0.1 mb/d, y-o-y. The largest growth increases were seen in Canada, Russia and China. Meanwhile, production is estimated to have declined in the UK, Brazil, Colombia and Indonesia.

Non-OPEC supply in 2022 is revised down by 0.3 mb/d to 2.7 mb/d, mainly on the back of a downward revision for Russia. On the other hand, the US liquids supply growth forecast for 2022 is revised up by 0.3 mb/d to 1.3 mb/d. The main contributors to liquids supply growth in 2022 are expected to be the US, Russia, Brazil, Canada, Kazakhstan, Guyana and Norway. OPEC NGLs are forecast to grow by around 0.1 mb/d both in 2021 and 2022, averaging 5.1 mb/d and 5.3 mb/d, respectively. In March, OPEC-13 crude oil production increased by 57 tb/d, m-o-m, to average 28.56 mb/d, according to available secondary sources.

Product Markets and Refining Operations

Refinery margins jumped in all main trading hubs in March, as product prices soared in response to a growing product supply-demand imbalance. A decline in total product output levels, amid the onset of a heavy turnaround season, resulted in a notable and disproportional rise in product netbacks relative to crude prices.

Moreover, in contrast to other regions, US refinery runs trended higher over the month, with gasoline availability showing signs of recovery. However, middle distillate availability continued to contract beyond the already low levels. This resulted in massive upward pressure on product prices and the robust performance of middle distillate markets, particularly in Europe.

Tanker Market

Tanker markets are being broadly impacted by uncertainties related to the conflict in Eastern Europe, which is expected to affect trade patterns. Aframax and Suezmax freight rates, the main vessels used to transport Black Sea flows, have particularly been effected. Aframax spot freight rates around the Mediterranean are up more than 70% in March from January levels, while spot Suezmax rates in the Atlantic basin are some 50% higher over the same period. Clean rates have also seen strong support on all monitored routes, particularly on the Mideast-to-East route.

Crude and Refined Products Trade

Preliminary data shows US crude imports increased 3%, m-o-m, in March to average 6.4 mb/d, while crude exports gained 8%, m-o-m, from the low levels witnessed in the previous month to average 3.1 mb/d. US product exports surged 22%, m-o-m, up from a weak performance the month before. In China, the latest data shows crude imports averaged 9.5 mb/d in February, down from the strong performance seen the month before as the Lunar New Year Holidays and Winter Olympics reduced refinery runs. India’s crude imports recovered some of the January losses, averaging 4.6 mb/d in February, as domestic demand continued to accelerate following the tapering off of the third wave of COVID-19 infections. Japan’s crude imports averaged 2.8 mb/d in February, amid higher product exports.

Commercial Stock Movements

Preliminary data sees total OECD commercial oil stocks down 22.8 mb, m-o-m, in February. At 2,599 mb, they were 372 mb less than the same time one year ago, 334 mb lower than the latest five-year average, and 321 mb below the 2015–2019 average. Within the components, crude stocks rose by 0.7 mb, m-o-m, while products stocks fell by 23.5 mb, m-o-m. At 1,254 mb, OECD crude stocks were 185 mb less than the latest five-year average and 194 mb below the 2015–2019 average. OECD product stocks stood at 1,345 mb, representing a deficit of 148 mb compared with the latest five-year average, and 128 mb below the 2015–2019 average. In terms of days of forward cover, OECD commercial stocks fell by 0.6 days, m-o-m, in February to stand at 57.3 days. This is 11.0 days below February 2021 levels, 8.6 days less than the latest five-year average, and 5.2 days lower than the 2015–2019 average.

Balance of Supply and Demand

Demand for OPEC crude in 2021 is revised up by 0.1 mb/d from the previous month’s assessment to stand at 28.1 mb/d, which is around 5.0 mb/d higher than in 2020. In contrast, demand for OPEC crude in 2022 is revised down by 0.1 mb/d from the previous month’s assessment, to stand at 29.0 mb/d, which is around 0.8 mb/d higher than in 2021.

-----

Earlier: