RUSSIA OIL EXPORTS UNCHANGED

PLATTS - 21 Apr 2022 - Russia's seaborne exports of crude and oil products appear to be more resilient to sanctions and boycotts than expected as India takes advantage of discounted crude and a few buyers reroute imports to Europe's Amsterdam-Rotterdam-Antwerp refining and storage hub, according to shipping analytics provider Kpler.

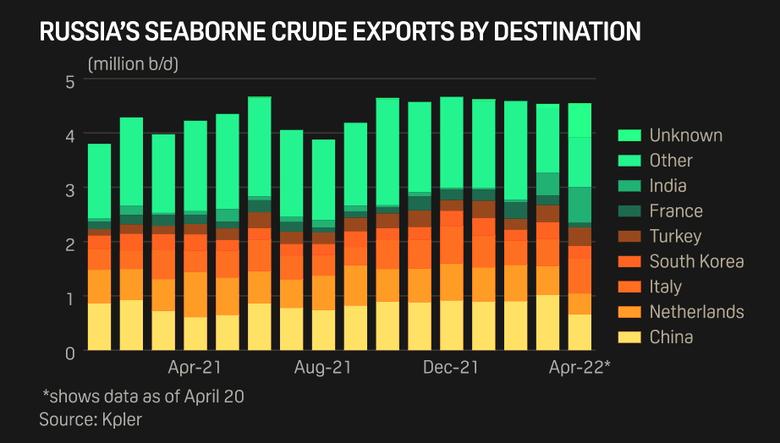

Russian seaborne crude exports, excluding CPC flows, were little changed at 4.54 million b/d in the month to April 20, after just a 52,000 b/d fall from February to March, according to Kpler shipping data. Over the same period, exports of Russia's key clean and dirty oil products rose 273,000 b/d month on month in the first three weeks of April after shrinking 873,000 b/d in March, the data showed.

Combined, Russia's seaborne crude and key oil products exports stood at 6.79 million b/d so far in April, down 640,000 b/d from 7.43 million b/d in February, according to Kpler shipping data.

Part of the normal 1 million b/d of Russia's Urals crude exported via the Druzhba pipeline to refiners in Central and Western Europe may also be curtailed, however, as refiners continue to seek alternative sources of crude.

Even with the potential fall in Druzhba flows, Russian export losses appear to remain well below the 2 million-3 million b/d impact estimated by a few market watchers a month ago.

The International Energy Agency estimated Russian production losses of about 1.5 million b/d in April, doubling to 3 million b/d in May if existing sanctions deter further buying or bans on Russian oil expand.

"As the market continues to zig and zag in search of clarity for what remains a very blurred future, today we look at what can readily be observed, and those observations suggest that so far, Russian oil exports continue to largely flow," S&P Global Commodity Insights' trade flow and modeling analyst Tony Starkey said in an April 14 note.

EU sanctions

S&P Global still expects to see a loss of nearly 3 million b/d in Russian crude and products exports in the coming months, however, as more buyers shun Russian oil.

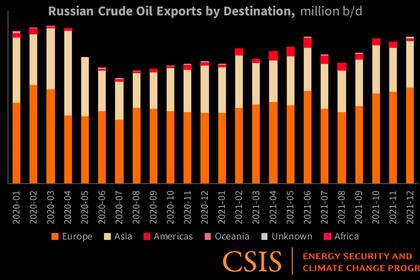

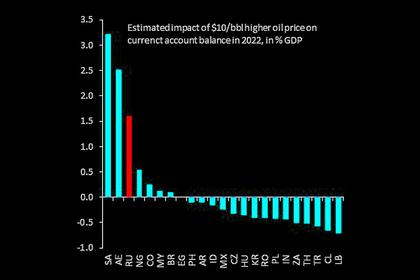

Europe is particularly dependent on Russian oil and was importing about 2.7 million b/d of crude and another 1.5 million b/d products, mostly diesel, before the invasion of Ukraine.

EU sanctions on Russia are expected to further crimp purchases of its oil and gas next month as traders shy away from deals due to ambiguous wording and growing unease over sourcing Russian commodities, according to traders and legal experts.

The European Commission's fourth sanctions package against Russia published March 15 prohibits direct or indirect deals with majority state-run Russian companies, including Rosneft, the oil arm of gas company Gazprom, and pipeline operator Transneft. Although the rules exempt imports of Russian fossil fuels to the EU, the exemptions only allow for "transactions which are strictly necessary."

The sanctions package also allows for trades with the Russian-listed entities under preexisting contracts in place prior to March 16 but only until May 15, creating further anxiety among commodities traders about their existing supply contracts with Russia.

"We expect waterborne crude deliveries to Europe to fall due to continued self-sanctioning against purchases of Russian-sourced crude. Deliveries through the Druzhba pipeline network are expected to continue flowing," S&P Global said in an April 14 note.

Some forecasts expect a less dramatic decline from Russia, however. The US EIA is predicting an 890,000 b/d fall in Russian supplies in the second quarter and OPEC forecast a fall of just 100,000 b/d versus the first quarter.

India buying

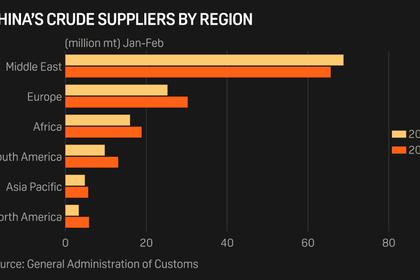

The Kpler shipping data showed that China -- the largest single buyer of Russian oil importing 1.6 million b/d of crude in 2021, equally divided between pipeline and seaborne routes -- has imported less seaborne Russian crude so far in April. But with some 630,000 b/d of cargo destinations still classed as "unknown," this figure could increase in the coming week to reach prewar average levels of about 900,000 b/d.

One country that has clearly stepped up purchases of Russian oil is India, where refiners have taken advantage of large discounts for Russian crude to secure cheap supplies. So far in April, Russian crude exports to India have rocketed more than 17-fold compared with February to average 658,000 b/d, the data showed.

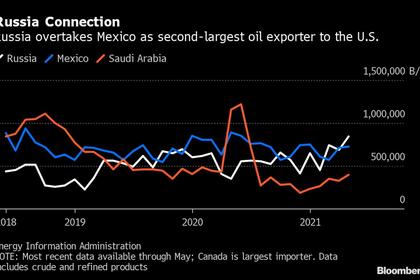

Meanwhile, the US ban on crude and product imports from Russia has halted flows to the US completely in April, the data showed. Exports to Lithuania and Israel have also stopped. In Europe, Russian crude exports to France, Germany, the UK and the Netherlands have dropped in April but flows to Italy and Turkey increased from February.

In terms of oil products, the figures showed Russia's key exports of diesel, fuel oil, vacuum gasoil and naphtha may have actually risen this month on a barrels-a-day basis, after sliding almost 900,000 b/d in March. Volumes of all four key Russian exports rose with the exception of diesel -- a major import requirement for European markets before the war in Ukraine.

Since February, diesel exports to the Netherlands -- home to key refineries and the ARA trading and storage hub -- have jumped more than eight-fold so far in April to more than 108,000 b/d, the data showed. The jump from just 13,000 b/d in February suggests a few buyers may be blending Russian diesel with other diesel sources in the ARA to avoid scrutiny about the continued imports of Russian diesel into Europe.

Shell, for instance, has been buying European diesel cargoes on the condition that less than 50% of the content by volume is sourced from Russia and have not been loaded in or transported from a Russian port, according to bid terms published via S&P Global.

-----

Earlier: