U.S. WRECKING ENERGY MARKETS

By CHRIS AMSTUTZ Risk Management Analyst GETCHOICE!

ENERGYCENTRAL - Apr 6, 2022 - We regret to inform you; the politicians are back at it again. We have commented on politics in energy numerous times in the past, and today we look to address the volley of energy headlines that have come out in recent weeks. Like every topic, there is nuance and gray area that is difficult to explain to those outside the energy industry. Today we start a new blog series to address ongoing questions from popular headlines in the industry. Here are some of the recent headlines with additional nuance discussed.

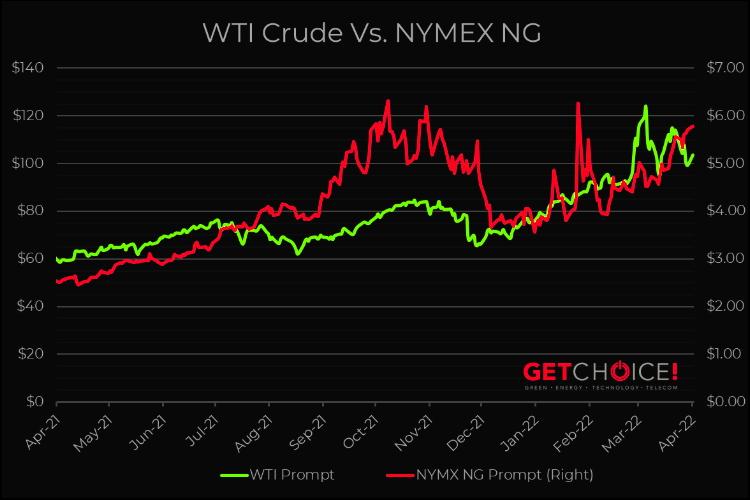

Will Biden’s Strategic Petroleum Reserve (SPR) Release Lower Gasoline Prices?

This article reports that the White House predicts gasoline prices to fall 10-30 cents per gallon on the announcement that 180 million barrels of oil would be released for U.S. consumption. SPR releases have had mixed results in the past and it is difficult to say what the final outcome for this will be. The visible outcome thus far, is that the market has lowered WTI oil price futures for the next 6 months, but increased prices beyond that point (see chart below). This is due to producers adapting their production outputs lower in the long run due to lower profit margins in the short run. So all in all, the more complicated answer is that politicians can marginally adjust oil and natural gas prices in the short run but these policies have rippling, unintended consequences in the future. Upward price movements, like what we have seen in the last 6 months, ultimately are tied to long term fundamentals of supply and demand against the back drop of industry trends.

Has the U.S. given up on the Green Energy transition?

This article discusses the “reluctance of President Biden to unleash clean energy rhetoric”. Green energy topics do not typically poll well when energy prices are high (hence the President’s reluctance), but many U.S. and European politicians believe that high prices are the catalyst to increasing renewable energy sources on the grid. The reality is that the U.S. is still not close to a macro, nationwide green future due to the sheer scale in technology required to change the current system. However, micro, individual business level green-initiatives are becoming more popular due to the ability to save money on utilities. The platform GET: Smart Management Technology (formerly Choice! Data Connect), allows businesses to benchmark usage, track Scope 2 & 3 carbon emissions, and quantify savings from these green initiatives at the site level. This trend will grow due to high energy prices and the need for increased cost efficiencies.

Earlier: