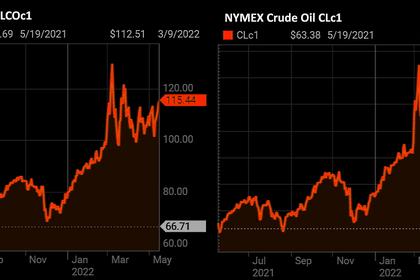

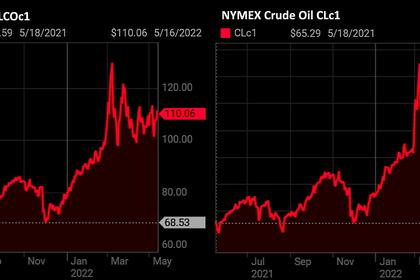

OIL PRICE: BRENT ABOVE $107, WTI ABOVE $107

REUTERS - May 19 - Oil prices fell on Thursday, following earlier gains, on concerns that high fuel prices could hurt economic growth, but planned easing of restrictions in Shanghai and a tight supply outlook capped losses.

Brent crude futures for July were down $1.25, or 1.2%, at $107.86 a barrel by 0932 GMT. U.S. West Texas Intermediate (WTI) crude futures for June fell $1.96, or 1.8%, to $107.63 a barrel.

Front-month prices for both benchmarks fell about 2.5% on Wednesday.

"Slumping stocks led by the US retail sector raised concerns about growth, and with that, demand for fuels," Saxo Bank analyst Ole Hansen said.

Heavy falls on European and Asian stock markets followed Wall Street's worst day since mid-2020, as stark warnings from some of the world's biggest retailers underscored just how hard inflation is biting.

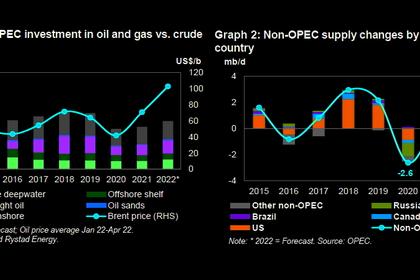

The looming possibility of a European Union ban on Russian oil imports has been supporting prices, however.

This month the EU proposed a new package of sanctions against Russia for its invasion of Ukraine, which Moscow calls a "special military operation".

That would include a total ban on oil imports in six months' time, but the measures have not yet been adopted, with Hungary among the most vocal critics of the plan.

Russian Deputy Prime Minister Alexander Novak said on Thursday that Moscow would send any oil rejected by European countries to Asia and other regions.

Novak said Russian oil production was about 1 million bpd lower in April but had increased by 200,000 bpd to 300,000 bpd in May with more volumes expected to be restored next month.

On Wednesday, the European Commission unveiled a 210-billion-euro ($220-billion) plan for Europe to end its reliance on Russian fossil fuels by 2027, and to use the pivot away from Moscow to quicken its transition to green energy.

Also, U.S. crude inventories (USOILC=ECI) fell last week, an unexpected drawdown, as refiners ramped up output in response to tight product inventories and near-record exports that have forced U.S. diesel and gasoline prices to record levels.

Capacity use on both the East Coast and Gulf Coast was above 95%, propelling those refineries close to their highest possible running rates.

In China, investors are closely watching plans to ease coronavirus curbs from June 1 in the most populous city of Shanghai, which could lead to a rebound in oil demand from the world's top crude importer.

($1=0.9537 euros)

-----

Earlier: