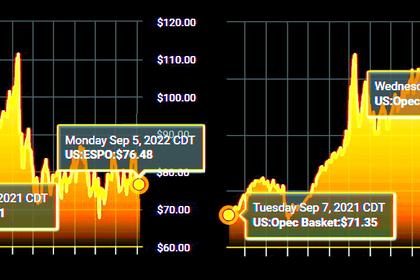

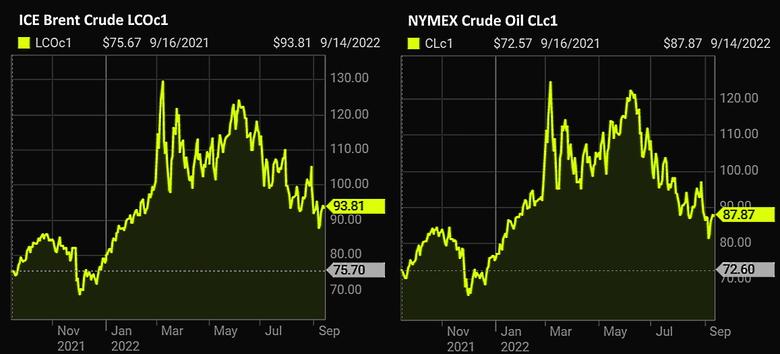

OIL PRICE: BRENT NEAR $94, WTI NEAR $88

REUTERS - Sept 14 - Oil prices stabilised on Wednesday, after dropping by more than $1 earlier in the session, following signs of bullish demand in an International Energy Agency (IEA) report.

Brent crude futures rose 8 cents, or 0.09%, to $93.25 a barrel by 0933 GMT. U.S. West Texas Intermediate crude was at $87.35 a barrel, up 4 cents, or 0.05%.

Prices stabilised following some "positive elements" in an IEA report published on Wednesday, said UBS analyst Giovanni Staunovo.

The IEA expects large-scale switching from gas to oil, estimated to average 700,000 barrels per day (bpd) in October 2022 to March 2023 - double the level of a year ago. The IEA said global observed inventories fell by 25.6 million bbl in July.

This follows forecasts from the Organization of the Petroleum Exporting Countries on Tuesday for growth in global oil demand in 2022 and 2023, citing signs that major economies were faring better than expected despite challenges such as surging inflation.

But analysts suggested OPEC's bullish take may be wishful thinking.

"OPEC continues to view the global economy with rose-tinted glasses despite the threat of recession in several key economies," said Stephen Brennock of oil broker PVM.

And the IEA expects growth in global oil demand to grind to a halt in the fourth quarter of this year as an economic slowdown deepens.

A hotter-than-expected U.S. inflation report on Tuesday dashed hopes the Fed could scale back its rate policy tightening in the coming months. Fed officials are set to meet next Tuesday and Wednesday, with inflation remaining way above the U.S. central bank's 2% target.

Price pressure continued to follow tough ongoing COVID-19 curbs in China which are squeezing fuel demand at the world's largest oil importer.

On the supply side, U.S. crude stocks rose by about 6 million barrels for the week ended Sept. 9, according to market sources citing American Petroleum Institute figures on Wednesday.

The U.S. government will release inventory data at 10:30 a.m. EDT (1430 GMT) on Wednesday.

-----

Earlier: