CLIMATIC MARKETS CARTHASIS

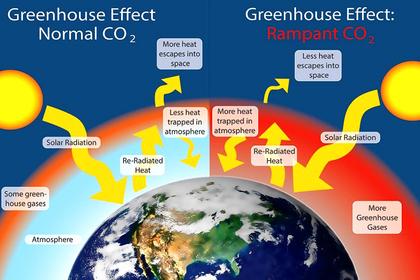

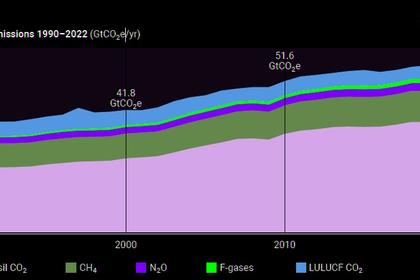

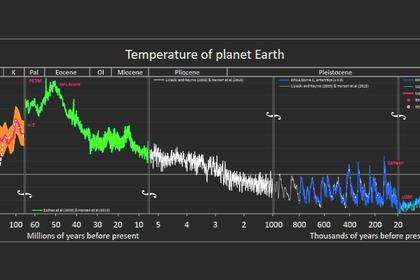

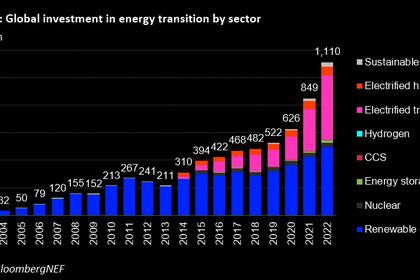

As we kick off the final week of the month and closure of the Thanksgiving celebrations,humanity on a global scale has found enlightenment, and solutions have been placed on the conveyor belt towards solving the drastic influx and consequences of a lack of global climatic health.The COP28 sessions are underway with various distinguished global members assisting in cleaning up the pile of dirt that has been kept under the carpet for decades.

Oil markets are still in maintenance of the pricing levels with BRENT trading shy above the $80/bbl at $82.03/bbl(+1.38%) & WTI Crude at $76.72/bbl(+1.12%),this is after the EIA Report publishing during the early NewYork session.EIA stating that more refineries are coming out of maintenance with a 1.6m bbl build in #crudeoil stocks,Cushing up 1.9m bbl. #Gasoline and distillate stocks both rise.Crude export and production held steady with gasoline demand (4-wk avg.) declining by 0.1mb/d to 8.8 mb/d. Prices seeing additional softness.

On the Natural Gas tabs,the #natgas ETFs with $UNG and $BOIL attracting a $672 million inflow this past month only to drop by 23% and 44% respectively.

Over the weekend, NaturalGas production rose to fresh all-time highs above 106 BCF/d and will hold close to that level on the day, up +5.1 BCF/d vs 2022.

The main agenda on the table is the OPEC+ Meeting set on November 30th.Discussions of the African baselines are the pivot point for the meeting,hoping for a consensus to come by.

WTI CrudeOil fell over $1.50 and intraday prices swung over 5% on the news of the OPEC+ Meeting being delayed to Thursday, November 30.

This change in date has made the WTI Friday Weekly(LO1) expiration a preferable indicator option for hedging meeting outcomes.Oil prices are at the behest of the OPEC+ meeting minutes.

On the European Front : Focus is on the PEP Programme: ECB may revisit $1.7T pandemic bond portfolio,consideration on replacement of maturing securities.Reinvestment is priced to continue until end of 2024.Headline inflation has been on an uptick.

Euro crossed 1.10 handle during the London session this week after a somewhat swinging session. Germany supplementary 2023 budget approved & suspension of debt break and debt limit paused for the 4th Year.

Several ECB Regulators plan push to ease bank payout.

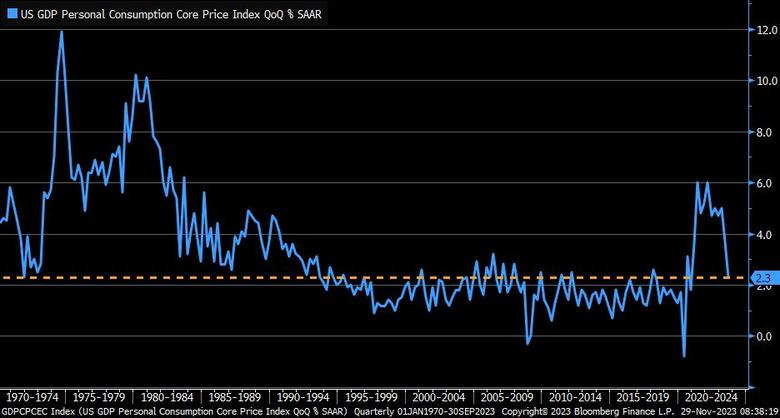

On the US Front:major focus is on the US Core PCE Data.Core PCE Price Index within 3Q23 GDP revised lower from +2.4% to +2.3%.The Yield on the US 10-year Treasury note trimmed its earlier retreat to hover near the 4.3% mark on Wednesday, but remained at an over two-month low as strong economic data eased the urgency for the Federal Reserve to start cutting interest rates.Talks of deflation should be within this spectrum as it brings a trickle down effect across the global markets.

Extreme weather events,food supply disruption add urgency to energy transition.Panama Canal drought has effectively reduced carrying capacity due to climate change.

Green deal creating incentives on critical minerals.

Symbiosis between US & China is crucial as they share critical mineral resources that enable effectiveness on the motive.Also,results are always timing driven in facing the climatic tragedy before us.

The die has been cast,truth has its own gravity and eventually pulls people back to it.

Andy Warr,

TophatFinanceGroup.

-----

Earlier: