INFLATION ; A MOVING TARGET

By Andy Warr, TophatFinanceGroup.

Moving through the banking sector turmoil has been wrapped with inflation data from different central banks fronts for the past two weeks.

This has trickled into the sensitive commodities markets especial Oil tabs seeing a thin price margin with the $70/bbl proving to be a sticky magnet,rather a line in the sand on the #CL currently trading at $69.71/bbl & $75.47/bbl on the #BRENT both paring gains of (+0.64%) at middle of the European session.

On the Banking Stocks tabs:

- First Republic Bank trading at 16.57 after a wild roller coaster ride,

- Deustche Bank springing up almost 5% intraday,

- Credit Suisse facing a probe dur to lack of accountability.

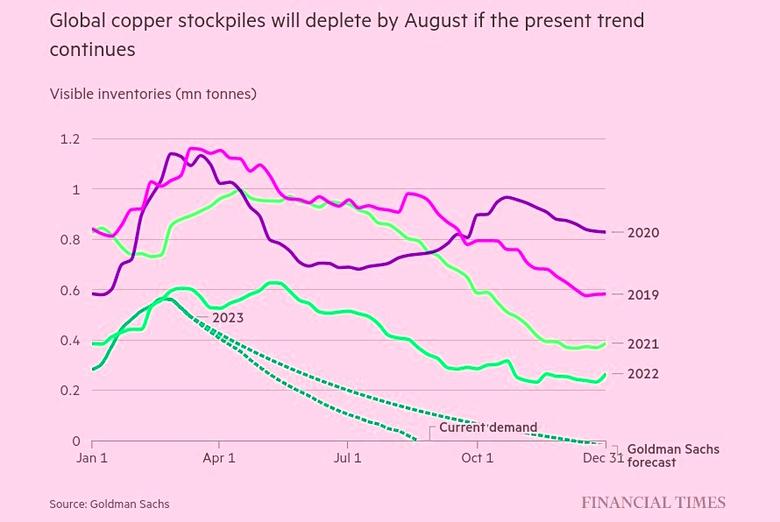

Perhaps, its time to look at Dr.Copper for guidance on economic health ?

On the scales of supply & demand within the Oil markets:

- Russia is now China's biggest Oil supplier,

- Data suggests there being too much demand for Oil in China,

- Demand impulse for Oil raising several concerns.

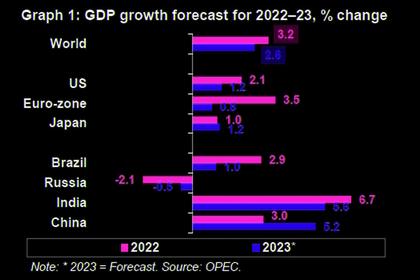

Taking into account 100k b/d in Europe, last week IEA & OPEC raised Russian inventory build to 86.1m barrels,last year it was 87m barrels ; 21m barrels in Canada was discovered.

This suggests that demand is taking a major hit by banking crisis,however there seems to be light at the end of the tunnel with the 25BP consensus coming in at the end of last week.

Banking crisis seems to be a regulatory issue not a monetary policy issue.

Dollar may get a leg up higher soon despite the fluid situation.Natural credit tightening by banks being a factor to consider,also remembering the Core PCE Data during the week.

S&P Regional Banks Index down (-37.50%) at 74.81, S&P Financials Index at 515.96 down (-12.85%).

OPEC Meetings in a weeks time may shed light of matters Oil.

Considerations of buying 1m b/d less this quarter than previous may help in regaining momentum with respect to pricing of Oil.

Cutting a little Oil in 2nd quarter,may bring a floor on the pricing level,bulls to $90/bbl is more on demand perspective than a presumed cut.

Russia to place nuclear weapons in Belarus may be another factor to consider for speculators as it is in line with volatility vis a vis geopolitics.

Don't throw the baby out with the bath water just yet,banking sector may prove its resilience in the long-run basis.

Good week ahead.

-----

Earlier: