WIDOWMAKER: DIRE STRAITS

As we mark the National Day of Singapore,we see a muted Asia session after the signs of deflation being experienced in China.

We look forward to the US CPI Print on Thursday for further guidance.

The China CPI,PPI are on a decline for the first time since 2020.

This has brought up the Renminbi to soar past the 7 handle,majority of the move not really backed up by strong bullish bets rather more of profit taking to happen for a fall back to 6.8s would be my bias.

Treasury auctions are off to a good start however more tension is on the longterm as it tests investors appetite for debt.Also,the downgrade plays a major role in the fundamental outlook.

On the Daily Data,we expect some news from the Mexico CPI,Numbers decelerate for 6th consecutive month.This is a good indicator of Economic resilience for the Emerging Markets(EM).

Italian Government clarified that the 'windfall tax' can't exceed 0.1% of the banks assets,this has brought an ease in the European equities market with the #DAX gaining 130pts at 15914(+0.86%).

The butterflies in the Italian banking sector have been fed on some nectary flowers it seems.

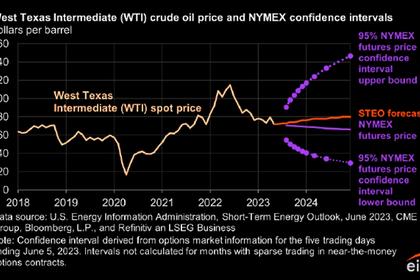

Oil tabs remain steady after the cross of the $80/bbl price mark,as the Stock 600 Energy Complex paring gains of +1.01% standing at 113.42 at the European Open.

BRENT trading at $86.05/bbl and WTI settling at $82.92/bbl after a short decline below $80/bbl during the previous US Session($79.95/bbl(-2.40%) on the Daily Chart).

I've attached the US crude production forecast of EIA #STEO August vs July in mbpd for a road map.

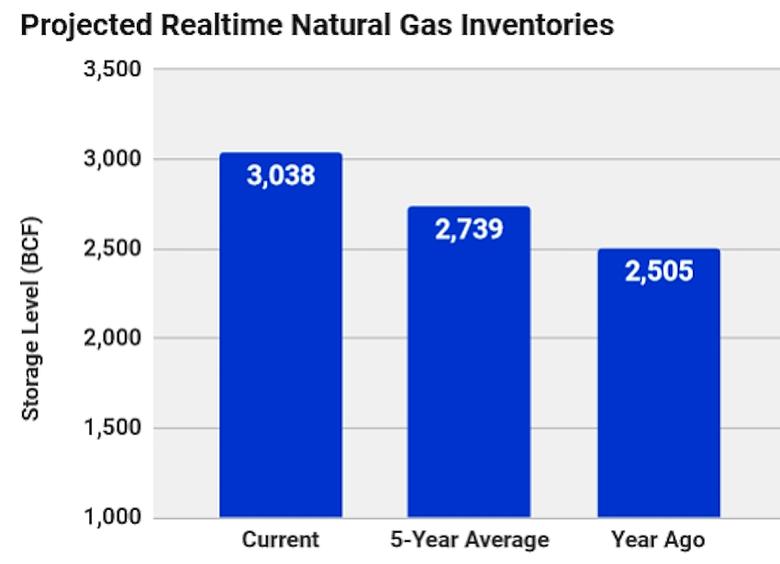

Our main focus for the week is on the Widowmaker #NaturalGas which indicates being in dire straits for the most of the week.

We were up +6.4% up on the previous daily session,clearly making it the Sultan of Swings with respect to the moves being experienced.

Currently we are trading at a major focal area at the $2.74/mmBtu resistance pivot point,Major 3month high was $2.91/mmBtu on 25th June 2023,

Play your games traders.

September $3.50 calls might just resurrect.

Also,projections of the Realtime #NattyGas storage surplus vs the 5-year average fell below +300 BCF for the first time since April.

With higher than average temperatures & above-average GWDDs expected to persist into mid-August, this could fell towards +260 BCF by the end of the month.

This is crucial data as the ping-pong goes on within the murky waters of the Widowmaker.Use it as your anchor.

Let us observe some calm and hope for better tidings from mother nature especially for Natural Gas traders,winter season is percolating.

---

Andy Warr,

TophatFinanceGroup .

-----

Earlier: