URANIUM PRICES UP

BLOOMBERG - Nov 19, 2024 - A product has just gone up in price by 90% in 12 months. It now costs more than is has in 16 years. Most people would think twice about diving into a market like that.

Not so those who run a nuclear power plant and must have the product in question: uranium. Shutting the plant down will cost you a fortune, says Nick Lawson of advisory firm Ocean Wall. Think $1 million a day. It could also make you extremely unpopular, with one in five households in the US reliant on nuclear energy. Worse, if you do have to do it, you can’t flick a switch to turn it back on once your ore has arrived; restarting means new safety checks and regulatory approvals that can take months if not years.

That, along with the fact that uranium is a small part of the overall cost, is why the enriched uranium market is one of the most price inelastic in the world. If you need it, you really need it. The problem — which I imagine is keeping utility managers up most nights — is that an increasingly long list of other people do too.

Governments appear to have finally grasped that nuclear power is the only cheap and reliable low-carbon power available — and therefore the only thing that gives them a hope of getting anywhere near their rash net-zero promises. They know they won’t get there with unreliable, expensive and politically divisive wind turbines and solar panels — and (finally) the greens do too.

So the French have given up on their (stupid) plan to reduce the share of electricity generated by nuclear. The UK is (also finally) seriously discussing expanding nuclear capacity and has delayed the closure of four reactors. It has also announced plans to spend hundreds of millions of dollars on producing the high-assay low-enriched uranium (HALEU) we need for the small modular reactors that are to be our low carbon saviors. And the Chinese, say Alpha Portfolio Management, have 55 nuclear reactors, another 24 under construction and around 150 planned over the next 15 years.

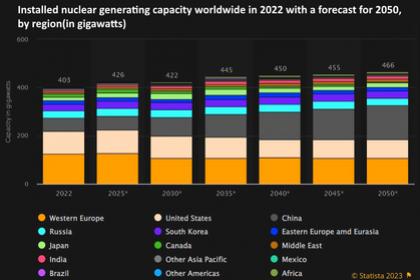

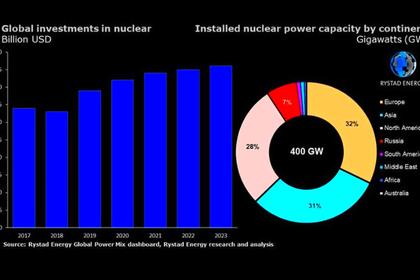

At COP28, 22 countries committed to a trebling of nuclear capacity by 2050. The slightly scary result? Globally uranium demand is expected to rise by 28% by 2030 and to double by 2040.

Back to the sleepless nights of our managers. They have not had to worry about uranium supplies for a long time. Nuclear has been out of favour for decades due to disasters in Fukushima and Chernobyl. There has also been a long-term supply overhang that, until very recently, has kept prices well below the cost of production. In the last uranium bull market, that secondary market kicked in, and the price rise, while sharp, was very short. Anyone who wanted uranium could get it with much bother or expense. No more.

The era of overhang is “emphatically behind us,” according to industry research group UxC. There has also been little investment in new mines for a while (why invest with prices so low?); inventories at the big producers are at record lows (Cameco Corp.’s fell more than 35% last year); and those same producers are also reporting production problems. This week, production giant Kazatomprom announced that a shortage of sulphuric acid was causing problems. Cameco warned last September that production levels were falling rather than rising. Expect profit warnings.

The truth is, there just isn’t enough uranium to go around, particularly given a relatively new competitor in the form of funds that hold physical uranium for investors — effectively taking it out of the market. (Yellow Cake Plc and Sprott Physical Uranium Trust are the main culprits here.) The result, says Lawson, is that the current demand for uranium is around 190 million pounds a year. The available supply is 140 million pounds. That’s about a 25% supply deficit already. Most utilities will hold two to three years of inventories. Smart managers might be thinking four or five might help them sleep better. Expense and bother in spades.

Some of you won’t be much bothered about this. You know that the cure for high prices is high prices, that demand begets supply and everything will be fine. But there is a problem with this argument in this market.

First, expanding the supply of uranium will take a long time. Mines don’t open in a day; they take more like a decade. So companies need to be sure that prices are staying high before they start even applying to start digging. They also need to hire: A long bear market has left them with a small and aging group of experts.

Geopolitical conflict clearly doesn’t help. Russia is a huge part of the uranium ecosystem and also owns stakes in some of the producers in Kazakhstan, which produces around 45% of the world’s uranium. Kazakhstan itself is at the center of a uranium great game: Recent visitors include Xi Jinping, Vladimir Putin and Emmanuel Macron. Meanwhile, Niger, which produces 5% of the world’s uranium, has just suffered a coup.

The second key point is that this is not just about the ore. You can’t shovel that directly into your power plant and hope for the best. For that, you need enriched uranium. And the supply of this is even tighter and more politically tricky: In 2021, 35% of global enrichment was provided by Russia.

So there you have it. Hedge funds want uranium (they like stuff that is going up fast). ETFs want it. Governments want it. Utilities must have it. They can’t all have what they want at the price they would like. That’s why this price shift is still “very much in its early stages,” says Sean Wade, CEO of Power Metal Resources.

What might bring all this to an end? There might be another accident — although on current numbers, you are four times as likely to be eaten by a shark than injured in a nuclear accident. The small modular reactor rollout could fail — but work on them is far enough advanced to make that seem unlikely. We could figure out how to get uranium from water more effectively (it is currently possible but very expensive). There could also be a breakthrough that overtakes nuclear: If you think fusion or perhaps the direct beaming of solar energy from space is just around the corner, uranium is not for you.

Otherwise, it looks like you should assume it’s likely to stay expensive for some time to come — and that the share prices of the equities in this still tiny and often volatile space will follow. (Total market cap of uranium-related equities is only around $60 billion).

In the UK, the most obvious ways in are via Yellow Cake, a London-listed fund that holds physical uranium, and the Geiger Counter Fund, which holds uranium-related equities. The latter trades on a 16% discount to its net asset value — it might be in a hot sector, but it’s listed on an unpopular market. Both have had very good runs already, but as long as utilities are fighting funds for ore, there may be more to come.

-----

Earlier: