GLOBAL MARKETS(2024) : A GOOD OLD SWITCHEROO

The year has started with a slush of activities within the Global markets. Geopolitical temperatures have cooled down a bit during the January-February trade sessions with majority of specialists stating the year being one that's on focus towards the data trickling in from the different global monetary & fiscal regulatory bodies.Interest rate talks being the bull's-eye in this case.

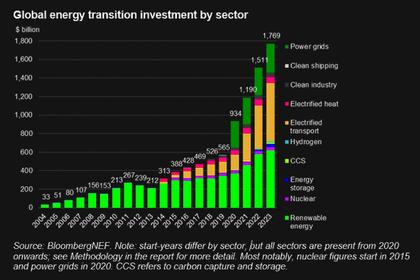

Also, point in case is the talks on new technologies developing within the EV Space, in correlation to energy & fintech as a sector.

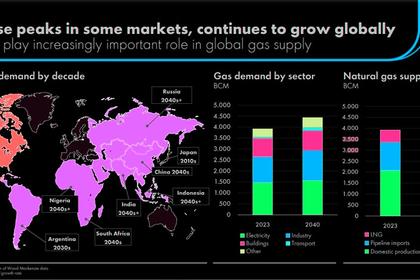

There seems to be a case of a Good Old Switcheroo happening within the elements of the financial markets,across the board.We are seeing news of new 'sanction' package towards Russia by the West, we all know how once bitten, twice shy works, however this month's point in case being the Natural Gas #NG tabs.

The bears have been very resilient for the past month cementing a floor on the pricing.

Today's price action saw a tick up of whooping 13% pre-NewYork session trading at $1.778/mmBtu with a thin range as majority of traders wait on the FOMC Minutes for guidance.

This is after a 16% price slump that drove the #Widowmaker shorts to a 2-year low price pivot.

Illustrations of beauty being experienced here as two technical trendlines converge with an extreme oversold condition on multiple indicators.

Question is, will the move hold or its a case of deadcats bouncing for a further clawing by the bears?

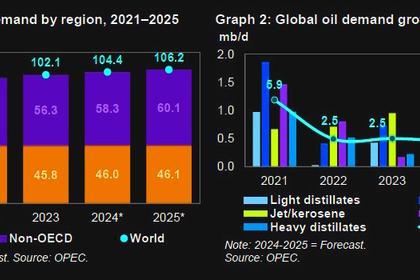

Oil tabs are still on navigation in the murky with the #BRENT trading at $82.51/bbl while #WTI Crude trading at $77.25/bbl, major concerns being on the war escalations vis a vis freight management towards the Red Sea, quite a debacle I must say.

At the start of the month, we saw #Crudeoil longs data jump 17%, partly offsetting wrong-footed sales the previous week. Russia stated that the cut of 500k b/d to meet the quota expectations for the month of February as part of a package of cuts promised by the OPEC+.

The year remains ripe for picking with majority of our global citizens working towards the building and generation of wealth as we are chained to the vicissitudes of having to make a living.

On the Asian Equities, we have a situation building with the HangSeng Index making a print of 34 year highs. $HSI_F futures broke out of the chop zone piercing a strong Resistance area (16,575 - 16,725) but retracement/pullback resulted in it closing under that area.

16,372 is the next Support level to watch; but first, FOMC minutes tonight & $NVDA Earnings Data post-market.

Shanghai Composite and Hangseng have been bouncing quite hard due to the intensity of QE.

German #DAX is also one to have your eyes peeled at too.

We are still on the mile-high club in the Yen as the 150 handle keeps steady,the Euro is muted still.The catalytic effect of interest-rate decisions from the ECB & BOE are yet to be felt in due time.

On the #Grains & #Softs :

#Corn and #Soybeans selling have driven overall sector short to a fresh 2019 high at -604k. #Cocoa sold into a parabolic rise, #Cotton long jumps 54% to 21-month high and #Coffee to a 2-year high.

US Equities facing a 3-day losing streak, Nasdaq #NQ trading at 15558(-1.41%) at the NewYork session start after the SP500 #ES treaded past the 5000 mark(at 5048.39) just weeks ago, a very remarkable and significant achievement.

It's an election year hence more clarity to come as time goes by.

On the Metals complex, we are much more intrigued with Silver #XAG as it is key towards the manufacturing of semi-conductors. We are currently trading at $22.84/oz at the NewYork session start.

I'd be keen at the $23.20-23.30/ounce area, here, bullish price action will find inevitable resistance ; only on the next breakout will we have a strong upward signal.

I cannot insist enough, that paying attention to Treasury Yields gyrations and #DXY(DollarSpotIndex) should be your bread and butter for your early yearly breakfast.

A look at China geopolitics should assist in how the scroll is unravelled.

We are at the genesis of a new financial year, keep your focus in the markets, it's a Good Old Switcheroo, you may experience déjavu in the coming months.

Stay safe out there and prudence is a virtue not to be underestimated.

Put your ducks in a row !

--

Andy Warr,

TophatFinanceGroup.

-----

Earlier: