OIL PRICE: BRENT ABOVE $83, WTI NEAR $80

REUTERS - Feb 20, 2024 - Oil prices were broadly steady on Tuesday, hovering close to three-week highs on heightened Middle East tensions and recovering China demand.

Brent futures ticked down 11 cents to $83.45 a barrel by 0413 GMT.

U.S. West Texas Intermediate (WTI) crude for April delivery inched down 11 cents to $78.35 a barrel. The March WTI contract rose 36 cents to $79.55 a barrel as traders prepared for that contract to expire during the day. There was no settlement for WTI on Monday due to a U.S. public holiday.

Crude markets were "marginally lower" in "quiet trading over the Presidents' Day holiday in the U.S. and as demand concerns offset ongoing Middle Eastern geopolitical tensions," IG market analyst Tony Sycamore said in a note.

The Iran-aligned Houthis continued their attacks on shipping lanes in the Red Sea and Bab al-Mandab Strait, with at least four more vessels hit by drone and missile strikes since Friday. One of them, the Belize-flagged, British-registered and Lebanese-managed Rubymar cargo vessel in the Gulf of Aden, was in danger of sinking, Houthis said, raising the stakes in their campaign to disrupt global shipping in solidarity with the Palestinians in Gaza.

"Signs of stronger demand in China also boosted sentiment," ANZ analysts wrote in a note.

Tourism revenues in China surged 47.3% year-on-year and rose above pre-COVID levels during the national Lunar New Year holiday that ended on Saturday.

China also cut a benchmark reference rate for mortgages by more than expected on Tuesday, in a bid to shore up its beleaguered property market and economy.

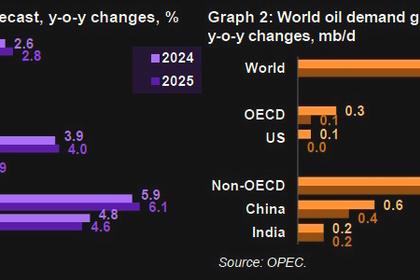

However, the price-supportive factors did not completely offset demand worries. A bearish International Energy Agency (IEA) report last week revised the 2024 oil demand growth forecast downward on expectations that renewable energy would supplant fossil fuel usage.

-----

Earlier: