Downstream

2019, December, 18, 13:00:00

A FORK IN THE ROAD FOR UTILITY GIS

As with many industries, the expectations for distribution power companies are that they either hold their operating costs flat year over year, or that they reduce their O&M expenditures each year.

2019, December, 18, 12:50:00

BP, RELIANCE NETWORK IN INDIA

BP and Reliance Industries Limited (RIL) signed a definitive agreement relating to the formation of their new Indian fuels and mobility joint venture. This follows the initial heads of agreement signed in August this year.

2019, December, 2, 14:15:00

5TH SUMMIT GECF DECLARATION

The essential role of natural gas in the attainment of UN Sustainable Development Goals, in particular Goal 7, as an environmentally friendly, affordable, reliable, accessible and flexible natural resource for ensuring economic development and social progress

2019, November, 25, 12:50:00

GERMANY'S INVESTMENT FOR CHINA: $10 BLN

German chemical giant BASF has begun construction of its $10-billion integrated petrochemicals project in China’s southern province of Guangdong,

2019, November, 15, 14:20:00

OIL PRICES 2019-20: $64-$60

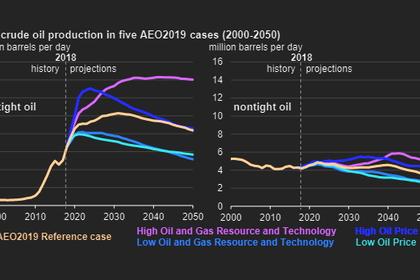

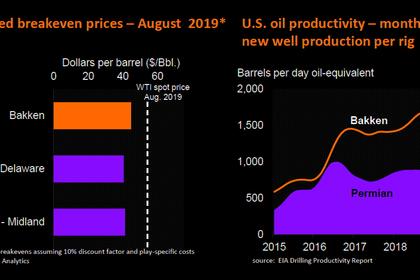

Brent crude oil spot prices averaged $60 per barrel (b) in October, down $3/b from September and down $21/b from October 2018. EIA forecasts Brent spot prices will average $60/b in 2020, down from a 2019 average of $64/b. EIA forecasts that West Texas Intermediate (WTI) prices will average $5.50/b less than Brent prices in 2020. EIA expects crude oil prices will be lower on average in 2020 than in 2019 because of forecast rising global oil inventories, particularly in the first half of next year.

2019, November, 15, 14:10:00

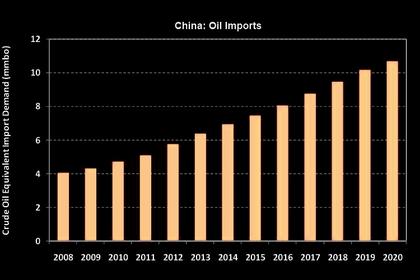

CHINA'S OIL THROUGHPUT UP TO 13.68 MBD

Crude oil throughput at China's domestic refineries jumped 9.2% year on year in October, to breach the 13 million b/d mark for the second time ever, at 13.68 million b/d,

2019, November, 13, 12:20:00

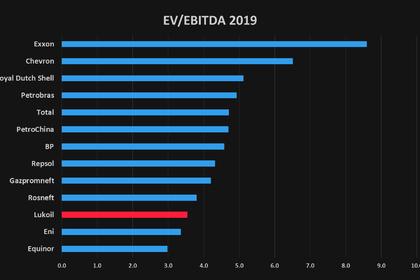

LUKOIL PRODUCTION +1.6%

For the nine months of 2019 LUKOIL Group's average hydrocarbon production excluding the West Qurna-2 project amounted to 2,337 thousand boe per day, which is 1.6% higher year-on-year.

2019, November, 6, 12:20:00

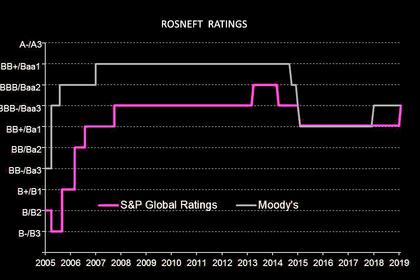

ROSNEFT'S PRODUCTION 5.78 MBD

9M 2019 AVERAGE DAILY HYDROCARBON PRODUCTION AMOUNTED TO 5.78 MMBOED, INCREASING BY 0.6% YOY

2019, October, 25, 09:30:00

U.S. PETROLEUM EXPORTS 5.47 MBD

In the first half of 2019, the United States exported 5.47 million barrels per day (b/d) of petroleum products, an increase of 19,000 b/d (0.3%) from the first half of 2018 and the slowest year-over-year growth rate for any half year in 13 years.

2019, October, 25, 09:25:00

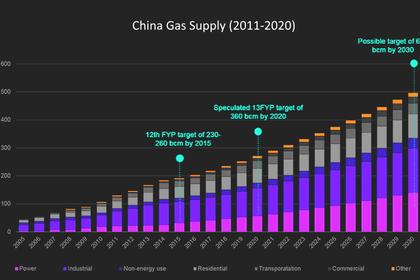

CHINA'S GAS DEMAND WILL UP BY 82%

City gas demand is likely to experience rapid growth over the next 10-15 years, driven by consumption growth from heating and the public sector.

This growth will be supported by China's growing urbanization and urban gasification, which are expected to exceed 70% within the next decade, up from 59.7% and 50.9% at the end of 2018, respectively.

2019, October, 18, 11:20:00

UAE INVESTMENT FOR INDIA $4 BLN

This is the next step of BASF’s and Adani’s investment plans as announced in January 2019. With the inclusion of ADNOC and Borealis as potential partners, the parties are examining various structuring options for the chemical complex that will leverage the technical, financial and operational strengths of each company. The total investment is estimated to be up to US$4 billion.

2019, October, 11, 11:45:00

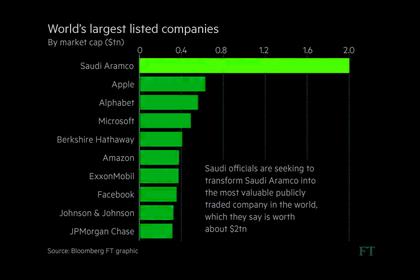

SAUDI ARAMCO IPO: $100 BLN

With an oil production capacity of about 12mn b/d and posting a profit of $46.9bn in the first half of 2019, Aramco is betting institutional investors will rush to buy the 5% stake set to be sold by the Saudi government.

2019, October, 7, 13:20:00

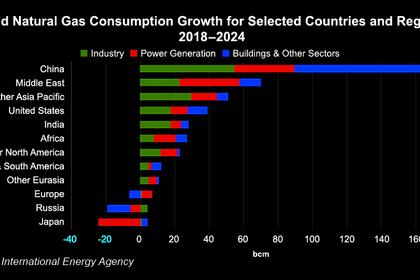

GECF: EXCEPTIONAL GROWTH

The Russian Energy Minister noted that 2018 was an exceptional year for growth for the natural gas industry with consumption recording a 5% growth, the fastest growth since 2010, to average 3.95 Tcm. The trade in 2018 was also characterized by a significant growth where global pipeline gas trade increased by almost 8%, including re-export operations in Europe. LNG trade growth continued exponentially with 10% for the second consecutive year, averaging a level of around 320 Mt.

2019, September, 23, 14:00:00

U.S. PETROLEUM DEMAND 21.5 MBD

Total U.S. petroleum demand of 21.5 mb/d was highest for any month since August 2005;

Improved infrastructure helped increase supply and lower prices;

Highest U.S. petroleum exports (8.1 mb/d) for the month of August; and

Total inventories increased year-on-year for the ninth consecutive month.

2019, September, 23, 13:45:00

ROSNEFT INVESTMENT FOR INDIA

Минприроды России произвело оценку запасов полезных ископаемых в натуральном и стоимостном измерениях по итогам 2018 года и их изменений относительно результатов оценки по итогам 2017 года.