Upstream

2023, November, 23, 06:50:00

RUSSIAN OIL GAS PRODUCTION DOWN

Russia is expected to reduce both oil and natural gas production this year, according to Deputy Prime Minister Alexander Novak. Oil is projected to fall by 8 million tons to 527 million tons, compared to 535 million tons last year, he said.

2023, November, 23, 06:30:00

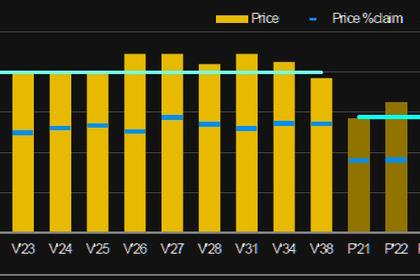

VENEZUELA'S DEBT OVERVIEW

We estimate Venezuela’s external debt stands at around US$167 billion. The majority is from the sovereign at US$107 billion, with PDVSA adding US$59 billion and ELECAR another US$1 billion. 21% is arrears due to missed interest payments.

2023, November, 23, 06:00:00

NUCLEAR FOR SRI LANKA

Sri Lanka's 2020 production of 15.6 TWh of electricity was dominated by fossil fuels, which accounted for some 10 TWh, and hydro (5 TWh) alongside some wind and solar,

2023, November, 22, 07:00:00

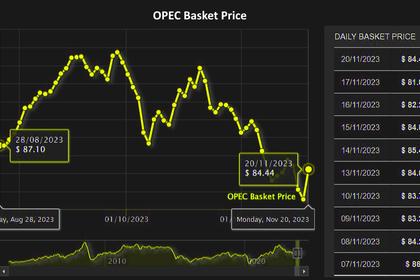

OIL PRICE: BRENT ABOVE $82, WTI NEAR $78

Brent rose 11 cents, or 0.1%, to $82.56 a barrel, WTI rose 14 cents, or 0.2%, to $77.91.

2023, November, 22, 06:45:00

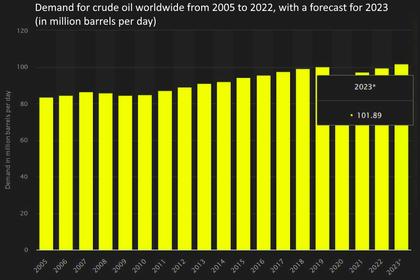

GLOBAL OIL DEMAND WILL UP BY 2.5 MBD

The world oil demand growth forecast for 2023 is revised up marginally from the previous month’s assessment to 2.5 mb/d.

2023, November, 17, 07:00:00

OIL PRICE: BRENT ABOVE $77, WTI NEAR $73

Brent were up 10 cents, or 0.1%, at $77.52 a barrel, WTI was nearly flat at $72.95.

2023, November, 17, 06:55:00

INDIA'S OIL DIVERSIFICATION

Oil ministry officials said India diversified its sources to import crude from as many as 39 nations and hoped the return of OPEC member Venezuela would add to the country's list of steady suppliers.

2023, November, 17, 06:50:00

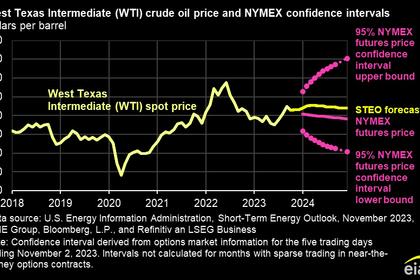

OIL PRICES 2023-24: $90 - $93

The Brent crude oil price will increase from an average of $90 per barrel (b) in the fourth quarter of 2023 to an average of $93/b in 2024.

2023, November, 17, 06:30:00

GLOBAL OIL DEMAND WILL UP

Global oil demand is now projected to rise by 2.4 million b/d in 2023 to 102 million b/d, but growth will decelerate to 930,000 b/d in 2024,

2023, November, 3, 07:00:00

OIL PRICE: BRENT NEAR $87, WTI NEAR $83

Brent rose 6 cents to $86.91 a barrel, WTI gained 12 cents, or 0.2%, to $82.58 a barrel.

2023, November, 3, 06:55:00

RUSSIAN OIL, GAS FOR CHINA

Russia is counting on a planned new pipeline to China as it seeks to make up for lost gas sales in Europe, but industry insiders see major political risks around a project that is overly dependent on one buyer and question whether it will justify the huge costs.

2023, November, 3, 06:50:00

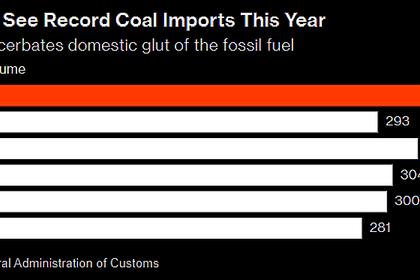

CHINA'S COAL UP ANEW

China has ramped up coal output since the 2021 power crisis in order to avoid a repeat, with this year’s annual production set to notch another record. Demand growth has also been relatively subdued amid China’s bumpy economic recovery.

2023, November, 3, 06:40:00

VENEZUELA: LIFTING SANCTIONS

However, there are growing signs of a thaw in relations between the Biden administration and Caracas, with the sides holding talks to explore temporarily lifting sanctions to encourage Venezuela to hold competitive presidential elections next year.

2023, October, 27, 07:00:00

OIL PRICE: BRENT NEAR $89, WTI ABOVE $84

Brent rose $1.16, or 1.3%, to $89.09 a barrel. WTI climbed $1.08, also 1.3%, to $84.29 a barrel.

2023, October, 27, 06:55:00

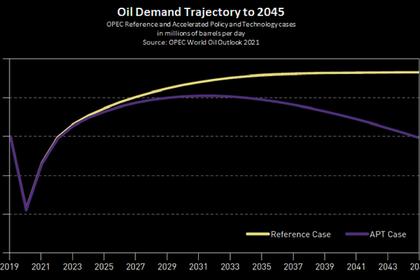

GLOBAL OIL WILL STAY

Prince Abdulaziz said that the energy transition will require hydrocarbons including petrochemicals.