N.America

2021, May, 24, 12:25:00

GEOTHERMAL ENERGY UP

The U.S. is the largest producer of geothermal energy, though its uses and popularity remain low.

2021, May, 24, 12:20:00

U.S. RIGS UP 2 TO 455

U.S. Rig Count is up 2 from last week to 455, Canada Rig Count is down 1 from last week to 58.

2021, May, 21, 10:05:00

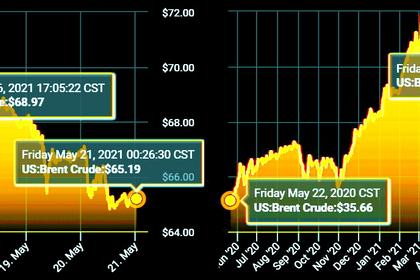

U.S., IRAN NUCLEAR DEAL

"The main issues, oil sanctions, petrochemical sanctions, shipping sanctions, insurance and so on and so forth, Central Bank and banks ... have been wrapped up," Iranian President Hassan Rouhani said on state television

2021, May, 21, 09:55:00

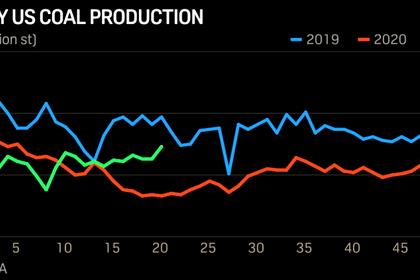

U.S. COAL PRODUCTION UP

The five-year average for week 19 is about flat with the most recent week at about 12.3 million st. Over 19 weeks, production was about 207 million st, up 3.3% from the year-ago period.

2021, May, 20, 14:00:00

NORD STREAM 2: NO SANCTIONS

US President Joe Biden entered the White House with the pipeline already nearly finished, leaving him with the decision of upsetting Germany or giving a win to Russian President Vladimir Putin.

2021, May, 20, 13:30:00

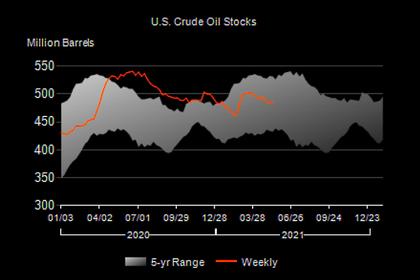

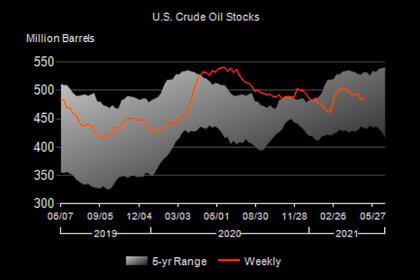

U.S. OIL INVENTORIES UP 1.3 MB TO 486.0 MB

U.S. commercial crude oil inventories increased by 1.3 million barrels from the previous week to 486.0 million barrels.

2021, May, 19, 14:25:00

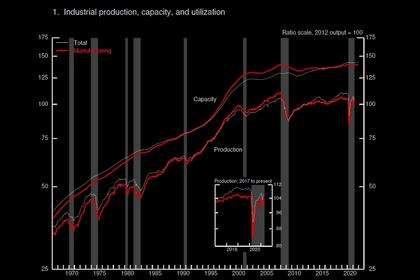

U.S. INDUSTRIAL PRODUCTION UP 0.7%

Total industrial production increased 0.7 percent in April. The indexes for mining and utilities increased 0.7 percent and 2.6 percent, respectively; the index for manufacturing rose 0.4 percent despite a drop in motor vehicle assemblies that principally resulted from shortages of semiconductors.

2021, May, 18, 13:00:00

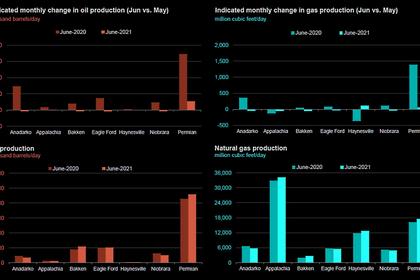

U.S. PRODUCTION: OIL +26 TBD, GAS (-53) MCFD

Crude oil production from the major US onshore regions is forecast to increase 26,000 b/d month-over-month in June 2021 from 7,707 to 7,733 thousand barrels/day, gas production to decrease 53 million cubic feet/day from 83,624 to 83,571 million cubic feet/day .

2021, May, 17, 11:25:00

CHEAP RENEWABLE ENERGY STORAGE

Pumped hydro energy storage constitutes 99% of global storage energy.

2021, May, 17, 11:15:00

U.S. RIGS UP 5 TO 453

U.S. Rig Count is up 5 from last week to 453, Canada Rig Count is up 4 from last week to 59.

2021, May, 13, 17:50:00

U.S. OIL INVENTORIES DOWN 0.4 MB TO 484.7 MB

U.S. commercial crude oil inventories decreased by 0.4 million barrels from the previous week to 484.7 million barrels,

2021, May, 13, 17:20:00

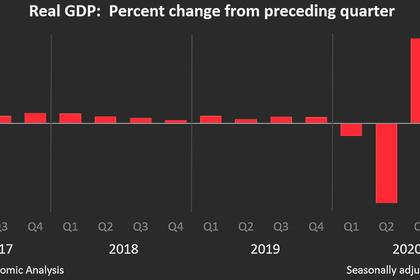

U.S. GDP UP 6.4%

Real gross domestic product (GDP) increased at an annual rate of 6.4 percent in the first quarter of 2021

2021, May, 13, 17:15:00

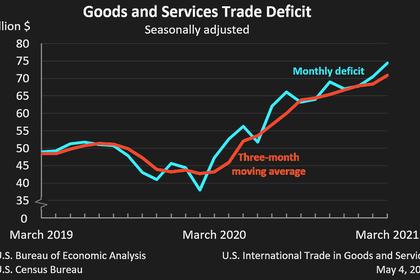

U.S. INTERNATIONAL TRADE DEFICIT UP TO $74.4 BLN

The U.S. goods and services deficit was $74.4 billion in March, up $3.9 billion from $70.5 billion in February

2021, May, 12, 12:20:00

U.S. RIGS UP 8 TO 448

U.S. Rig Count is up 8 from last week to 448, Canada Rig Count is up 4 from last week to 55,

2021, May, 7, 14:50:00

REDUCING METHANE FOR CLIMATE

Methane is significantly more polluting than carbon dioxide, with estimates suggesting it is 84 times more potent than CO2 over a 20-year timeframe.