W.Europe

2022, June, 21, 14:15:00

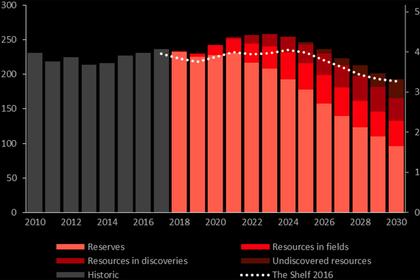

NORWAY OIL, GAS PRODUCTION 1.831 MBD

Preliminary production figures for May 2022 show an average daily production of 1 831 000 barrels of oil, NGL and condensate.

2022, June, 20, 12:10:00

RUSSIAN GAS FOR BOSNIA AND HERZEGOVINA +56%

Gazprom's gas supplies to Bosnia and Herzegovina in the period from January 1 to June 15, 2022, increased by 55.5 per cent compared to the same period of 2021.

2022, June, 20, 11:40:00

FRANCE'S DIGITAL NUCLEAR

"We are pleased to partner with Inria and to continue investing in research for the advancement of reliable, low-carbon energy generation," said Alexis Marincic, senior executive vice president, Engineering & Design Authority, Framatome.

2022, June, 17, 13:35:00

EUROPE WITHOUT RUSSIAN GAS

In the worst-case scenario where the Nord Stream pipeline to Germany is shut totally, Europe will fail to reach storage levels the European Union has ordered by the start of the heating season in November. And the region could run out of stocks completely by January.

2022, June, 17, 13:30:00

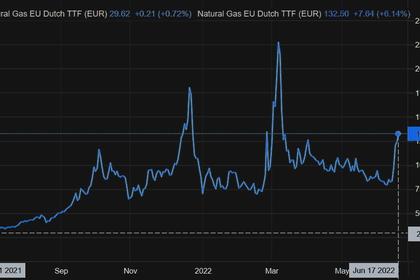

EUROPEAN GAS PRICES UP AGAIN

Eni SpA will receive just half of its requested gas volumes from Russia’s Gazprom PJSC on Friday, compared with about two-thirds the previous day.

2022, June, 17, 13:20:00

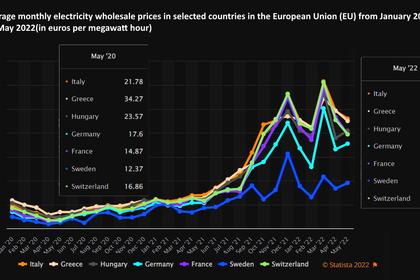

EUROPEAN SOLAR UP

The surge in electricity supply did little to ease rising prices that are being driven higher by climbing gas costs as Russia cuts some flows to Europe.

2022, June, 16, 12:50:00

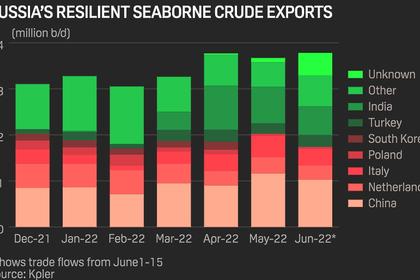

RUSSIAN OIL RESTORING

"We see that we have a fairly significant increase in June compared to May, up around 600,000 b/d," Novak said on the sidelines of the St Petersburg International Economic Forum,

2022, June, 16, 12:45:00

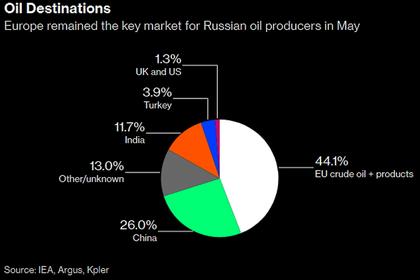

RUSSIAN OIL EXPORTS MAXIMUM

Compared to pre-war levels in January and February, Russia's shipped crude exports from June 1-15 rose by 576,000 b/d to average about 3.88 million b/d,

2022, June, 16, 12:35:00

EUROPEAN GAS PRICES UP ANEW

European nations have for months feared Russian supply cuts in retaliation for sanctions aimed at Moscow for its invasion of Ukraine.

2022, June, 16, 12:30:00

GAZPROM PRODUCTION DOWN

According to preliminary data, Gazprom produced 226 billion cubic meters of gas from January 1 through June 15, 2022. This is a decrease of 6.4 per cent (or 15.5 billion cubic meters) versus the same period of last year.

2022, June, 16, 12:25:00

BRITAIN'S NUCLEAR PROGRESS

The UK Department for Business, Energy & Industrial Strategy (BEIS) said on 14 June that the government had published documents which show significant progress towards implementing a new funding model which will give nuclear projects the financial support they need and attract private investment.

2022, June, 15, 14:50:00

RUSSIA'S OIL REVENUE UP BY $20 BLN

The decline in overall export volumes is mainly due to lower oil-product flows, while Russian crude shipped in May grew nearly by 500,000 barrels a day compared to the start of the year, mainly thanks to higher deliveries to Asia.

2022, June, 15, 14:40:00

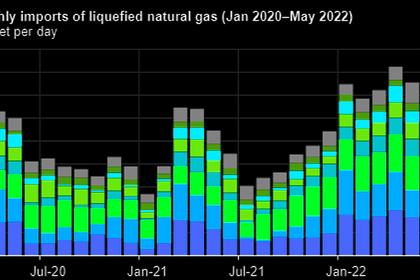

EUROPEAN LNG IMPORTS UP

From January through May 2022, LNG imports into the European Union and the United Kingdom averaged 14.9 Bcf/d, which is 5.9 Bcf/d (66%) more than the annual average in 2021 and 4.7 Bcf/d more than the pre-pandemic high of 10.3 Bcf/d in 2019

2022, June, 15, 14:20:00

EUROPE AGAINST NUCLEAR

There has been a split within the European Union over whether or not nuclear power - and natural gas - should be included as being "sustainable". Nuclear energy was left out of the initial Delegated Act pending further assessment.

2022, June, 14, 11:40:00

EUROPEAN GAS PRICES UP

Russian shipments through the Nord Stream pipeline to Germany are set to swing broadly on Tuesday, nominations show. The link is also scheduled to shut down July 11-21 for seasonal maintenance.