Regions

2017, November, 3, 12:30:00

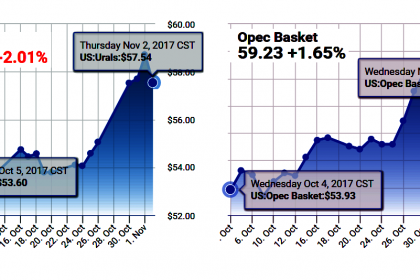

OPEC OIL PRICE: $58.49

OPEC daily basket price stood at $58.49 a barrel Thursday, 2 November 2017

2017, November, 3, 12:25:00

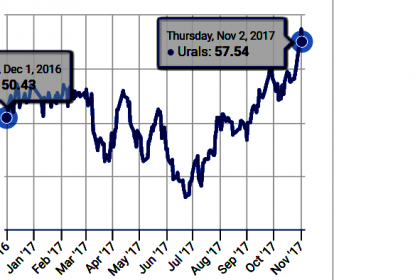

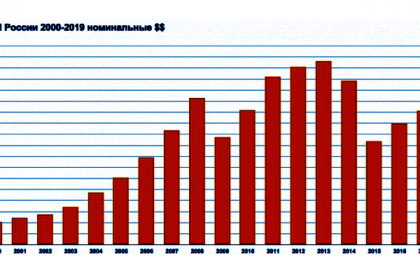

ЦЕНА URALS: $51,15

Средняя цена нефти марки Urals по итогам января – октября 2017 года составила $ 51,15 за баррель.

2017, November, 3, 12:20:00

СОТРУДНИЧЕСТВО РОССИИ И САУДОВСКОЙ АРАВИИ

По линии энергетики Министр отметил потенциал сотрудничества по вопросам совместной разработки нефтяных и газовых месторождений на территории России и Саудовской Аравии, производства нефтегазового оборудования, разработки и внедрения современных технологий в области нефтегазодобычи, а также подготовки кадров для топливно-энергетического сектора Саудовской Аравии.

2017, November, 1, 08:50:00

RUSSIA - IRAN NUCLEAR ENERGY

ROSATOM - On the 31st of October 2017, in the Bushehr Province (Iran) the work commissioning ceremony at the main building of power unit No. 2 of Bushehr NPP (Bushehr-2 project) was held.

2017, October, 27, 19:00:00

TRANSCANADA SELLS SOLAR $540 MLN

TransCanada Corporation has entered into an agreement to sell its Ontario solar portfolio comprised of eight facilities with a total generating capacity of 76 megawatts to Axium Infinity Solar LP, a subsidiary of Axium Infrastructure Canada II Limited Partnership, for approximately $540 million.

2017, October, 25, 12:25:00

OPEC COOPERATION

Compliance among OPEC and major non-OPEC producers reached 120% in September, its highest level since the output constraint deal was launched in January, the Joint Ministerial Monitoring Committee said.

2017, October, 25, 12:20:00

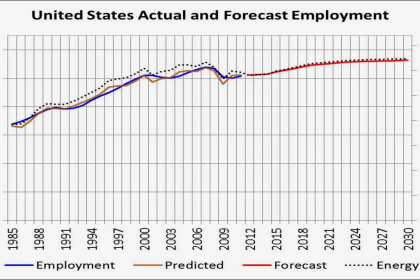

U.S. ECONOMY & EMPLOYMENT 2016 - 2026

Changing demographics in the population will have far-reaching effects on the labor force, the economy, and employment over the 2016–26 decade. The overall labor force participation rate is projected to decline as older workers leave the labor force, constraining economic growth. The aging baby-boomer segment of the population will drive demand for healthcare services and related occupations.

2017, October, 25, 12:15:00

RENEWABLE INVESTMENT $3.7 BLN

A group of private-equity investors led by New York-based Global Infrastructure Partners and China’s sovereign wealth fund will acquire a portfolio of Asian wind and solar energy projects from Singapore-based Equis Pte Ltd for $3.7bn.

2017, October, 25, 12:10:00

AUSTRALIAN OIL UP

The S&P/ASX 200 Energy index added 0.7 per cent, with Beach Energy – the recent buyer of Origin Energy’s conventional oil and gas business assets – up 2.8 per cent, Origin up 1.1 per cent and Caltex Australia up 1 per cent.

2017, October, 23, 11:40:00

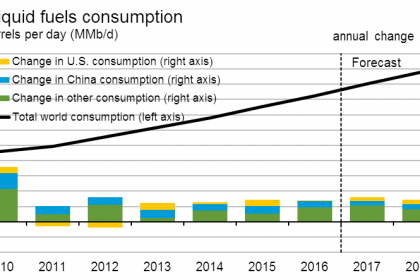

U.S. PETROLEUM DEMAND UP TO 2.4%

Total petroleum deliveries increased 2.4 percent from September 2016. These September deliveries were the highest September deliveries in a decade. For the third quarter 2017, total petroleum deliveries, a measure of U.S. petroleum demand, increased 2.1 percent from the same period last year to nearly 20.4 million barrels per day. For year to date 2017, total domestic petroleum deliveries increased 1.2 percent compared to the same period last year.

2017, October, 23, 11:35:00

ВЗАИМОДЕЙСТВИЕ РОССИИ И ТУРЦИИ

Александр Новак добавил, что растет доля расчетов в национальных валютах, реализуется ряд проектов в промышленной сфере, продолжается работа над нормативно-правовой базой, расширяется взаимодействие в энергетической сфере. «Флагманскими проектами в этой области являются газопровод «Турецкий поток» и АЭС «Аккую», - пояснил глава Минэнерго России.

2017, October, 23, 11:30:00

РОССИЯ: РОСТ КОНКУРЕНТОСПОСОБНОСТИ

Мы должны будем увидеть рост конкурентоспособности за счёт снижения себестоимости продукции, технологическое обновление в проблемных секторах, в том числе в жилищно-коммунальном хозяйстве. Достигнем заданных целей по Парижскому соглашению. И, конечно же, высвобождающиеся энергоресурсы будут способствовать дополнительному экономическому росту.

2017, October, 23, 11:25:00

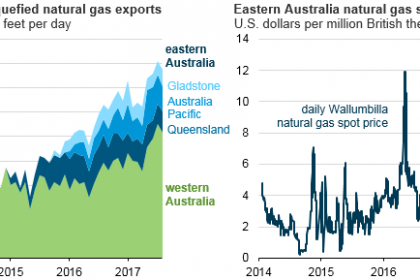

AUSTRALIAN LNG UP ANEW

Australia became the world’s second-largest exporter of liquefied natural gas (LNG) in 2015 and is likely to overtake Qatar as the world’s largest LNG exporter by 2019. As Australia’s LNG exports have increased, primarily from LNG projects in eastern Australia, the country has had natural gas supply shortages in eastern and southeastern Australia and an increase in domestic natural gas prices.

2017, October, 23, 11:20:00

U.S. DEFICIT - 2017: $666 BLN

U.S. Treasury Secretary Steven T. Mnuchin and Office of Management and Budget (OMB) Director Mick Mulvaney today released details of the fiscal year (FY) 2017 final budget results. The deficit in FY 2017 was $666 billion, $80 billion more than in the prior fiscal year, but $36 billion less than forecast in the FY 2018 Mid-Session Review (MSR). As a percentage of Gross Domestic Product (GDP), the deficit was 3.5 percent, 0.3 percentage point higher than the previous year.

2017, October, 23, 11:15:00

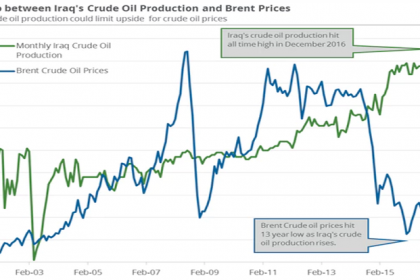

LIBYAN OIL PRODUCTION 1 MBD

Libya’s oil production increased steeply to the current level of 850,000 b/d from a low point in August 2016 of below 300,000 b/d. Production surpassed 1 million b/d in July.