Trends

2016, November, 22, 18:50:00

НОВАТЭК СПГ: БОЛЬШЕ $10 МЛРД.

«Новатэк» ожидает, что капитальные затраты на проект «Арктик СПГ – 2» на Гыданском полуострове превысят $10 млрд. Компания ведет предварительные работы по проектированию, мощность предприятия будет аналогична «Ямал СПГ» (16,5 млн т в год), запасы газа территории могут обеспечить поставки СПГ до 70 млн т в год, ресурсная база проекта – 1,2 трлн куб. м газа и 56,5 млн т жидких углеводородов по категории С1 + С2.

2016, November, 18, 18:50:00

OIL DEMAND 2040

Global oil demand won’t stop growing before 2040 despite pledges made at the Paris climate change summit last year to cap greenhouse-gas emissions.

2016, November, 11, 19:00:00

OIL PRODUCTION GROWTH

Supply growth from nations outside the OPEC will be “just shy” of 500,000 barrels a day, an increase of 110,000 barrels a day from the agency’s forecast last month, it said Thursday. Russian production is likely to grow by 190,000 barrels a day, building on a 230,000-barrel increase in 2016.

2016, November, 9, 19:10:00

OIL PRICES: $43 - $51

EIA expects Brent crude oil prices will average close to $48/ barrel (b) in the fourth quarter of 2016 and in the first quarter of 2017. Forecast Brent prices average $43/b in 2016 and $51/b in 2017. West Texas Intermediate (WTI) crude oil prices are forecast to average about $1/b less than Brent prices in 2017. The values of futures and options contracts indicate significant uncertainty in the price outlook, with NYMEX contract values for February 2017 delivery traded during the five-day period ending November 3 suggesting that a range from $35/b to $66/b encompasses the market expectation of WTI prices in February 2017 at the 95% confidence level.

2016, November, 8, 18:35:00

DEMAND WILL UP AGAIN

OPEC raised its outlook for oil use in 2018, 2019 and 2020, when it sees demand reaching 98.3 million barrels a day, or 900,000 more than the group projected in its previous annual outlook.

2016, November, 8, 18:30:00

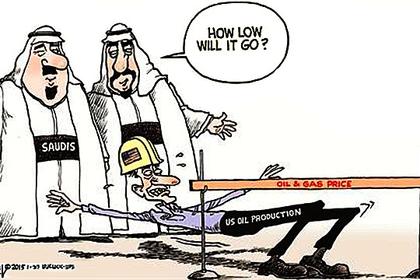

BOTTOM IS GOING

Oil producers would love to see higher prices, but OPEC so far has been unable to cut output.

In September, OPEC agreed to have a committee look at potentially cutting production to 32.5 million to 33 million barrels a day, shaving off 700,000 barrels a day — some 2 percent of overall production.

2016, October, 31, 19:05:00

НЕГАТИВНЫЕ НИЗКИЕ ЦЕНЫ

Негативное воздействие низких цен, проявившееся в серьезном сокращении инвестиций в нефтедобычу, будет продолжаться третий год подряд, что станет беспрецедентной ситуацией.

2016, October, 31, 18:50:00

DEEPWATER OIL UP

Global offshore oil production (including lease condensate and hydrocarbon gas liquids) from deepwater projects reached 9.3 million barrels per day (b/d) in 2015. Deepwater production, or production in water of depths greater than 125 meters, has increased 25% from nearly 7 million b/d a decade ago.

2016, October, 27, 18:50:00

GAZPROM - EU AGREEMENT

The state-controlled Russian energy group will yield to EU demands on how it sells gas in Europe in order to escape a penalty for past anti-competitive behaviour. The bargain is likely to anger eastern and Baltic states that have campaigned for a tougher approach.

2016, October, 25, 18:55:00

ПРАВИЛЬНОЕ РЕШЕНИЕ

«Самое сильное и продолжительное падение цен на рынке за последние 45 лет в условиях нехватки финансирования рискует обернуться дефицитом ресурсов, который приведет к непредсказуемым скачкам цен и в конечном счете сильно ударит по потребителям. В текущей ситуации «заморозка» или даже сокращение добычи на определенное время – правильное решение для мировой энергетики», – подчеркнул Александр Новак.

2016, October, 24, 18:50:00

МЕДЛЕННОЕ ВОССТАНОВЛЕНИЕ РЫНКА

«Сегодня у нас есть общее понимание, что рынок восстанавливается медленно, инвестиции в отрасль находятся на рекордно низком уровне, запасы существенно превышают средние значения за пять лет. Мы видим целесообразность принятия мер для балансировки рынка в ближайшие месяцы с целью возврата инвестиций и снижения волатильности», - отметил Александр Новак, выступая на пресс-конференции по итогам переговоров.

2016, October, 24, 18:30:00

INDIA'S LNG IMPORTS UP 33%

For the April-September period, India’s LNG imports were 12.7bn m³, up almost by 27% on year.

2016, October, 21, 18:45:00

RUSSIAN OIL&GAS INVESTMENT

However, Russian oil and natural gas companies’ capital investment programs have been less affected, if at all.

2016, October, 21, 18:40:00

SAUDI'S OIL RECORD

The economic consequences of cheap oil have been severe for Saudi Arabia. Riyadh is burning through foreign-exchange reserves, government contractors have gone unpaid, and civil servants, who make up two-thirds of the labor force, will get no bonus this year. The country’s fiscal deficit is more than 10 percent of gross domestic product, the highest ratio of any Group of 20 nation. The International Monetary Fund forecasts that Saudi economic growth will slow to about 1 percent next year, the worst since 2009. A few banks predict a recession.

2016, October, 21, 08:20:00

RUSSIAN - INDIAN NUCLEAR

ROSATOM - "Historically, India is one of our key foreign partners. Two power units of Russian design are already operating on the Kudankulam NPP site and two more are under construction. To increase the state corporation's market presence, it was decided to open a regional center in Mumbai. This will enable us to join forces with our Indian partners and enhance the performance of Russian nuclear enterprises operating in India," said Aleksey Pimenov, the Regional President of Rosatom South Asia.