Trends

2016, January, 19, 20:20:00

OIL MARKET COULD DROWN

In a stark assessment of the oil market, the International Energy Agency warned of an oil overhang of at least 1m barrels a day for a third consecutive year in 2016.

2016, January, 19, 20:15:00

OIL INVESTMENT'S COLLAPSE

The impact is not confined to the United States. Oil and gas projects around the world worth $380 billion have been postponed or canceled since 2014.

2016, January, 19, 20:10:00

OPEC SEES MORE

Demand for OPEC's oil will rise to an average 31.65 million b/d in 2016, from 29.90 million b/d in 2015, the producer group said in its latest monthly report.

2016, January, 19, 20:05:00

PRICES TAKES SOME TIME

“I am optimistic about the future, the return of stability to the global oil markets, the improvement of prices and the cooperation among the major producing countries,” al-Naimi said. “Market forces as well as the cooperation among producing nations always lead to the restoration of stability. This, however, takes some time.”

2016, January, 17, 15:15:00

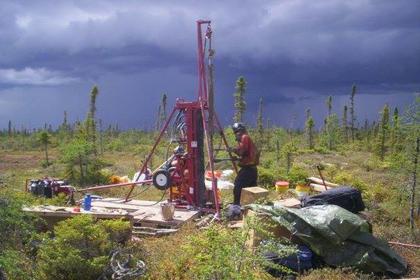

CANADA'S LONG-TERM EFFECTIVENESS

"We're playing close attention to the price of oil, and of course that has an important impact on the Canadian dollar, which we're also paying close attention to. In that context, we know that it's doubly important that we think about how we can make investments that have an impact on the economy ... and also think about how we can improve our long-term effectiveness as a country and to increase our long-term rate of growth."

2016, January, 15, 20:20:00

WEAK US INDUSTRY

The slowdown has been rapid. As recently as a year ago, US manufacturing production was growing at an annual rate of 4.5 per cent, says Chad Moutray, chief economist for the National Association of Manufacturers. By November that had slowed to 0.9 per cent and this year Mr Moutray expects production to grow just 1.4 per cent.

2016, January, 15, 20:05:00

OIL COMPANIES ROUT

“Companies have to be prudent in the face of what’s happening,” says Daniel Yergin, vice-chairman of consultancy IHS. “It’s a wrenching period for the industry.”

2016, January, 10, 18:30:00

GLOBAL GAS CHALLENGES

“The advent of [more sellers of] LNG is another challenge of the gas market,” Adeli said and noted that the U.S. has utilised modern technologies to produce gas from shale, so that the country has been turned from a gas importer to an exporter. Australia, another OECD country with no interest in joining organisations that could be seen as cartels, is already an LNG exporter and its output is rising sharply over the coming few years.

2016, January, 10, 17:55:00

OIL SERVICE'S CAP

Even if E&P clients are able to negotiate more favorable terms for their debt, the industry’s overextended balance sheets will put a cap on activity — even if oil prices rise. On the producer side, companies will most likely de-lever before they drill should some extra cash come in the door. For OFS, building all the new equipment such as walking rigs and big frac spreads to meet strong client demand has some players in this sector significantly over-levered.

2015, December, 31, 13:55:00

SAUDI: GORILLA IN THE ROOM

“The 800-lb. gorilla in the room, and by that I mean Saudi Arabia, showed it’s power,” said John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy. “They are on a mission to squeeze out the high-priced producers and aren’t done yet. Things could get very ugly in the second and third quarters for countries like Venezuela and Nigeria and for U.S. exploration companies.”

2015, December, 31, 13:45:00

BLEAK OIL PRICES

The immediate outlook for oil prices remains bleak, with some analysts like Goldman Sachs saying prices as low as $20 per barrel might be necessary to push enough production out of business and allow a rebalancing of the market.

2015, December, 31, 13:40:00

2016: OIL PRICES UPDOWN

The latest Reuters survey of 31 analysts showed an average price forecast for Brent for next year at $57.95 a barrel, more than $20 above current prompt market values.

2015, December, 29, 20:00:00

2016: OIL MARKETS BALANCE

“We see the market balancing some time in 2016. We see demand ultimately exceeding supply...Prices in due course will respond,” he said.

2015, December, 29, 19:55:00

2016 WILL BE WORSE

For oil and gas producers, 2016 will be a year of cost-cutting, restructuring, refinancing when it is possible, and in some cases bankruptcy when it is not. Merger and acquisition activity, which was sluggish this year because of disagreements over valuations, may pick up speed.

2015, December, 29, 19:45:00

SAUDI CUTS & RAISES

Government ran a record deficit of nearly 367 billion Saudi riyals ($98 billion) this year, or about 15% of gross domestic product, as low oil prices suppressed revenue, pushing it to cut planned spending by 14% in 2016 amid expectations that income from oil sales will remain under pressure.