Trends

2024, February, 7, 06:40:00

INDIA NEED COAL ENERGY

India is already exploring coal gasification, for which it is setting aside 85 billion rupees ($1 billion) in subsidies to help get projects off the ground. The early-stage technology, which turns coal into gas to generate electricity, results in marginally lower emissions compared to conventional coal firing.

2024, February, 7, 06:35:00

ДОХОДЫ РОССИИ + 195,4 МЛРД. РУБ.

Ожидаемый объем дополнительных нефтегазовых доходов федерального бюджета прогнозируется в феврале 2024 года в размере 195,4 млрд руб.

2024, February, 2, 07:00:00

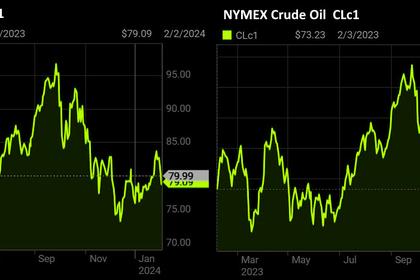

OIL PRICE: BRENT NEAR $79, WTI NEAR $74

Brent climbed 37 cents, or 0.5%, to $79.07 a barrel, WTI gained 30 cents, or 0.4%, to $74.12 a barrel.

2024, February, 2, 06:55:00

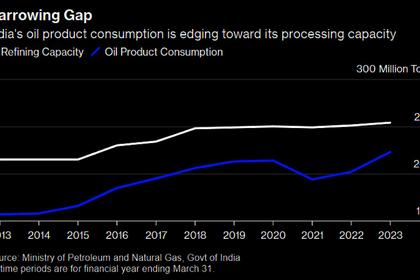

INDIA NEED OIL REFINING

India’s refining capacity is projected to increase by 56 million tons by 2028, Junior Oil Minister Rameswar Teli said last month, without elaborating. That equates to an overall capacity boost of 22%, or 1.12 million barrels a day.

2024, February, 2, 06:50:00

INDIA NEED MORE COAL

India recorded a peak electricity demand of 243 gigawatts last year, exceeding the power ministry’s projections of 229 gigawatts and prompting the ministry to push for more coal power. Maximum demand is expected to jump to 366 gigawatts by 2032.

2024, January, 29, 07:00:00

OIL PRICE: BRENT NEAR $84, WTI ABOVE $78

Brent rose 29 cents, or 0.4%, to $83.84 a barrel, WTI gained 34 cents, or 0.4%, to $78.35 a barrel.

2024, January, 29, 06:45:00

RUSSIAN URANIUM PRODUCTION EXTENSION

According to World Nuclear Association information, Russia produced 2508 tU in 2022, making it the sixth largest producer of uranium in the world, while Russian reactor requirements for 2023 were estimated at 6284 tU.

2024, January, 29, 06:25:00

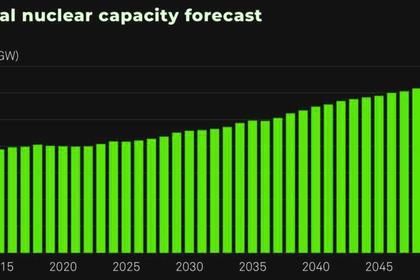

GLOBAL NUCLEAR RECORD

While global growth in electricity demand eased slightly to 2.2% in 2023 due to falling electricity consumption in advanced economies, it is projected to accelerate to an average of 3.4% from 2024 through to 2026.

2024, January, 29, 06:15:00

U.S. ARTIFICIAL INTELLIGENCE

Divided into four operational areas—NAIRR Open, NAIRR Secure, NAIRR Software, and NAIRR Classroom—the NAIRR pilot is bringing private sector, non-profit and philanthropic organizations, industry partners, and nine Federal agencies together to provide access to advanced computing, datasets, models, software, training, and user support to U.S. based researchers and educators.

2024, January, 24, 07:00:00

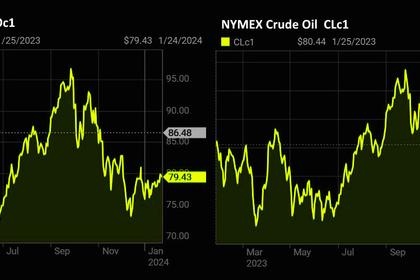

OIL PRICE: BRENT ABOVE $79, WTI ABOVE $74

Brent dipped 14 cents, or 0.1%, to $79.41 a barrel, WTI ticked down 11 cents, or 0.2%, to $74.26 a barrel.

2024, January, 24, 06:50:00

RUSSIAN OIL EXPORTS CONTINUING

Naphtha and fuel oil are loaded onto Clearocean Apollon Clyde Noble tankers at the nearby Ust-Luga Oil terminal.

2024, January, 24, 06:40:00

U.S., RUSSIA OIL SANCTIONS

In the last few months of 2023, the US ramped up enforcement of the price cap and imposed multiple rounds of sanctions on entities and ships that carried Russian crude oil above the price cap.

2024, January, 24, 06:30:00

GLOBAL NUCLEAR POWER SUPPORT

The survey found that, across the 20 countries surveyed, 28% of respondents oppose the use of nuclear energy while 46% support it. Of the 20 countries surveyed, 17 have net support for nuclear energy's use. Support was found to be more than three times higher than opposition in the world's two most populated countries, China and India.

2024, January, 24, 06:25:00

BRITAIN'S NUCLEAR INVESTMENT $1.7 BLN

Currently, about 15% of Britain's energy needs are met by nuclear power, a drop from 27% in the 1990s as older plants have been decommissioned and new ones are taking time to build.

2024, January, 22, 07:00:00

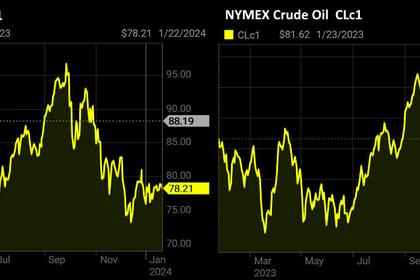

OIL PRICE: BRENT ABOVE $78, WTI ABOVE $73

Brent fell 9 cents, or 0.1%, to $78.47 a barrel, WTI inched up 11 cents to $73.52 a barrel.