All publications by tag «PETROBRAS»

2021, April, 13, 12:50:00

PETROBRAS REIMBURSEMENT $6.5 BLN

Under terms of the latest agreement, Petrobras will receive $3.253 billion and own a 39.5% operating stake in the Atapu Field, which pumped first oil in June 2020.

2021, March, 18, 12:00:00

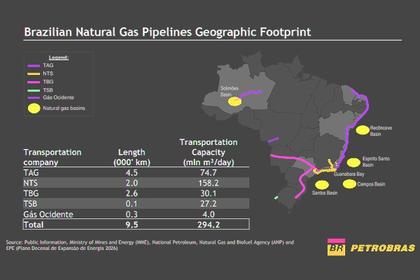

BRAZIL OPENS GAS MARKET

Gas distribution and the operation of gas pipelines will switch from a concession regime to a regime of authorizations granted by the oil and gas regulator ANP.

2020, June, 3, 12:40:00

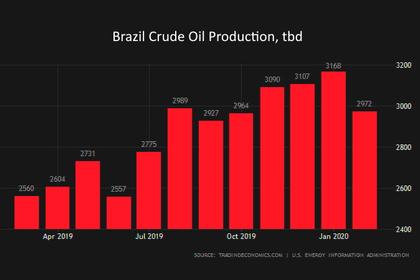

BRAZIL'S PETROLEUM PRODUCTION 3.7 MBD

Companies operating in Brazil pumped 3.738 million b/d of oil equivalent in April

2020, February, 21, 11:45:00

PETROBRAS NET INCOME $10.2 BLN

Petrobras highlights of the 2019 result:

- Adjusted EBITDA was US$ 32.7billion, an increase of 3.8% in relation to 2018, due to lower production costs and lower contingencies.

- Net income reached US$ 10.2 billion, mainly reflecting gains with asset sales.

- The adjusted net debt / LTM Adjusted EBITDA ratio increased to 2.41x, applying the effects of IFRS 16, from 2.20x in 2018. Once these effects were eliminated, the index would have been 1.95x.

- The remuneration to shareholders in the form of dividends and interest on capital was R$ 10.6 billion, equivalent to R$ 0.73 per common andR$ 0.92 per preferred share in circulation.

2019, October, 21, 13:05:00

PETROBRAS PRODUCTION UP 16.5%

Petrobras, which has been was completing the installation of seven new floating production units, produced 2.794 million b/d of oil equivalent in the third quarter from domestic fields. Oil and gas output was up 9.5% from the second quarter.

2019, August, 26, 15:05:00

PETROBRAS RATING BA2

Moody's Investors Service (Moody's) affirmed the Ba2 corporate family rating of Petroleo Brasileiro S.A. - PETROBRAS (Petrobras). Simultaneously, Moody's raised the company's baseline credit assessment (BCA) to ba2 from ba3. The actions were triggered by the company's continued success in improving its credit metrics and liquidity position. The rating outlook is stable.

2019, August, 5, 13:10:00

PETROBRAS NET INCOME $1.3 BLN

Accounting net income excluding non-recurring factors was US$ 1.3 billion and operating cash flow reached US$ 5.2 billion. Advances in pre-salt exploration, with lower lifting cost (US$ 6/boe) and better quality of oil, allowed adjusted EBITDA per barrel of oil equivalent (boe) in the exploration & production (E&P) business to reach US$ 33.50 in 2Q19 against US$ 29.50 last year, despite the drop in average Brent oil prices from US$ 71.0 to US$ 68.8.

2019, April, 8, 11:15:00

GAS PIPELINE FOR BRAZIL $8.6 BLN

REUTERS - A consortium led by French utility Engie has won a bid for Petrobras’ TAG pipeline arm with an $8.6 billion offer, in a deal that boosts Engie’s presence in a fast-growing sector and will help Petrobras cut its debts.

2019, March, 20, 10:05:00

PETROBRAS WILL SELL $10 BLN

Brazilian state-led oil producer and refiner Petrobras expects to ramp up its divestments in the near term, with a series of deals expected to close by the end of April, according to Chief Executive Roberto Castello Branco.

2019, March, 13, 10:40:00

PETROBRAS NET INCOME $7.17 BLN

Net income in 2018 was US$ 7,173 million, equivalent to US$ 0.55 EPS, reflecting higher operating income and improved financial results, due to lower interest expenses as a result of lower indebtedness and gains due to the renegotiation of debts of the electric sector.