M&A

2023, October, 13, 06:40:00

FRANCE'S NUCLEAR VETOES

Economy Minister Bruno Le Maire faced a difficult decision between maintaining France as an attractive investment destination and maintaining sovereignty over strategic technology, but finally decided to veto the takeover.

2023, June, 30, 06:20:00

ENI ACQUIRE NEPTUN FOR $4.9 BLN

Under the terms of the deal announced on Friday, Eni will acquire Neptune for $2.6bn, while Vår Energi — Eni’s Norwegian listed subsidiary — will acquire the company’s operations in Norway for $2.3bn.

2023, February, 17, 10:40:00

AUSTRALIAN WIND PROJECT 10 GW

The wind project is currently under development near the Port of Newcastle and will be situated in proximity of energy transmission infrastructure.

2022, October, 13, 12:40:00

WESTINGHOUSE ACQUISITION $8 BLN

Brookfield Renewable, together with its institutional partners, will own a 51% interest in Westinghouse and Cameco will own 49%. Closing of the transaction is expected in the second half of 2023, subject to certain conditions, including approval from Brookfield Business Partners unit holders and regulatory approvals.

2022, October, 7, 10:05:00

FRANCE TAKEOVER EDF €9.7 BLN

To take the group private, the French government will spend €9.7bn, including transaction costs.

2022, February, 8, 13:40:00

AUSTRALIA'S RENEWABLE 1.6 GW

RES has acquired Blueshore, an asset management business with 1.6 GW of renewable projects under management in Australia.

2021, November, 18, 13:00:00

ROSNEFT, SHELL DEAL

Rosneft exercised the pre-emption right for 37.5% share of the PCK (Schwedt) refinery from Shell.

2021, November, 11, 14:40:00

MAERSK, NOBLE COMBINATION

Noble and Maersk shareholders will each hold 50% in the combined entity, which will be named Noble Corp. with headquarters in Houston.

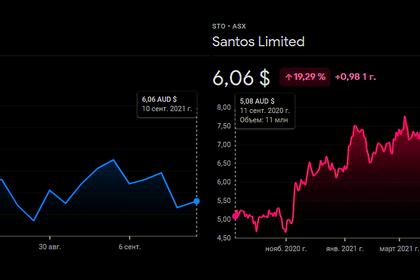

2021, September, 13, 12:10:00

AUSTRALIA'S SANTOS MERGE

The Merger creates a regional champion of size and scale, with a pro-forma market capitalisation of approximately A$21 billion

2021, August, 4, 12:10:00

AUSTRALIA'S SANTOS, OIL SEARCH MERGER A$21 BLN

Pro-forma market capitalisation of A$21 billion which would position the merged entity in the top-20 ASX-listed companies and the 20 largest global oil and gas companies

2021, July, 30, 08:05:00

CHINA, CHILE GRID

CGE is one of the largest electricity distribution companies in Chile and supplies electricity to 45% of the country's households.

2021, June, 22, 12:00:00

ARAMCO DEAL $12.4 BLN

Aramco and an international investor consortium, including EIG and Mubadala, today announced the successful closing of the share sale and purchase agreement, in which the consortium has acquired a 49% stake in Aramco Oil Pipelines Company, a subsidiary of Aramco, for $12.4 billion.

2021, February, 3, 12:05:00

EQUINOR, BP WIND PARTNERSHIP $1.1BLN

The two companies will also establish a strategic partnership in the US offshore wind sector, seeking new opportunities.

2021, January, 21, 14:00:00

AKER, MAINSTREAM ACQUISITION €900 MLN

Mainstream Renewable Power is the largest independent developer in Chile and has significant assets in Africa.

2021, January, 14, 13:55:00

U.S. SHALE ACQUISITION $4.5 BLN

Pioneer Natural Resources has completed the acquisition of Parsley Energy following stockholder approvals.