M&A

2020, May, 19, 11:55:00

OIL&GAS INDUSTRY: THE NEXT TRANSFORMATION

To change the current paradigm, the industry will need to dig deep and tap its proud history of bold structural moves, innovation, and safe and profitable operations in the toughest conditions. The winners will be those that use this crisis to boldly reposition their portfolios and transform their operating models. Companies that don’t will restructure or inevitably atrophy.

2020, May, 18, 08:45:00

CHINA, EUROPE ACQUISITIONS

“We have to see that Chinese companies, partly with the support of state funds, are increasingly trying to buy up European companies that are cheap to acquire or that got into economic difficulties due to the coronavirus crisis,”

2020, April, 27, 12:10:00

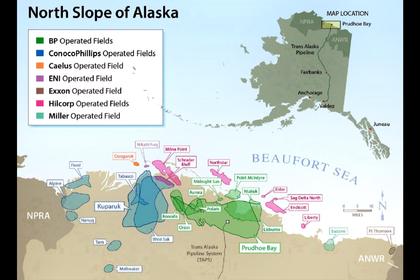

BP, HILCORP DEAL $5.6 BLN

The original agreement provided for Hilcorp to pay $4.0 billion near-term and $1.6 billion through an earnout thereafter.

2020, March, 30, 09:55:00

ROSNEFT SELLS VENEZUELA'S ASSETS

Rosneft entered into an agreement with a company 100%-owned by the Russian government on the sale of shares and termination of its participation in all projects in Venezuela,

2020, March, 26, 11:15:00

MUBADALA, OMV AGREEMENT $4.68 BLN

OMV, which currently owns a 36 percent stake in Borealis, will acquire an additional 39 percent from Mubadala.

The transaction value amounts to $4.68 billion and represents the biggest acquisition in OMV’s history and the largest transaction ever for Mubadala.

2020, March, 9, 14:45:00

GAZPROM, OMV NEGOTIATIONS

Gazprom, OMV have agreed, inter alia, to extend until June 2022 the negotiations for the final agreement on the deal.

2019, December, 18, 12:25:00

ARAMCO'S INVESTMENT FOR HYUNDAI $1.2 BLN

Saudi Arabian Oil Company (Saudi Aramco) has completed, through its subsidiary Aramco Overseas Company B.V. (AOC), the acquisition of 17% of Hyundai Oilbank from Hyundai Heavy Industries Holdings, for approximately US$1.2 Billion. The completion follows receipt of all necessary regulatory consents and approvals.

2019, November, 25, 13:20:00

GAZPROM SOLD SHARE 3.59%, $3 BLN

Gazprom Gazoraspredeleniye, a company controlled by Gazprom, successfully completed the sale of 850,590,751 ordinary shares of Gazprom (3.59 per cent of the share capital).

2019, November, 25, 13:10:00

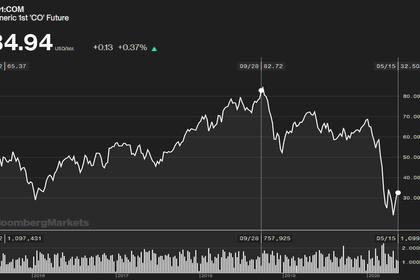

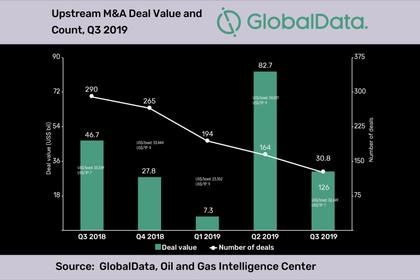

OIL, GAS UPSTREAM M&A: $63.4 BLN

One of the top capital raising deals of Q3 2019 was Petroleos Mexicanos’ public offering of notes for gross proceeds of $7.5bn.

2019, November, 25, 12:30:00

MITSUBISHI, ENECO ACQUISITION $4.52 BLN

Under the terms of the deal, Mitsubishi will own 80% of Eneco and partner Chubu 20%.

2019, October, 14, 13:30:00

SANTOS, CONOCOPHILLIPS ACQUISITION $1.39 BLN

Acquisition of ConocoPhillips’ northern Australia business with operating interests in Darwin LNG, Bayu-Undan, Barossa and Poseidon for US$1.39 billion plus a

$75 million contingent payment subject to FID on Barossa

2019, October, 2, 11:40:00

U.S., CHINA LNG INVESTMENT: $3.59 BLN

Parent company Sempra Energy also announced an agreement to sell an 83.6% stake in the Peruvian Luz del Sur for $3.59 billion in cash to China Yangtze Power International, or CYP, a subsidiary of CTG, a company statement showed.

2019, August, 28, 12:10:00

BP SELLS ALASKA FOR $5.6 BLN

BP announced that it has agreed to sell its entire business in Alaska to Hilcorp Alaska, based in Anchorage, Alaska. Under the terms of the agreement, Hilcorp will purchase all of BP's interests in the state for a total consideration of $5.6 billion.

2019, August, 12, 12:45:00

ARAMCO, RELIANCE DEAL 20%

Aramco signed a letter of intent to take a 20% stake in Reliance’s oil-to-chemicals business in one of the largest ever foreign investments in India, Reliance announced.

2019, August, 9, 13:00:00

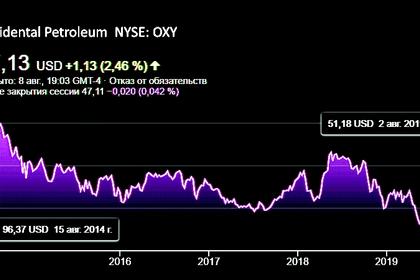

OCCIDENTAL, ANADARKO TRANSACTION: $55 BLN

Occidental Petroleum Corporation ("Occidental" or "the Company") (NYSE: OXY) today announced the successful completion of its acquisition of Anadarko Petroleum Corporation ("Anadarko") (NYSE: APC) in a transaction valued at $55 billion, including the assumption of Anadarko’s debt.