M&A

2019, May, 31, 12:00:00

ITACHA ACQUIRE CHEVRON $2 BLN

Ithaca Energy Ltd., a subsidiary of Delek Group Ltd., will acquire Chevron North Sea Ltd. (CNSL) for $2 billion, adding 10 producing field interests to Ithaca’s existing portfolio, four of which relate to assets operated by Ithaca.

2019, May, 27, 11:30:00

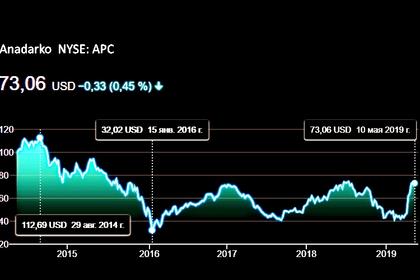

ALGERIA STOP TOTAL

Algeria will block Total from acquiring Anadarko's assets in Algeria, energy minister Mohamed Arkab told reporters on a sidelines of a conference on Sunday.

2019, May, 13, 11:55:00

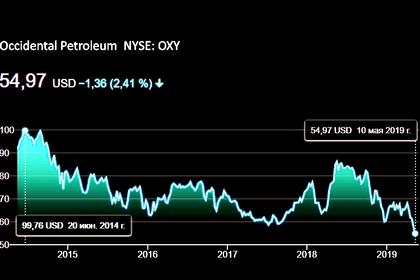

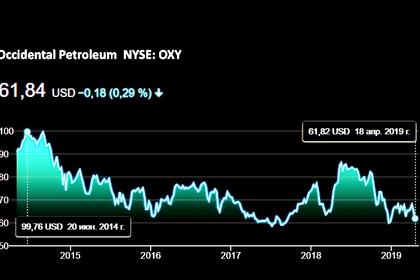

OCCIDENTAL, ANADARKO DEAL: $57 BLN

Occidental ("Occidental" or "the Company") (NYSE: OXY) ) today entered into a definitive agreement whereby Occidental will acquire Anadarko Petroleum Corporation ("Anadarko") (NYSE: APC) for $59.00 in cash and 0.2934 shares of Occidental common stock per share of Anadarko common stock, in a transaction valued at $57 billion, including the assumption of Anadarko's debt.

2019, May, 13, 11:50:00

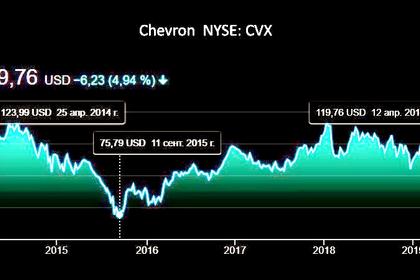

CHEVRON, ANADARKO: NO COUNTERPROPOSAL

Chevron Corporation (NYSE: CVX) announced that, under the terms of its previously announced Merger Agreement with Anadarko Petroleum Corporation (NYSE: APC), it will not make a counterproposal and will allow the four-day match period to expire. Accordingly, Chevron anticipates that Anadarko will terminate the Merger Agreement.

2019, May, 8, 11:20:00

OCCIDENTAL SALES $8.8 BLN

Occidental Petroleum Corp agreed to sell Anadarko's Algeria, Ghana, Mozambique and South Africa assets to Total SA for $8.8 billion.

2019, April, 26, 10:25:00

OCCIDENTAL, ANADARKO MERGER $57 BLN

Occidental Petroleum made a new $57 billion offer for Anadarko

2019, April, 15, 11:55:00

CHEVRON BUYS ANADARKO FOR $50 BLN

Chevron Corporation (NYSE: CVX) announced that it has entered into a definitive agreement with Anadarko Petroleum Corporation (NYSE: APC) to acquire all of the outstanding shares of Anadarko in a stock and cash transaction valued at $33 billion, or $65 per share. Based on Chevron’s closing price on April 11th, 2019 and under the terms of the agreement, Anadarko shareholders will receive 0.3869 shares of Chevron and $16.25 in cash for each Anadarko share. The total enterprise value of the transaction is $50 billion.

2019, March, 29, 11:30:00

SAUDI ARAMCO PAYS $69.1 BLN

Saudi Aramco announced the signing of a share purchase agreement to acquire a 70% majority stake in Saudi Basic Industries Corporation (SABIC) from the Public Investment Fund of Saudi Arabia, in a private transaction for $69.1bn.

2019, March, 29, 10:45:00

EnBW RENEWABLE INVESTMENT $13.5 BLN

EnBW on Thursday unveiled a 12-billion euro ($13.5 billion) investment plan and said it was close to acquiring French renewable group Valeco, as the German utility continues its strategy of moving away from fossil fuels.

2019, March, 27, 11:20:00

ENEL ACQUIRED RENEWABLE $900 MLN

Enel acquired 650 MW of renewable capacity from its U.S. joint venture EGPNA REP

2019, March, 22, 09:45:00

WINTERSHALL WILL BE THE LARGEST

Germany's Wintershall -- which is set to complete its merger with upstream company DEA by the end of June -- plans to expand its projects in Russia, which will remain its core production region post-merger, its CEO Mario Mehren said Thursday.

2019, January, 16, 10:50:00

PGGM, SHELL ACQUISITION OF ENECO

SHELL - PGGM and Shell have joined forces to explore the opportunity to participate in the controlled auction for the sustainable energy provider Eneco. In December 2018 Eneco and its shareholders’ committee announced the start of the privatisation process.

2018, November, 14, 11:35:00

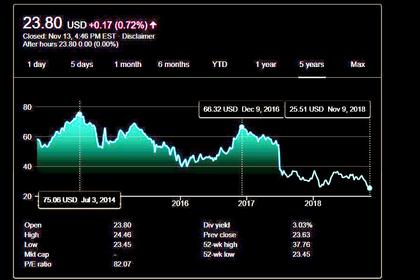

BHGE, GE MAXIMIZES VALUE

GE - Baker Hughes, a GE company and General Electric Company Announce a Series of Long-Term Agreements to Maximize Value for Both BHGE and GE

2018, November, 2, 11:45:00

BP - BHP ACQUISITION: $10.5 BLN

BP - BP has completed the $10.5 billion acquisition of BHP’s U.S. unconventional assets in a landmark deal that will significantly upgrade BP’s U.S. onshore oil and gas portfolio and help drive long-term growth.

2018, October, 31, 13:15:00

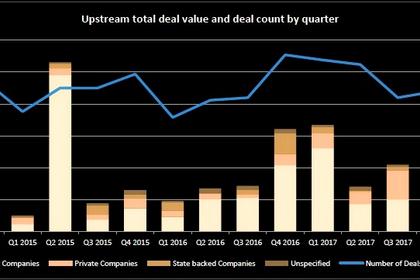

OIL & GAS CONSOLIDATION

PLATTS - Consolidation through the oil and gas sector is heating up, spurred in many cases by too many small companies, lack of operator scale, profits and in the oilfield services segment, an inability to raise prices after the recent downturn, industry executives said