M&A

2020, December, 24, 13:20:00

CHINA'S ENERGY SECURITY $6.3 BLN

China Oil & Gas Pipeline Network Corp. is part of an effort by President Xi Jinping’s government to consolidate the nation’s major pipelines and other midstream facilities into a single firm, intended to boost competition among drillers and downstream oil and gas sellers. The entity officially started operations in October.

2020, December, 14, 12:20:00

СДЕЛКА РОСНЕФТИ, EQUINOR $550 МЛН.

ПАО «НК «Роснефть» и Equinor закрыли сделку, в результате которой норвежская компания приобретает 49% ООО «КрасГеоНац».

2020, December, 3, 11:40:00

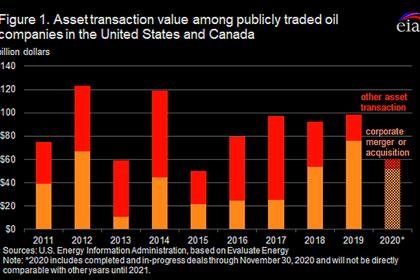

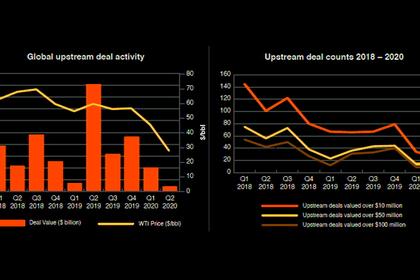

U.S. OIL, GAS M&A

Including completed and announced deals in progress through November 30, asset transactions in the United States and Canada totaled $60 billion,

2020, October, 26, 14:00:00

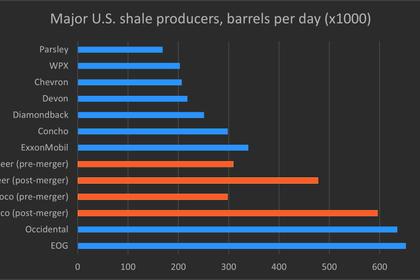

U.S. SHALE SURVIVORS

The sector is in full-on merger mode in response to oil prices that have been stuck at around $40 a barrel in recent months after the Covid-19 pandemic hit global demand.

2020, October, 22, 14:45:00

IBERDROLA, PNM ACQUISITION $8.3 BLN

The Spanish energy group Iberdrola, through its affiliate Avangrid, has acquired PNM Resources, the power utility of New Mexico and Texas, for a total consideration of US$8.3bn.

2020, October, 22, 14:40:00

PIONEER, PARSLEY ACQUISITION $7.6 BLN

US shale producer Pioneer Natural Resources has entered into a definitive agreement to acquire its peer Parsley Energy

2020, October, 20, 15:15:00

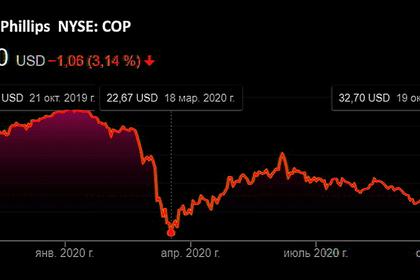

CONOCOPHILLIPS, CONCHO RESOURCES ACQUISITION $9.7 BLN

ConocoPhillips (NYSE: COP) and Concho Resources (NYSE: CXO) announced that they have entered into a definitive agreement to combine companies in an all-stock transaction.

2020, October, 9, 11:50:00

TOTAL BUYS WIND

To be installed in the Mediterranean, off the coast of Gruissan in Aude department, EolMed is one of four floating wind projects awarded by the French state in 2016.

2020, October, 8, 12:35:00

CHINA MERGES COAL

In 2019, China was the largest coal producer in the world, with an output of 3,691 Mt, followed by India (769 Mt) and the United States (640 Mt).

2020, October, 6, 15:15:00

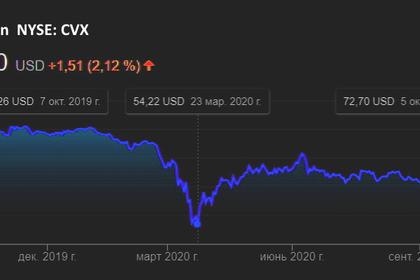

NOBLE, CHEVRON DEAL $4.2 BLN

Noble Energy shareholders have approved a deal to sell the oil and gas producer to Chevron Corp, making Chevron the No. 2 U.S. shale oil producer and giving it international natural gas reserves close to growing markets.

2020, August, 10, 11:25:00

OIL, GAS M&A

The top country in terms of M&A deals activity in Q2 2020 was the US with 83 deals, followed by China with 33 and Canada with 21.

2020, August, 7, 13:20:00

IBERDROLA BOUGHT RENEWABLE INFIGEN

Spanish energy group Iberdrola has taken over Australian renewable producer Infigen Energy

2020, July, 27, 15:35:00

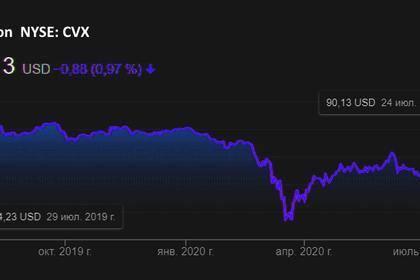

CHEVRON BUY NOBLE $5 BLN

Chevron Corporation (NYSE: CVX) announced today that it has entered into a definitive agreement with Noble Energy, Inc. (NASDAQ: NBL) to acquire all of the outstanding shares of Noble Energy in an all-stock transaction valued at $5 billion, or $10.38 per share.

2020, June, 16, 13:30:00

ARAMCO, SABIC ACQUISITION $69 BLN

Aramco had been looking to restructure the deal after SABIC’s market value fell more than 40% due to an oil price slump.

2020, May, 26, 10:15:00

TC ENERGY SELLS $2.1 BLN

TC Energy Corporation has completed the sale of a 65 per cent equity interest in the Coastal GasLink Pipeline Project