M&A

2018, October, 29, 12:10:00

WINTERSHALL IPO

PLATTS - In September 27, 2018, BASF signed a transaction agreement with LetterOne to merge their respective oil and gas businesses, Wintershall and DEA, into a joint venture.

2018, October, 19, 10:35:00

MEG & HUSKY TAKEOVER: $2.3 BLN

BLOOMBERG - MEG Energy Corp. said Wednesday it had rejected a C$3 billion ($2.3 billion) hostile takeover by Husky Energy Inc. and plans to launch a strategic review with an eye to finding another buyer.

2018, October, 19, 10:30:00

SHELL SELLS $1.9 BLN

SHELL - Royal Dutch Shell plc (Shell), through its affiliate Shell Overseas Holdings Limited, has reached an agreement with publicly listed Norwegian Energy Company ASA (Noreco), to sell its shares in Shell Olie-og Gasudvinding Danmark B.V. (SOGU) for a consideration amount of $1.9 billion. SOGU is a wholly-owned Shell subsidiary that holds a 36.8% non-operating interest in the Danish Underground Consortium (DUC).

2018, October, 10, 07:30:00

BHGE ACCURES 5% IN ADNOC: $11 BLN

BHGE - BHGE will acquire a five percent stake in ADNOC Drilling. The transaction values ADNOC Drilling at approximately $11 billion.

2018, October, 4, 14:35:00

СОГЛАШЕНИЕ ГАЗПРОМА И OMV

ГАЗПРОМ - 3 октября в Санкт-Петербурге Председатель Правления ПАО «Газпром» Алексей Миллер и Председатель Правления OMV AG Райнер Зеле подписали Основополагающее соглашение о продаже активов.

2018, October, 3, 08:15:00

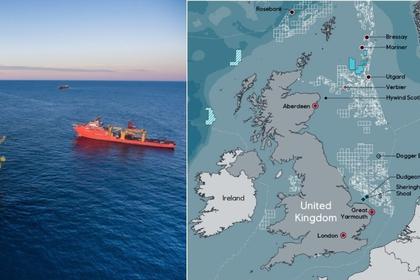

EQUINOR ACQURIES 40%

EQUINOR - Equinor has signed an agreement to acquire Chevron’s 40% operated interest in the Rosebank project, one of the largest undeveloped fields on the UK Continental Shelf (UKCS).

2018, October, 1, 11:10:00

WINTERSHALL & LETTERONE MERGER

MEOG - Chemicals company BASF and investment company LetterOne signed a transaction agreement to merge their respective oil and gas businesses in a joint venture, which will operate under the name Wintershall DEA.

2018, September, 10, 12:30:00

MUBADALA PETROLEUM IN RUSSIA

MEOG - Mubadala Petroleum, Gazprom Neft and the Russian Direct Investment Fund (RDIF, the Russian Federation's sovereign wealth fund) announced the establishment of a joint venture to develop oil fields in the Tomsk and Omsk regions of Western Siberia.

2018, September, 10, 12:15:00

WESTINGHOUSE NEED INNOVATION

WNN - Westinghouse Electric Company is starting the next phase in its long history with one key message: The nuclear industry, which has always provided safe, clean and reliable energy, needs innovation now more than ever before.

2018, September, 5, 10:40:00

TRANSOCEAN BUYS OCEAN: $2.7 BLN

REUTERS - Offshore oil driller Transocean Ltd said on Tuesday it would buy peer Ocean Rig UDW Inc in a $2.7 billion cash-and-stock deal, its second major acquisition this year as the company bets on a recovery in the offshore sector.

2018, August, 22, 12:35:00

SANTOS BUYS QUADRANT: $2.15 BLN

REUTERS - Australian oil and gas firm Santos Ltd said on Wednesday it has agreed to buy privately held Quadrant Energy for at least $2.15 billion, bagging access to what may be the biggest oil find off Western Australia in over two decades.

2018, August, 20, 14:05:00

MITSUBISHI BUYS 25% BALNGADESH LNG

PLATTS - Japan's Mitsubishi has agreed to acquire a 25% interest in Bangladesh's Summit LNG import project, which includes a floating, storage and regasification unit, with the remaining 75% held by Summit Corporation, the Japanese LNG trader said in a statement late last week.

2018, April, 6, 18:05:00

SANTOS TAKEOVER: $10.4 BLN

REUTERS - Australian gas producer Santos Ltd (STO.AX) said on Tuesday it would “engage with” Harbour Energy after receiving a $10.4 billion takeover offer from the U.S. company, its fourth unsolicited bid since August 2017.

2018, January, 5, 23:30:00

BROOKFIELD BUYS WESTINGHOUSE: $4.6 BLN

WNN - Brookfield highlighted Westinghouse's "strong market position" as the "largest service provider" to the world's nuclear facilities; its well-established global base of long-term customers; its "attractive" revenue and cash flow profile, with regularly scheduled services provided under long-term contracts; and its "strong reputation", driven by focus on innovation.

2018, January, 4, 12:25:00

QATARGAS & RASGAS MERGER

TOGY - The merger of the world’s largest LNG producers, Qatargas and RasGas, is complete, and the new entity, called Qatargas, has started operations, parent company Qatar Petroleum (QP) announced