M&A

2017, December, 13, 12:20:00

LETTERONE & BASF MERGER

LETTERONE - BASF and L1 Energy, the energy investment arm of LetterOne, announce their intention to merge their oil and gas subsidiaries.

2017, November, 13, 10:05:00

TOTAL ACQUIRES ENGIE'S LNG $2 BLN

Total SA has agreed to acquire LNG assets from Engie SA for as much as $2.04 billion. The deal includes interests in liquefaction plants, long-term LNG sales and purchase agreements, an LNG tanker fleet, and access to regasification capacities.

2017, October, 20, 12:25:00

U.S. FOREIGN ACQUISITIONS UP $125 BLN

The sum total in August of all net foreign acquisitions of long-term securities, short-term U.S. securities, and banking flows was a monthly net TIC inflow of $125.0 billion. Of this, net foreign private inflows were $131.5 billion, and net foreign official outflows were $6.5 billion.

2017, September, 8, 08:35:00

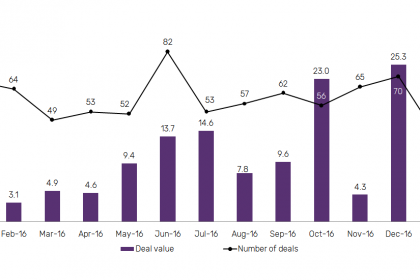

UK M&A $6 BLN

Almost $6 billion worth of mergers and acquisitions have taken place in the UK oil and gas sector in the first half of the year – sending a strong vote of confidence in a basin that has been grappling with the challenges of a major downturn, a new report reveals.

2017, September, 6, 10:39:00

NABORS - ROBOTIC ACQUISITION

Nabors Industries Ltd. ("Nabors") (NYSE: NBR), announced that it has acquired Stavanger based Robotic Drilling Systems AS ("RDS"), a provider of automated tubular and tool handling equipment for the onshore and offshore drilling markets. This transaction integrates the highly capable RDS team and product offering with the technology portfolio of Canrig, Nabors rig equipment subsidiary, and strengthens the development of its drilling automation solutions.

2017, September, 4, 12:15:00

SCHLUMBERGER - EURASIA DEAL STOP

The acquisition of Russia’s Eurasia Drilling Co (EDC) by U.S. oilfield services giant Schlumberger (SLB.N) has been held up by U.S. sanctions on Russia, Russian Deputy PM Arkady Dvorkovich was quoted as saying by local news services.

2017, August, 24, 14:10:00

ROSNEFT BOUGHT ESSAR

Rosneft Successfully Closes Strategic Deal for the Acquisition of 49% of Essar Oil Limited

2017, August, 24, 13:40:00

TOTAL - MAERSK DEAL: $7.45 BLN

French oil company Total agreed Monday to buy Danish conglomerate AP Moller-Maersk's oil business for $7.45 billion, in a deal that will strengthen its position in the North Sea.

2017, August, 16, 09:05:00

OFFSHORE DRILLING MERGERS

Mergers among offshore oil drillers are raising hopes that consolidation could bring relief to a sector struggling to emerge from an industry downturn triggered by low crude prices.

2017, August, 15, 10:30:00

NABORS - TESCO ACQUISITION

Nabors Industries Ltd. ("Nabors") (NYSE: NBR) is pleased to announce that the company has signed an Arrangement Agreement ("Agreement") to acquire all of the issued and outstanding common shares of Tesco Corporation ("Tesco") (NASDAQ: TESO), with each outstanding share of common stock of Tesco being exchanged for 0.68 common shares of Nabors. This transaction will create a leading rig equipment and drilling automation provider by combining Canrig, Nabors rig equipment subsidiary, with Tesco's rig equipment manufacturing, rental and aftermarket service business. Additionally, Tesco operates a tubular services business in numerous key regions globally, which will immediately benefit Nabors Drilling Solutions' operation.

2017, July, 24, 13:35:00

SCHLUMBERGER & EURASIA: 51%

"I warmly welcome Schlumberger as our majority shareholder. It builds on our strategic alliance with Schlumberger since 2011 and our mutually beneficial business relationship since 2007. The combination of the technology knowhow and operational expertise of Schlumberger coupled to the financial strength of the Investment Funds, brings significant benefits to our customers and the Russian conventional land drilling market."

2017, March, 7, 18:35:00

SHELL & SAUDI AGREEMENT

Royal Dutch Shell plc ("Shell") today announces the signing of binding definitive agreements between SOPC Holdings East LLC (a U.S. downstream subsidiary of Shell) and Saudi Refining Inc. ("SRI") (a wholly owned subsidiary of Saudi Arabian Oil Company (“Saudi Aramco”)) on the separation of assets, liabilities and businesses of Motiva Enterprises LLC (“Motiva”), a 50/50 refining and marketing joint venture.

2017, February, 6, 18:35:00

INDIA'S OIL CONSOLIDATION

With India's oil demand showing no signs of slowing, which in turn is attracting a lot of multinational firms to set up shop in the country, the government is stepping up efforts to ensure that state-run oil companies are on equal footing to compete, not just with domestic private players but also with global oil firms.

2016, December, 15, 18:45:00

GAZPROM - OMV AGREEMENT

Alexey Miller, Chairman of the Gazprom Management Committee, and Rainer Seele, Chairman of the OMV Executive Board, signed the Basic Agreement regarding the asset swap. The signing ceremony took place in the presence of Hans Jörg Schelling, Minister of Finance of the Republic of Austria, and Anatoly Yanovsky, Deputy Minister of Energy of Russia.

2016, December, 12, 18:40:00

ROSNEFT SUCCESSFUL DEAL

Rosneft Board of Directors has approved a strategic cooperation agreement with Qatar Investment Authority and Glencore, providing for further cooperation in upstream projects, logistics and global trading.