Statements

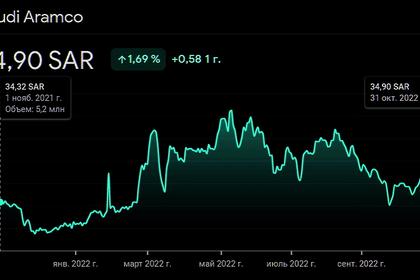

2022, November, 1, 16:35:00

SAUDI ARAMCO NET INCOME UP TO $42.4 BLN

Aramco announces third quarter 2022 results Q3 net income rises 39% YoY to $42.4 billion; free cash flow increases to a record $45.0 billion

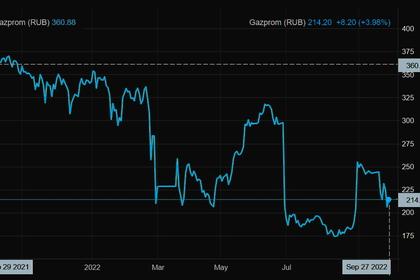

2022, September, 28, 12:20:00

GAZPROM'S FINANCIAL GROWTH

The net profit amounted to RUB 2.514 trillion, which not only marks a 2.6-fold increase against the amount recorded in the first half of 2021 but also exceeds the total profit of the Gazprom Group for the two previous calendar years!

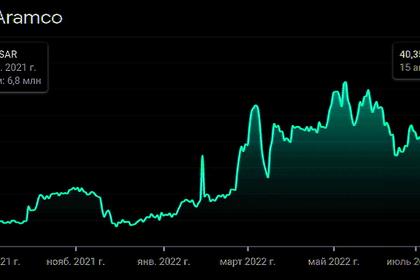

2022, August, 15, 12:10:00

SAUDI ARAMCO NET INCOME UP TO $87.9 BLN

The Saudi Arabian Oil Company (“Aramco” or “the Company”) announced its financial results for the second quarter of 2022, posting a 90% year-on-year (YoY) increase in net income

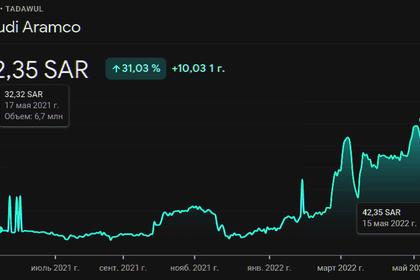

2022, May, 16, 11:40:00

SAUDI ARAMCO NET INCOME $39.5 BLN

Aramco announces first quarter 2022 results

Net income: $39.5 billion (Q1 2021: $21.7 billion)

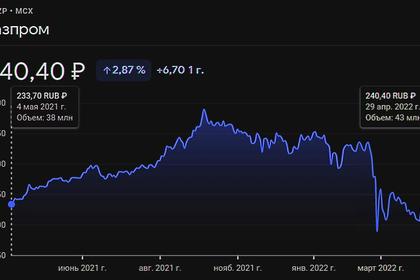

2022, May, 4, 12:10:00

GAZPROM PROFIT RUB 2,093 BLN

For the year ended December 31, 2021 profit attributable to the owners of PJSC Gazprom amounted to RUB 2,093,071 million.

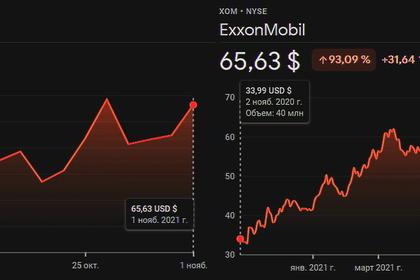

2021, November, 2, 13:20:00

EXXON EARNINGS $6.8 BLN

Exxon Mobil Corporation announced estimated third-quarter 2021 earnings of $6.8 billion, or $1.57 per share assuming dilution.

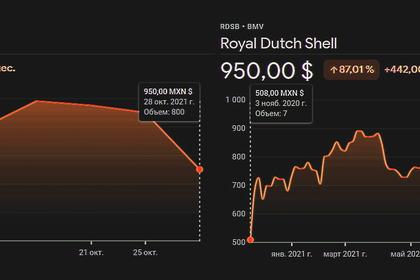

2021, November, 1, 13:25:00

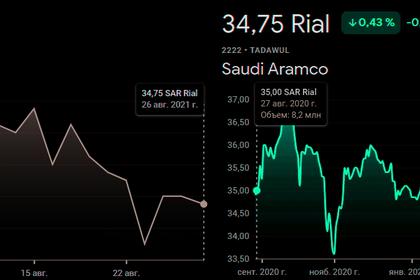

SAUDI ARAMCO NET INCOME $30.4 BLN

The Saudi Arabian Oil Company (“Aramco” or “the Company”) announced its third quarter financial results, recording a 158% year-on-year (YoY) increase in net income to $30.4 billion and declaring a dividend of $18.8 billion to be paid in the fourth quarter.

2021, November, 1, 13:20:00

SHELL LOSS $400 MLN

Third quarter 2021 income attributable to Royal Dutch Shell plc shareholders was a loss of $0.4 billion, which included non-cash charges of $5.2 billion due to the fair value accounting of commodity derivatives and post-tax impairment charges of $0.3 billion, partly offset by net gains on sale of assets of $0.3 billion.

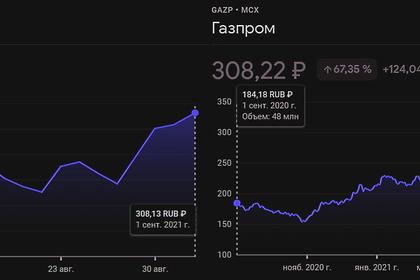

2021, September, 1, 13:25:00

GAZPROM PROFIT RUB995.5 BLN

Gain attributable to the owners of PJSC Gazprom amounted to RUB 968,498 million for the six months ended June 30, 2021.

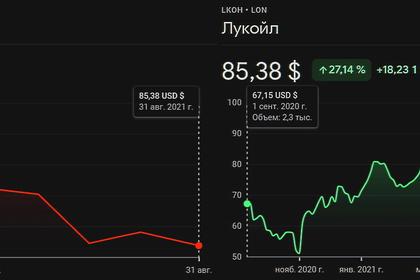

2021, September, 1, 13:20:00

LUKOIL PROFIT RUB347.2 BLN

In the second quarter of 2021, profit attributable to PJSC LUKOIL shareholders amounted to RUB 189.8 bln, which is 20.5% higher quarter-on-quarter.

2021, August, 26, 16:15:00

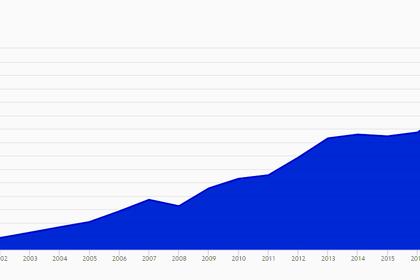

NORWAY PENSION FUND EARNING $100 BLN

In the first half of 2021, the fund returned 9.4 percent, equivalent to 990 billion kroner.

2021, August, 26, 16:10:00

SAUDI ARAMCO NET INCOME $47.2 BLN

Saudi Aramco net income: $25.5 billion (Q2) / $47.2 billion (H1)

2021, August, 26, 16:00:00

AUSTRALIA'S SANTOS NET PROFIT $354 MLN

The reported net profit after tax of US$354 million includes net gains on asset sales and is significantly higher than the corresponding period mainly due to impairments included in the previous half-year result.

2021, August, 4, 12:05:00

TC ENERGY NET INCOME $982 MLN

TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company) announced net income attributable to common shares for second quarter 2021 of $982 million or $1.00 per share compared to net income of $1.3 billion or $1.36 per share for the same period in 2020.

2021, August, 4, 12:00:00

NOVATEK PROFIT RR 164.4 BLN

Profit attributable to shareholders of PAO NOVATEK increased to RR 99.3 billion (RR 33.07 per share) in the second quarter 2021 and to RR 164.4 billion (RR 54.76 per share) in the six months 2021 as compared to RR 41.6 billion and RR 10.9 billion, respectively, in the corresponding periods in 2020.